Key Takeaways

- New game launches and cost optimizations are expected to boost EG7's revenue and improve net margins, maintaining profitability at lower revenue levels.

- EG7's solid live service game foundation and strategic acquisition exploration are anticipated to contribute to stable earnings and accelerated growth.

- EG7 faces financial challenges due to market downturns, delayed releases, unmet targets, and increased costs, raising concerns about future revenue stability and profitability.

Catalysts

About Enad Global 7- Engages in development, marketing, publishing, and distribution of PC, console, and mobile games in Sweden, rest of Europe, North America, South America, Asia, Africa, and Oceania.

- EG7 is expected to benefit from new game launches in 2025, such as Singularity 6's Palia in Q2 and Cold Iron's new game in the second half of the year, potentially boosting revenue growth with new titles in the market.

- Cost optimizations and restructuring actions totaling SEK 191 million throughout 2024, including SEK 88 million at the beginning of 2025, are expected to improve net margins by positioning the company to maintain profitability at lower revenue levels.

- A strong foundation of live service games from Daybreak, Big Blue Bubble, and Piranha, accounting for a significant part of their predictable revenue base, is anticipated to contribute to stable earnings and cash flow.

- The expected recovery in the Petrol business, driven by operational optimizations, is projected to enhance profitability in 2025 following a challenging period.

- EG7's active exploration of strategic acquisitions, backed by a stable balance sheet with no debt, could lead to accelerated growth and potentially improved earnings through opportunistic deals at attractive valuations.

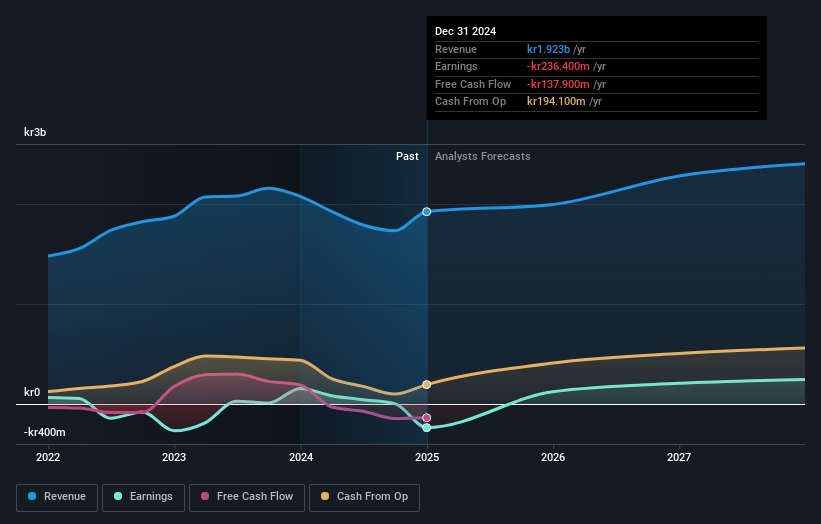

Enad Global 7 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Enad Global 7's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -12.3% today to 10.2% in 3 years time.

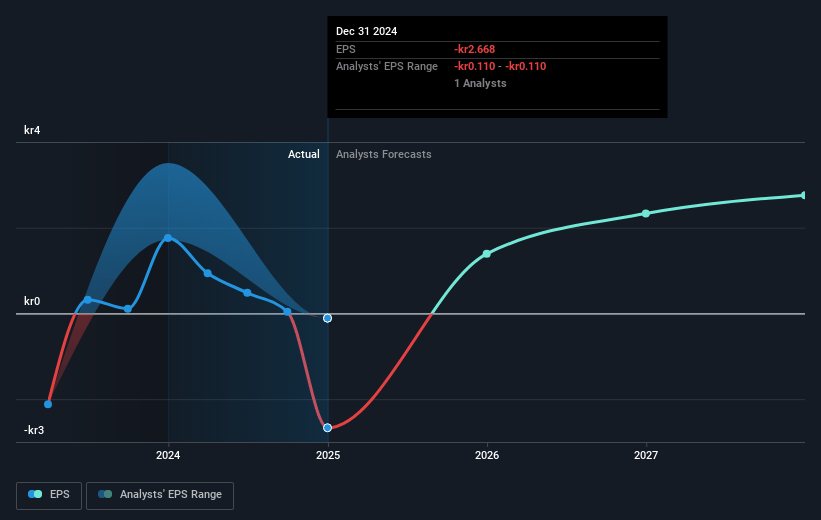

- Analysts expect earnings to reach SEK 244.5 million (and earnings per share of SEK 2.76) by about April 2028, up from SEK -236.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, up from -4.1x today. This future PE is lower than the current PE for the SE Entertainment industry at 23.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Enad Global 7 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The market downturn has negatively impacted EG7's service businesses, such as Petrol and Toadman, resulting in decreased revenues and net losses, which could further affect overall profitability.

- The delayed release of MechWarrior 5 Clans into a highly competitive window hurt its sales performance, underscoring the risk of revenue fluctuations based on release timing.

- EG7 failed to meet its 2024 revenue and profit targets due to several factors, including the underperformance of some titles and increased costs, highlighting potential uncertainty in future financial performance.

- The company's inability to provide guidance for 2025 due to variability and unpredictability in outcomes from new product releases raises concerns about future revenue stability.

- Additional financing to seize market opportunities in a turbulent market could introduce financial risk and affect the company's net margins if not managed cautiously.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK38.0 for Enad Global 7 based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK2.4 billion, earnings will come to SEK244.5 million, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of SEK11.0, the analyst price target of SEK38.0 is 71.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.