Key Takeaways

- Expansion into new regions and innovative game launches aim to enhance market penetration and drive future revenue growth.

- Strategic investments in emerging markets and enhanced RNG offerings support increased customer engagement and improved net margins.

- Operational and cyber challenges, coupled with market dependency and regulatory changes, threaten Evolution's revenue stability and profitability.

Catalysts

About Evolution- Develops, produces, markets, and licenses online casino systems to gaming operators in Europe, Asia, North America, Latin America, and internationally.

- Evolution's expansion strategy includes opening new studios in Colombia and the Czech Republic, enhancing their ability to meet growing demand in Latin America and Europe. This is expected to boost future revenues by broadening market reach and increasing operational capacity.

- The launch of new games, including major titles like Lightning Storm and acquisition-led innovation from Arcadia Gaming Solutions, is projected to drive player engagement and revenue growth. These actions enhance their product portfolio and potentially increase net margins through unique, high-demand offerings.

- Evolution's gradual rollout of new games in North America and the introduction of Ezugi as a standalone brand are poised to increase market penetration and revenue in this crucial market, enhancing future earnings potential.

- The strategic investment in expanding studio operations in emerging markets like Brazil and the Philippines positions Evolution for future revenue growth as these regions regulate and expand their online gaming markets.

- The integration and expansion of the RNG (Random Number Generator) offerings, including new features and tools through the OSS (One-Stop-Shop) system, are expected to enhance customer attraction and retention, contributing positively to revenue and potentially improving net margins over time.

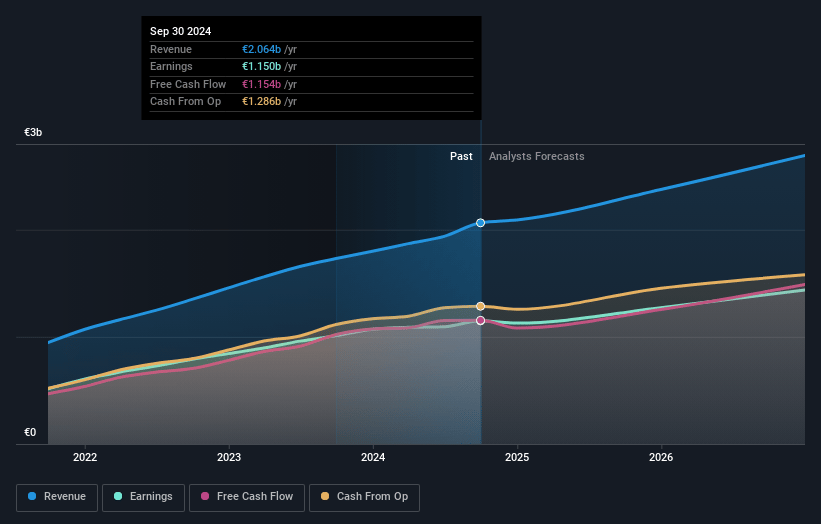

Evolution Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Evolution's revenue will grow by 12.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 55.7% today to 52.6% in 3 years time.

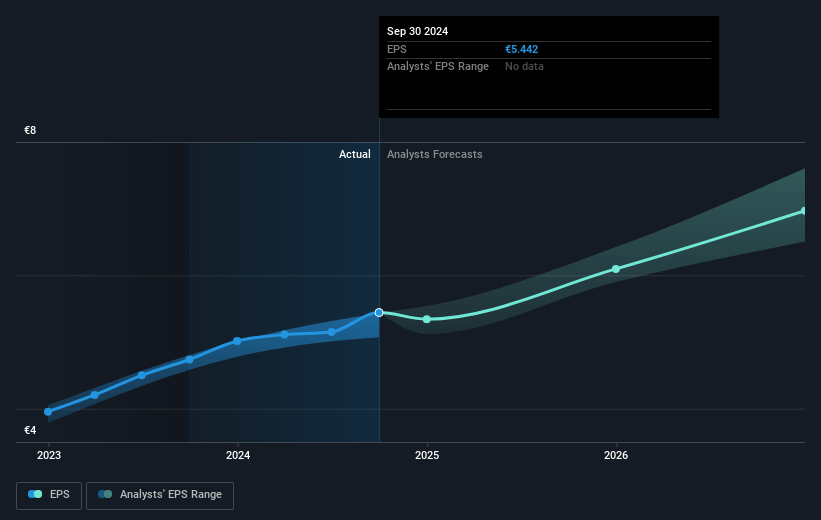

- Analysts expect earnings to reach €1.5 billion (and earnings per share of €7.43) by about January 2028, up from €1.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, up from 13.8x today. This future PE is lower than the current PE for the GB Hospitality industry at 22.4x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.86%, as per the Simply Wall St company report.

Evolution Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Operational challenges in Georgia, including strikes and illegal actions by union activists, have resulted in reduced studio capacity, which may lead to decreased revenue and profitability if not mitigated effectively.

- Increased frequency and sophistication of cyberattacks, particularly in Asia, have disrupted operations and could lead to further revenue losses if not adequately addressed.

- Fluctuations in revenue growth from high-stakes markets like Asia can create uncertainty around long-term earnings stability, particularly with ongoing cyber threats.

- Dependency on rapidly expanding yet volatile markets such as North America and Asia presents execution risks that could impact expected revenue and margins if growth in these regions does not meet expectations.

- Ongoing regulatory changes and taxation challenges, like the potential increased tax obligations under the Pillar II regime, could adversely affect net margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK1332.96 for Evolution based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK1760.84, and the most bearish reporting a price target of just SEK880.41.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.9 billion, earnings will come to €1.5 billion, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 5.9%.

- Given the current share price of SEK881.8, the analyst's price target of SEK1332.96 is 33.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

KA

kapirey

Community Contributor

Evolution to Navigate Market Risks with Strategic Growth Initiatives

Risks Financial risk management: market risk (including currency risk and cash flow interest risk), credit risk and liquidity risk. Political decisions and other legal aspects.

View narrativeSEK 730.78

FV

12.6% overvalued intrinsic discount9.00%

Revenue growth p.a.

4users have liked this narrative

0users have commented on this narrative

14users have followed this narrative

14 days ago author updated this narrative

IN

Investingwilly

Community Contributor

A Compounding Machine

Evolution AB (EVO) is the undisputed leader in the online live casino market, boasting a business model that combines cutting-edge technology, scalability, and deep industry expertise. With a consistent track record of revenue growth, profitability, and operational efficiency, Evolution is a prime example of a high-margin, high-quality business operating in a growing niche.

View narrativeSEK 1.80k

FV

54.3% undervalued intrinsic discount15.54%

Revenue growth p.a.

11users have liked this narrative

0users have commented on this narrative

84users have followed this narrative

16 days ago author updated this narrative

SU

SuEric

Community Contributor

King of the Live Casino

Evolution Gaming - King of the Live Casino Evolution Gaming is the leading B2B provider of live casino solutions. They power the online games you love!

View narrativeSEK 1.96k

FV

57.9% undervalued intrinsic discount20.00%

Revenue growth p.a.

4users have liked this narrative

0users have commented on this narrative

6users have followed this narrative

about 1 month ago author updated this narrative