2025 Q1 update

- Strong revenue growth yoy 45% exceding expectations. Strong EPS of 178%, however easy comps should be noted.

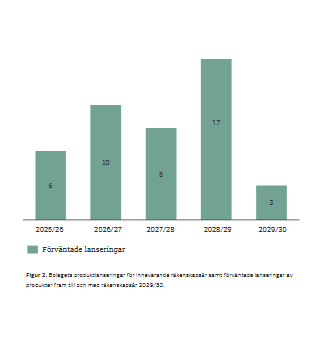

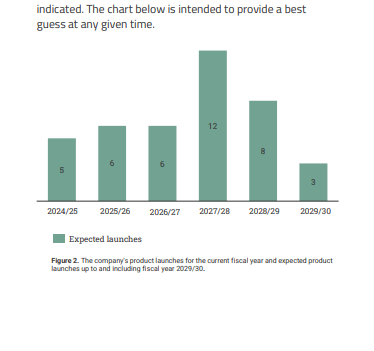

- Many new products added to the pipeline to this quarter (11 new, 6 deployed, 1 unaccounted for = 44 products in the pipeline)) supporting the growth thesis, expected deployment years set out below.

- Valuation looking a bit stretched at current levels.

Catalysts

- Recurring Cash Flow: EQL’s core generic product delivers near‐“infinite” cash flow, thanks to its essential role in healthcare.

- Market Niche & Protection: Its product is too small for major competitors to challenge, ensuring a stable, low‐competition environment.

- Inelastic Demand: As the medicine addresses a fundamental human need, demand remains robust across economic cycles.

- Robust Pipeline Conversion & Growth Potential: With a current marketed portfolio of 40 products and an additional 40 in the pipeline, assuming a conversion rate of around 70% (figure from CMD). This implies that around 28 new products could successfully launch from the existing pipeline. This is less than previously expected reducing certainty in new forecasts provided by the company at the CMD.

Assumptions

- Revenue in 5 Years: Assuming the company's targets set at the CMD , the underlying growth would correspond to around 30% p.a. for the next five years with in light of strong past growth execution on set targets it is not deemed unreasonable that the company can achieve this.

- Based on historical data—where net profit margins have generally ranged between about 9% and 12%—and the outlook driven by strong revenue growth through successful pipeline conversion and scale efficiencies, it's reasonable to expect margins to improve over time. While the long‑term targets suggest that margins could eventually reach the 18–19% range (roughly 70–75% of a 25% EBITDA margin which is the target to breached at the end of the period - as presented CMD), when discounting future cash flows to today’s value, the effective benefit of those improved margins is lower.Therefore, for our 5‑year forecast we will apply a constant net profit margin of 15% throughout the period (decrease from past assumption of 17%). This middle ground reflects a conservative view that balances historical performance with future improvements while accounting for the reduced present value of margins realized later in the forecast. In this framework, 15% represents about 60% of the targeted 25% EBITDA margin.

Risks

- Personnel Risk: The company’s success has historically depended on key individuals who have effectively executed its strategic agenda. Maintaining and attracting the right talent is critical; the departure of experienced executives or loss of specialized expertise could adversely impact operational efficiency and strategic execution.

- Geopolitical & Supply Chain Risks: International operations expose the company to geopolitical uncertainties—such as transport disruptions or regional instability — that can affect supply chains and increase operational costs. Past issues, like transport disruptions in key routes (e.g., the Suez Canal), demonstrate the potential impact of external factors.

Valuation

- Given that the industry average is around 19× while more comparable companies trade at about 30×, a reasonable P/E for EQL Pharma in 5 years would likely fall between these figures. Considering its stable, recurring cash flows from essential generics, along with a strong growth story driven, a multiple in the high teens to low 20s would be justified. If the company successfully executes its pipeline and further improves margins, the market could reward it with a P/E closer to 25×. Assuming PE ratio to be in the high range following successful execution of growth targets.

- Given the business model with steady, close to perpetual cash flows, discount rate remains at low at 6% adding ~1% to Simple’s 4.76% suggested rate, due to the current earnings not covered by free cashflow (negative 40-50 msek for 2023 and 2024).

What to Look for in the Next Quarterly Report

- Pipeline Progress: Updates on the conversion rate of the pipeline, particularly how many of the 40 potential products advance into the market. Key product launches and any changes in the pipeline composition (e.g., additional products in the review or launch phases). On upcoming calls Seek clarity on the number of new candidates to add to achieve targets.

- At the CMD it was mentioned that the forecast was build bottom up which would give good opportunities for management to track if the performance is not tracking targets and if so where the differences lie.

- Strained cashflow/cash conversion needs to improve over the coming quarters to align with earnings over time.

How well do narratives help inform your perspective?

Disclaimer

The user Mandelman has a position in OM:EQL. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.