Key Takeaways

- Strategic shift to value-added specialty oils and operational excellence initiatives set the stage for sustained margin and profit growth through innovation and efficiency gains.

- Local manufacturing expansion and strong ESG positioning drive diversification, premiumization, and future-proof AAK against evolving regulatory and market demands.

- Shifting consumer trends, regulatory risks, and overreliance on vulnerable processed ingredients threaten long-term growth, margins, and competitive positioning unless innovation accelerates.

Catalysts

About AAK AB (publ.)- Develops and sells plant-based oils and fats in Sweden and internationally.

- While analyst consensus expects SEK 300 million in annual cost savings by mid-2026 from the Fit-to-Win program, ongoing site deep dives and the adoption of a global operational excellence model suggest that AAK could unlock further, sustained efficiency gains beyond 2026, significantly expanding net margins and driving compounding improvements in operating profit per kilo over the long term.

- Analyst consensus views AAK's strategic move toward value-added specialty oils as a lever for steady margin expansion; however, accelerating customer innovation, ongoing product mix enhancements, and market-led portfolio optimization point to a much sharper increase in specialty product penetration, potentially resulting in a step-change in both revenue growth and gross margin profile as secular demand for plant-based, clean-label solutions intensifies.

- The company's local manufacturing presence across key emerging markets, particularly following greenfield investments and strategic acquisitions in Latin America and Asia, positions AAK to benefit from rising urbanization and processed food consumption, which could drive sustainable double-digit volume growth and diversify top-line performance even amidst cyclical softness in developed regions.

- Rapidly tightening global ESG regulations and heightened corporate sustainability demands are expected to favor AAK disproportionately due to its established traceable supply chain and industry-leading sustainability reporting, enabling it to capture premium pricing, win incremental share from less-compliant competitors, and expand EBITDA margins as customers prioritize de-risked supplier partnerships.

- AAK's robust balance sheet and disciplined yet active approach to M&A, coupled with increasing market consolidation in specialty ingredients, provides significant optionality for transformational deals in high-growth markets, which could accelerate both revenue and earnings growth beyond organic trajectories through synergies, cross-selling, and new product introductions.

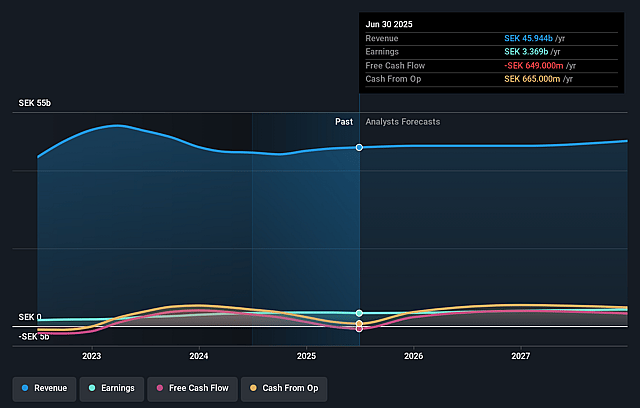

AAK AB (publ.) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AAK AB (publ.) compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AAK AB (publ.)'s revenue will grow by 3.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.3% today to 9.6% in 3 years time.

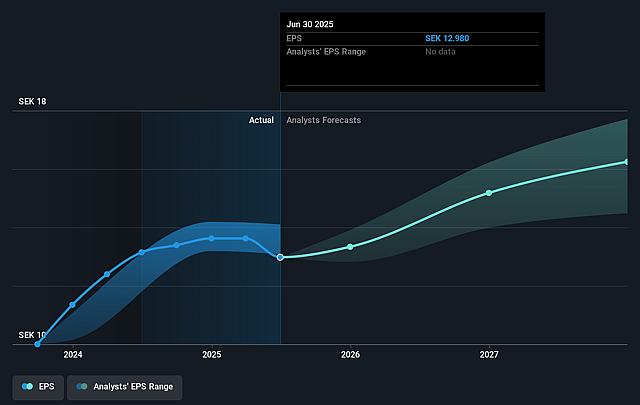

- The bullish analysts expect earnings to reach SEK 4.9 billion (and earnings per share of SEK 18.83) by about September 2028, up from SEK 3.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.1x on those 2028 earnings, up from 19.8x today. This future PE is greater than the current PE for the GB Food industry at 22.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.92%, as per the Simply Wall St company report.

AAK AB (publ.) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent declines in volumes across key segments such as Food Ingredients and Chocolate & Confectionery, despite margin improvements, suggest that end-market demand may be structurally weaker, which is likely to limit top-line revenue growth over the long term.

- Exposure to ongoing shifts in consumer preferences toward fresher, minimally processed and plant-based foods, as well as potential regulatory actions targeting unhealthy fats, may erode underlying demand for AAK's core processed food ingredients, dampening both revenue and volume growth.

- Heavy reliance on palm oil, a commodity under increasing regulatory and public scrutiny for environmental and social reasons, leaves AAK vulnerable to reputational setbacks, supply chain disruption, regulatory compliance costs, and potential margin compression if sourcing options become constrained.

- Failure to accelerate innovation and capture market share in high-growth, value-added segments (such as healthier fats and plant-based alternatives) could result in lost opportunities for premium pricing and competitive differentiation, threatening both revenue momentum and net margins.

- Intensifying competition from both low-cost global producers and specialty fat players, especially as large customers consolidate and increase their bargaining power, could erode pricing power and compress earnings and margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AAK AB (publ.) is SEK380.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AAK AB (publ.)'s future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK380.0, and the most bearish reporting a price target of just SEK245.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK50.9 billion, earnings will come to SEK4.9 billion, and it would be trading on a PE ratio of 23.1x, assuming you use a discount rate of 4.9%.

- Given the current share price of SEK256.4, the bullish analyst price target of SEK380.0 is 32.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.