Key Takeaways

- Marketing partnerships, AI advancements, and strategic acquisitions are expected to boost Cheffelo's customer loyalty and competitive edge, positively impacting revenue and margins.

- Anticipated economic improvements and organizational changes aim to enhance consumer demand and retention, likely driving future growth and better cost management.

- Cheffelo faces risks from high marketing costs, interest rate uncertainty, currency volatility, and competition, potentially affecting profitability and market share.

Catalysts

About Cheffelo- Engages in the supply and delivery of meal kits to the customer's front door in Sweden, Norway, and Denmark.

- Cheffelo's marketing partnership with Middagsfrid and the related customer acquisition strategies are expected to boost customer loyalty and reduce churn, particularly in Sweden. This should positively impact future revenue growth.

- The anticipation of reduced interest rates in Sweden and Denmark is expected to improve consumer demand, favoring Cheffelo's growth in these markets. As consumer confidence recovers, this is likely to enhance revenue.

- Organizational changes including the recruitment of a Chief Growth Officer aim to sharpen the focus on customer acquisition and retention, which is expected to drive future revenue growth and could improve net margins through better cost management.

- The use of AI and technology enhancements to personalize customer experiences and optimize meal selections could increase order frequency and reduce churn, positively affecting both revenue and earning potential.

- Potential market consolidation and strategic acquisitions (e.g., Kokkens Hverdagsmad's customer relationships) provide an opportunity for Cheffelo to gain market share and strengthen its competitive position, likely enhancing future revenue and margins.

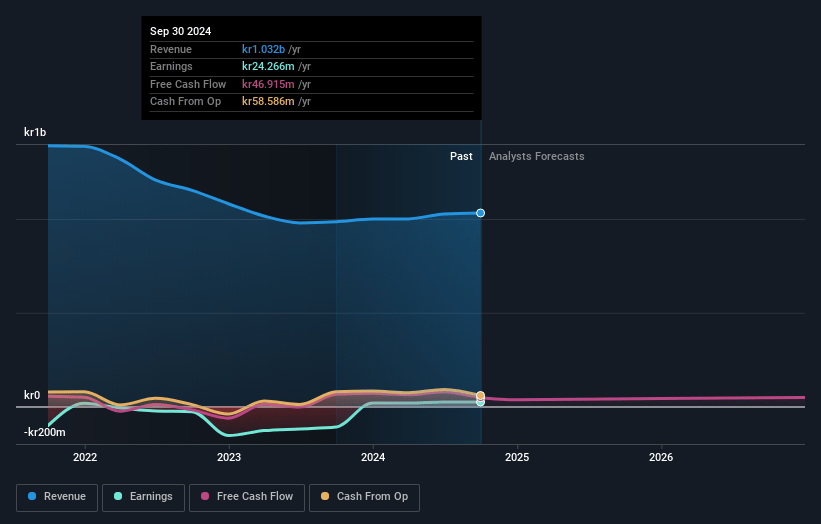

Cheffelo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cheffelo's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.4% today to 3.8% in 3 years time.

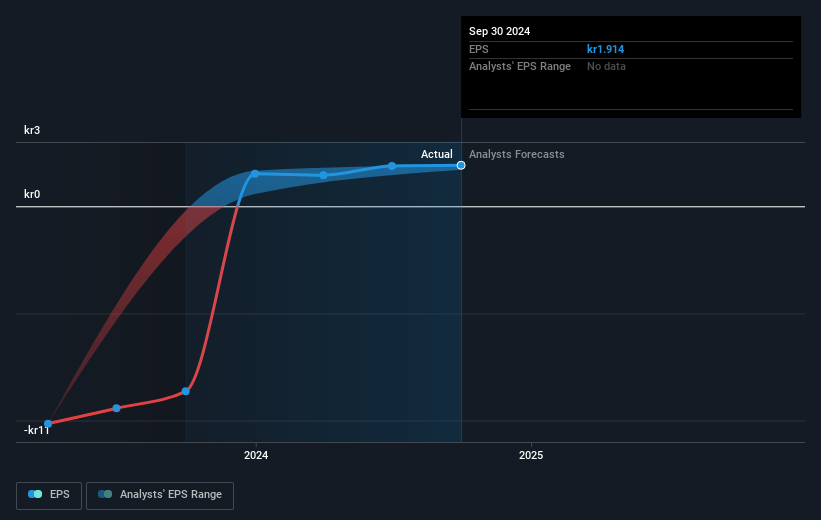

- Analysts expect earnings to reach SEK 45.7 million (and earnings per share of SEK 4.16) by about February 2028, up from SEK 24.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.5x on those 2028 earnings, down from 15.9x today. This future PE is lower than the current PE for the SE Food industry at 22.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.5%, as per the Simply Wall St company report.

Cheffelo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a risk associated with Cheffelo's high marketing expenditures, which has led to negative EBIT for Q3. This negatively impacts net margins and could hinder profitability if not managed carefully moving forward.

- Interest rate uncertainty in key markets like Norway could dampen consumer spending power and slow growth, potentially affecting Cheffelo's revenue projections and sales growth.

- The company's reliance on loyalty discounts and promotions in Denmark may impact net sales growth, as these discounts are subtracted from sales figures, thereby affecting earnings.

- Currency volatility between SEK and other Nordic currencies presents a financial risk, potentially causing fluctuations in top-line revenues despite natural hedges on profitability.

- The competitive landscape, particularly with formidable competitors like HelloFresh, poses a risk to Cheffelo's market share and customer acquisition, potentially impacting revenue and market positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK35.0 for Cheffelo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK41.0, and the most bearish reporting a price target of just SEK30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK1.2 billion, earnings will come to SEK45.7 million, and it would be trading on a PE ratio of 10.5x, assuming you use a discount rate of 4.5%.

- Given the current share price of SEK30.5, the analyst price target of SEK35.0 is 12.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives