Key Takeaways

- Strategic expansions and acquisitions, including Medilink and non-European market entry, are poised to drive significant revenue and profitability growth.

- Focus on operational efficiency and high-margin product launches aims to stabilize EBITDA margins, enhancing overall earnings and net margins.

- EQL Pharma faces potential risks from reliance on geographic expansion, high leverage, strategic pipeline success, and unpredictable COVID-19 test sales, impacting growth and profitability.

Catalysts

About EQL Pharma- Engages in the development, marketing, and sale of generic medicines to pharmacies and hospitals in Sweden, Denmark, Norway, Finland, and the rest of Europe.

- The company is planning to grow its sales by 30% on average per year until '28-'29, driven by launching products from its pipeline, expanding strategic key products, and initiating a new business unit focused on Special Generics. This is expected to significantly impact future revenue growth.

- EQL Pharma successfully placed an oversubscribed bond to fund the Medilink acquisition, reflecting strong credit investor confidence. This acquisition is expected to contribute to revenue and profitability growth by expanding the company's product offerings and market reach.

- The company aims to stabilize and improve its EBITDA margin above 25% in the upcoming years by focusing on cost control, launching high-margin products, and optimizing operational efficiencies. This will enhance net margins and overall earnings.

- The expansion into non-European markets, such as through its sales deal with Pharmalink for the GCC region, is a catalyst for revenue growth. The company is also progressing with launching products in Germany, France, and the UK, opening up additional revenue streams and market diversification.

- EQL Pharma is investing in its operational resources to increase project success rates and optimize its organization by expanding its workforce in strategic locations such as Bangalore and Eastern Europe. This strategic focus on operational efficiency is expected to impact net margins favorably.

EQL Pharma Future Earnings and Revenue Growth

Assumptions

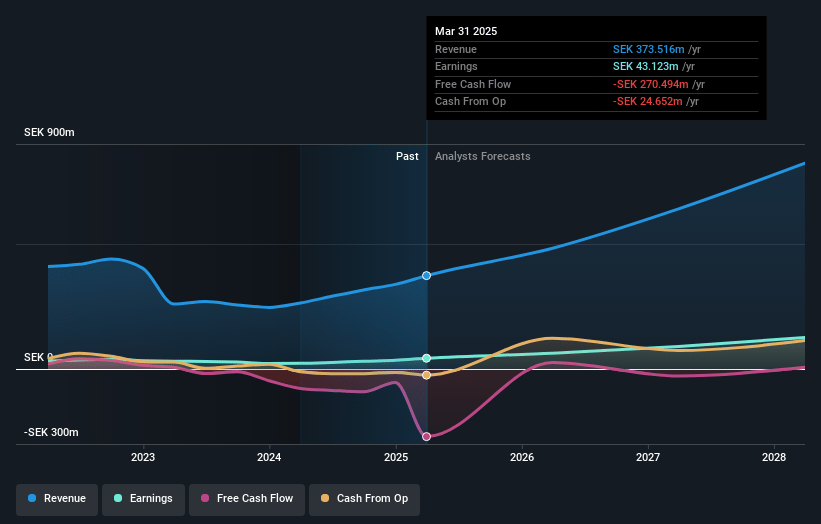

How have these above catalysts been quantified?- Analysts are assuming EQL Pharma's revenue will grow by 29.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 15.4% in 3 years time.

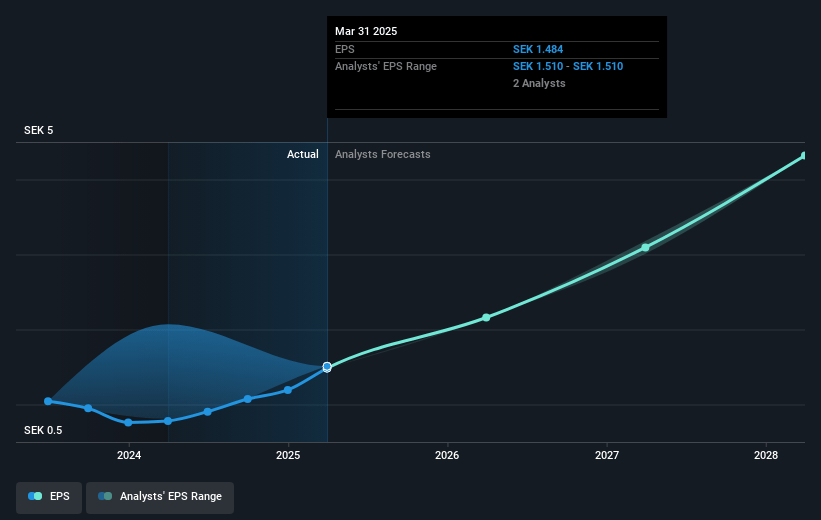

- Analysts expect earnings to reach SEK 126.0 million (and earnings per share of SEK 4.35) by about May 2028, up from SEK 43.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.8x on those 2028 earnings, down from 55.3x today. This future PE is greater than the current PE for the SE Healthcare industry at 16.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.76%, as per the Simply Wall St company report.

EQL Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on geographic expansion and access to previously unentered markets can pose regulatory and political risks, which could impact expected revenue growth if approvals or launches are delayed.

- The leverage ratio is currently high (3.5 to 4.0x), and reliance on debt for acquisitions may strain financial flexibility, potentially impacting net margins and earnings if interest rates rise or cash flows do not meet expectations.

- The success of strategic pipeline and product launches is critical for growth, and any delays or failures in product development or market acceptance could impact revenue projections significantly.

- The optimistic targets for EBITDA margin stability and increase may not materialize, especially if operational inefficiencies or cost overruns occur, which would impact net margins and expected profitability.

- Dependence on unpredictable COVID-19 test sales as part of the revenue mix introduces risk, especially as these sales are expected to remain low, and any misjudgment in inventory management could lead to marginal losses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK75.0 for EQL Pharma based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK819.5 million, earnings will come to SEK126.0 million, and it would be trading on a PE ratio of 19.8x, assuming you use a discount rate of 4.8%.

- Given the current share price of SEK82.1, the analyst price target of SEK75.0 is 9.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.