Catalysts

About Sectra

Sectra provides medical imaging IT and cybersecurity solutions for health care systems and governments globally.

What are the underlying business or industry changes driving this perspective?

- The shift to large, long-duration cloud contracts concentrates revenue growth in a few complex projects where implementation delays, extended pilot phases and slower hospital onboarding could push out recognition of usage-based fees. This could constrain revenue growth and EBIT per share even as fixed delivery and support costs rise.

- Dependence on hyperscale cloud infrastructure, primarily Azure, exposes Sectra to structurally increasing compute and storage costs as imaging volumes, photon-counting CT data sizes and genomics workloads grow faster than pricing power. This could compress gross margins in the cloud portfolio over time.

- Expanding into advanced diagnostics such as genomics, integrated reporting and cardiology viewers while maintaining strong R&D in cybersecurity requires sustained high levels of capitalized development and specialist hiring. This carries the risk of structurally higher operating expenses and lower net margins if incremental module uptake lags expectations.

- Regulatory and data-sovereignty constraints on using U.S.-based cloud providers in parts of Europe may slow or block conversion of legacy on-premise customers to the SaaS model. This could limit recurring revenue growth and leave a larger-than-anticipated share of the installed base in lower-margin or flat-license arrangements.

- Clinical workloads in radiology, orthopedics and age-related disease imaging may grow more slowly than anticipated if staffing bottlenecks, budget-constrained hospitals and AI-driven productivity tools reduce imaging volume growth per installed site. This could undermine assumptions behind per-exam pricing and pressure long-term earnings growth.

Assumptions

This narrative explores a more pessimistic perspective on Sectra compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

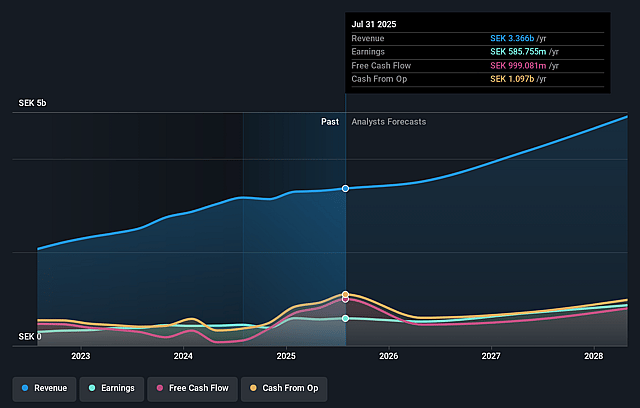

- The bearish analysts are assuming Sectra's revenue will grow by 15.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 17.4% today to 17.8% in 3 years time.

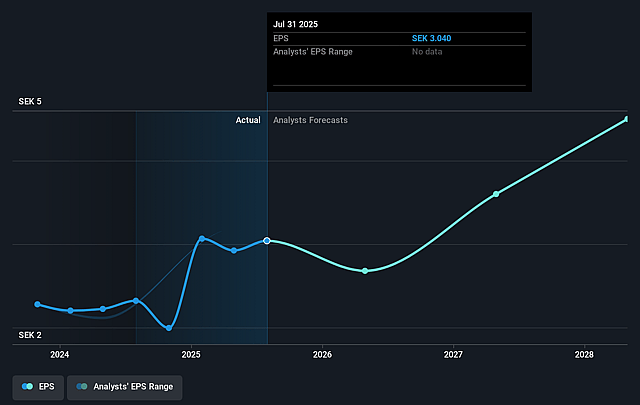

- The bearish analysts expect earnings to reach SEK 920.0 million (and earnings per share of SEK 4.78) by about December 2028, up from SEK 585.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 28.8x on those 2028 earnings, down from 89.5x today. This future PE is lower than the current PE for the GB Healthcare Services industry at 62.8x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.2%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company operates in structurally growing end markets, with aging populations driving sustained demand for imaging in cancer, cardiovascular, neurodegenerative and musculoskeletal diseases. This supports long-term growth in contract volumes and recurring revenue and could underpin higher revenue and earnings than expected.

- Sectra is already seeing strong traction in its transition to a cloud based Software as a Service model, with recurring revenue up 18% and cloud recurring revenue up 61%. If this mix shift continues it can structurally lift visibility, scalability and profitability, supporting resilient net margins and earnings.

- The business has demonstrated robust financial performance with equity to assets at roughly 51%, an operating margin of 19% against a long-term target of 15% and EBIT per share growth of 109% over five years. This indicates financial strength and execution that can support higher long-term earnings and justify a stronger share price.

- High order intake and an expanding global footprint, including large multi year Sectra One Cloud contracts in North America, the U.K. and Sweden as well as a strong reputation as an innovative market leader, create a sizable backlog that can convert into growing recurring revenue and support durable earnings growth.

- Ongoing innovation in advanced diagnostics and cybersecurity, such as photon counting CT viewing, genomics, integrated reporting and secure communications services, positions Sectra to capture incremental spend as AI, cloud and security needs increase. This could expand the addressable market and support higher long-term revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Sectra is SEK115.0, which represents up to two standard deviations below the consensus price target of SEK207.5. This valuation is based on what can be assumed as the expectations of Sectra's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK300.0, and the most bearish reporting a price target of just SEK115.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be SEK5.2 billion, earnings will come to SEK920.0 million, and it would be trading on a PE ratio of 28.8x, assuming you use a discount rate of 6.2%.

- Given the current share price of SEK272.0, the analyst price target of SEK115.0 is 136.5% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Sectra?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.