Key Takeaways

- STANLEY integration is set to enhance Securitas' revenue and margin growth by enabling focus on high-margin technology and cost control improvements.

- Strategic growth in Europe and North America, coupled with strong cash flow, positions Securitas for improved earnings and financial stability.

- Termination of a key North American contract and cost pressures in key divisions may threaten revenue and net margin stability if unresolved.

Catalysts

About Securitas- Provides security services in North America, Europe, Latin America, Africa, the Middle East, Asia, and Australia.

- The integration of STANLEY is nearing completion, allowing Securitas to focus more on commercial development and potentially increase its revenues in the high-margin technology sector, positively impacting future earnings.

- Strength in Europe through strategic improvements in security services and structural changes in the business model suggests an ongoing margin improvement, which could positively influence future net margins.

- The commercial development and leadership changes in North America, combined with strong technology sales, suggest increased future sales and customer retention, likely benefiting the revenue and earnings positively.

- Cost control measures and improvements are anticipated following the STANLEY integration, particularly in North America, suggesting better control over operating expenses and possibly enhancing future net margins.

- Continued strong cash flow generation and reduced leverage are expected to support further strategic investments and debt reduction, aiding long-term earnings growth and financial stability.

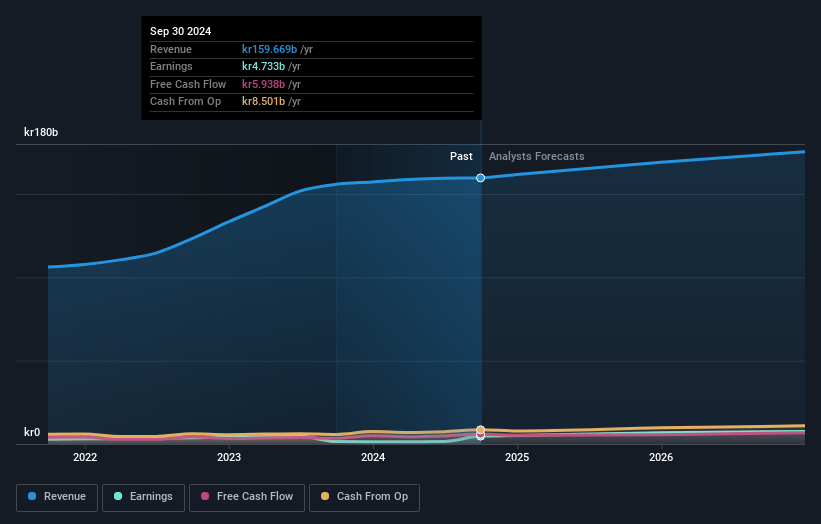

Securitas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Securitas's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 4.6% in 3 years time.

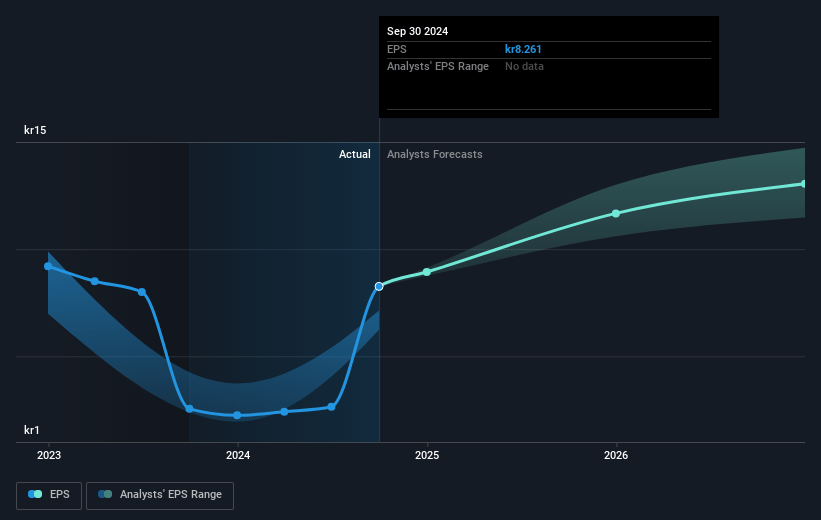

- Analysts expect earnings to reach SEK 8.3 billion (and earnings per share of SEK 14.51) by about January 2028, up from SEK 4.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SEK6.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, down from 16.8x today. This future PE is lower than the current PE for the GB Commercial Services industry at 17.8x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.23%, as per the Simply Wall St company report.

Securitas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The termination of a significant aviation contract in North America negatively impacted growth in services, which could affect future revenues if not compensated by new contracts or increased sales in other divisions.

- Negative impact on operating margin from cost pressures in the Technology business and the Pinkerton subsidiary, with ongoing cost development issues after the STANLEY carve-out, could influence net margins until these costs are managed more effectively.

- High inflation environments, such as in Türkiye, contributed to sales growth, which might not be sustainable if inflationary pressures decline, potentially impacting revenue growth figures.

- The U.S. Government investigation provision related to Paragon resulted in a SEK 536 million charge, posing risks to net earnings and cash flow if related costs increase beyond current provisions.

- Currency fluctuations, particularly related to the U.S. dollar, created a 5% negative impact on the financial results, which could continue to affect earnings and net margins given the company's international operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK137.42 for Securitas based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK175.0, and the most bearish reporting a price target of just SEK88.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK182.7 billion, earnings will come to SEK8.3 billion, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of SEK139.1, the analyst's price target of SEK137.42 is 1.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives