Key Takeaways

- Adoption driven by regulatory changes and expansion into new patient segments supports scalable, predictable growth and strengthens market position globally.

- Product innovation and recurring revenue streams improve margins, offsetting economic headwinds and enhancing long-term earnings stability.

- Overdependence on the U.S. market, a narrow product focus, and margin pressures heighten financial vulnerability, especially if international expansion and technology adoption falter.

Catalysts

About Senzime- A medical device company, develops, manufactures, and markets algorithm-powered patient monitoring systems to increase patient safety during and after surgery in Europe and the United States.

- Recent updates to U.S. and European anesthesia guidelines increasingly mandate the use of objective neuromuscular monitoring, accelerating hospital adoption of Senzime's next-gen TetraGraph system; this is expected to drive sustained top-line revenue growth as standard of care shifts and compliance broadens globally.

- Expansion into the pediatric patient segment, with the soon-to-be-finalized European guideline establishing EMG (Senzime's technology) as the preferred method, positions the company to access an untapped 10% market segment-supporting incremental revenue growth and improving earnings potential through increased market share.

- Growing healthcare infrastructure investment and rising procedure volumes tied to an aging global population are fueling strong demand, evidenced by record sales and the need to rapidly increase production capacity; this sets the stage for long-term, scalable revenue expansion.

- High product innovation and premium positioning of the next-gen TetraGraph-demonstrated by increasing gross margins (68.4% adjusted) and customer willingness to accept price hikes-suggest Senzime can defend or even enhance net margins as revenues grow, despite recent tariff and currency headwinds.

- A rising installed base, recurring consumable sales (e.g., TetraSens sensors), and expansion of commercial distribution (notably in the U.S. and through the Fukuda partnership in Japan, U.K., and U.S.) enhance revenue predictability and cash flow, supporting stronger future earnings and reducing business volatility.

Senzime Future Earnings and Revenue Growth

Assumptions

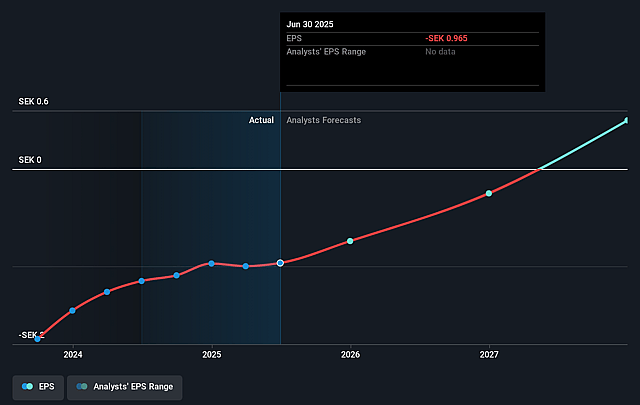

How have these above catalysts been quantified?- Analysts are assuming Senzime's revenue will grow by 81.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -156.8% today to 8.2% in 3 years time.

- Analysts expect earnings to reach SEK 39.4 million (and earnings per share of SEK 0.5) by about August 2028, up from SEK -126.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 73.4x on those 2028 earnings, up from -8.2x today. This future PE is greater than the current PE for the SE Medical Equipment industry at 44.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.59%, as per the Simply Wall St company report.

Senzime Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on the U.S. market (72% of total business) exposes Senzime to geographic concentration risk; any downturn in U.S. healthcare spending, regulatory change, or hospital budget tightening could significantly impact revenue and earnings.

- The company's strong growth is highly dependent on continued guideline-driven adoption in anesthesia monitoring; if clinical guidelines change, competing technologies gain favor, or guideline compliance stagnates, it could result in lower demand, impacting topline revenue growth.

- New U.S. tariffs and currency fluctuations have already negatively impacted gross margins; persistent trade tensions, increased tariffs, and adverse foreign exchange rates could further compress net margins and erode profitability.

- Senzime currently relies heavily on its TetraGraph system and associated consumables, creating significant product concentration risk-should technological disruption (e.g., wearables, AI-driven alternatives) or commoditization occur, both revenue and earnings could be threatened.

- The flat utilization and sensor sales quarter-on-quarter, along with slow sales cycles and entrenched legacy competitors in Europe and Asia, suggest that expanding outside the U.S. will be challenging; failure to diversify geographically or accelerate adoption abroad would limit revenue scalability and expose financials to regional downturns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK12.8 for Senzime based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK480.5 million, earnings will come to SEK39.4 million, and it would be trading on a PE ratio of 73.4x, assuming you use a discount rate of 5.6%.

- Given the current share price of SEK6.63, the analyst price target of SEK12.8 is 48.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.