Last Update01 May 25Fair value Increased 0.70%

AnalystConsensusTarget has decreased profit margin from 3.2% to 1.5% and increased future PE multiple from 161.5x to 354.8x.

Read more...Key Takeaways

- Strategic shift to orthobiologics boosts growth and operational efficiency, enhancing future revenue and sustaining high net margins.

- U.S. market expansion and distinctive product benefits position OssDsign for significant market share and increased adoption.

- Heavy reliance on limited customers, high competition, and regulatory risks could create revenue volatility and potential cash flow challenges.

Catalysts

About OssDsign- Designs, manufactures, and sells implants and material technology for bone regeneration in Sweden, Germany, the United States, the United Kingdom, rest of Europe, and internationally.

- The strategic shift to a pure-play orthobiologics company has proven highly successful, as evidenced by over 100% year-over-year growth. Continued operational efficiency improvements and scalability are expected to drive future revenue growth.

- The company's gross margin increased to 95.4% for the full year, up from 74.6% in 2023, signaling improved production efficiencies that are likely to sustain high net margins moving forward.

- OssDsign's significant investment in building a robust repository of clinical evidence through more than 10 clinical and preclinical white papers enhances its value proposition, which could drive increased adoption and revenue.

- The expansion into the U.S. market, including the signing of a large GPO contract and broad access to hospitals and surgical centers, positions OssDsign favorably to capture significant market share, boosting future earnings.

- OssDsign Catalyst’s unique capabilities, such as exceptional intraoperative handling qualities and dual pathway bone formation, provide distinct competitive advantages likely to lead to increased sales and market penetration.

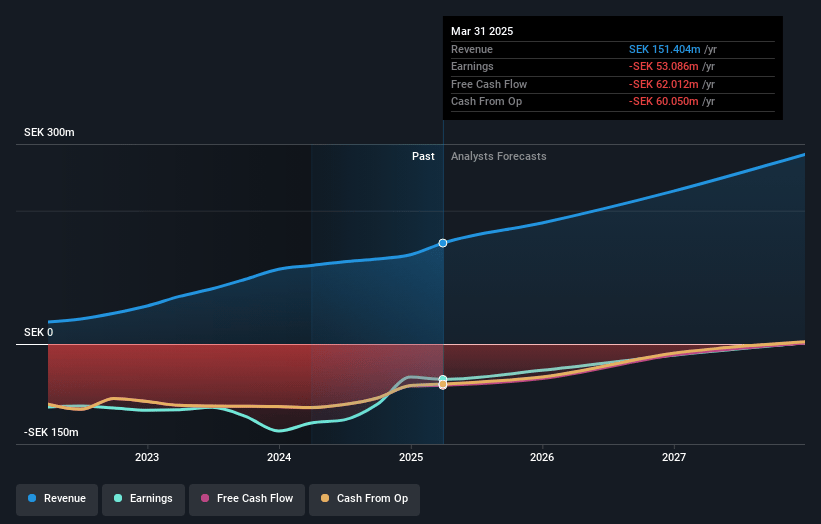

OssDsign Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OssDsign's revenue will grow by 28.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -37.1% today to 1.5% in 3 years time.

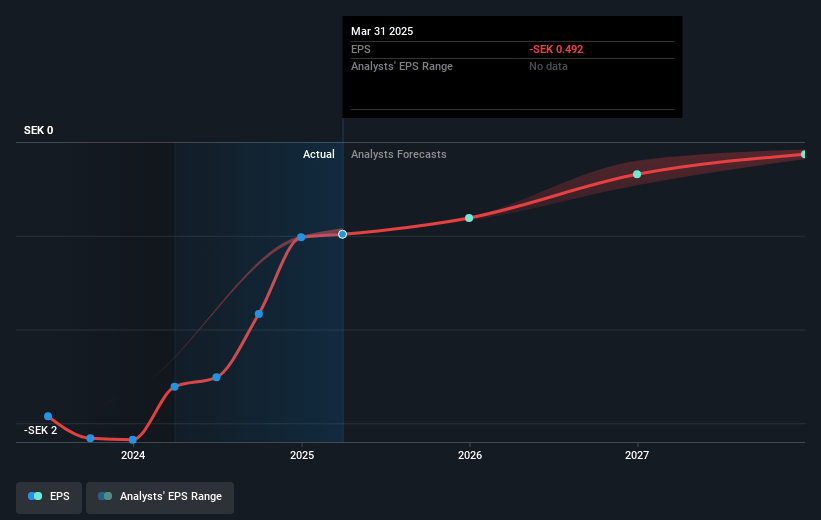

- Analysts expect earnings to reach SEK 4.2 million (and earnings per share of SEK -0.08) by about May 2028, up from SEK -49.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK27 million in earnings, and the most bearish expecting SEK-9.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 354.8x on those 2028 earnings, up from -26.2x today. This future PE is greater than the current PE for the SE Medical Equipment industry at 30.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.45%, as per the Simply Wall St company report.

OssDsign Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company relies heavily on a limited number of customers and specific orders for growth, indicated by the mention of one-off orders contributing to past growth, which could create revenue volatility. (Revenue)

- The presence of high competition in the orthobiologics market suggests potential difficulty in maintaining high growth and market share, impacting future revenue projections. (Revenue)

- Increased provisions related to royalty payments indicate the possibility of higher-than-expected operational costs, which could affect profitability. (Net Margins)

- Despite reaching its targeted revenue run rate, the company is still cash flow negative, indicating challenges in achieving cash flow positivity and potential liquidity issues. (Earnings)

- OssDsign’s reliance on FDA-clearance for future market pursuits suggests potential regulatory risks, which could affect the speed and success of U.S. market expansion. (Revenue)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK13.0 for OssDsign based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK281.9 million, earnings will come to SEK4.2 million, and it would be trading on a PE ratio of 354.8x, assuming you use a discount rate of 5.4%.

- Given the current share price of SEK13.3, the analyst price target of SEK13.0 is 2.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.