Narratives are currently in beta

Key Takeaways

- Sustained acquisitions and strong cash flow fortify revenue growth and support future investments, leveraging decentralized operations for margin enhancement.

- Strategic focus on profitable contracts in Sweden and high-growth markets like Germany boosts future earnings and profit margins.

- Underperformance in Sweden, competitive pressures, and weather challenges could impact revenue, margins, and cash flow, highlighting risks in profitability and operational execution.

Catalysts

About Green Landscaping Group- Engages in the green space management and landscaping business in Sweden, Norway, Finland,Germany, and internationally.

- Green Landscaping Group plans to continue its acquisition strategy in 2025, with ambitions to acquire 8 to 10 companies. This sustained M&A activity is expected to drive revenue growth by contributing to their overall 10% growth ambition.

- The company's decentralized business model, which promotes being close to customers and quick decision making, is designed to maintain and potentially enhance profit margins in the long term.

- Strong cash flow generation and reduced leverage in Q4 2024, down to 2.5x, provide financial headroom and support the ability to pursue future investments and acquisitions, positively impacting future earnings.

- In the Swedish market, an emphasis on improving profit margins over growth, including termination of unprofitable contracts, is expected to enhance net margins progressively over the next few years.

- High-growth activities in other European markets, particularly focusing on Germany, supported by a new headquarters in Munich, are poised to boost revenue and EBITA significantly, reinforcing future earnings growth.

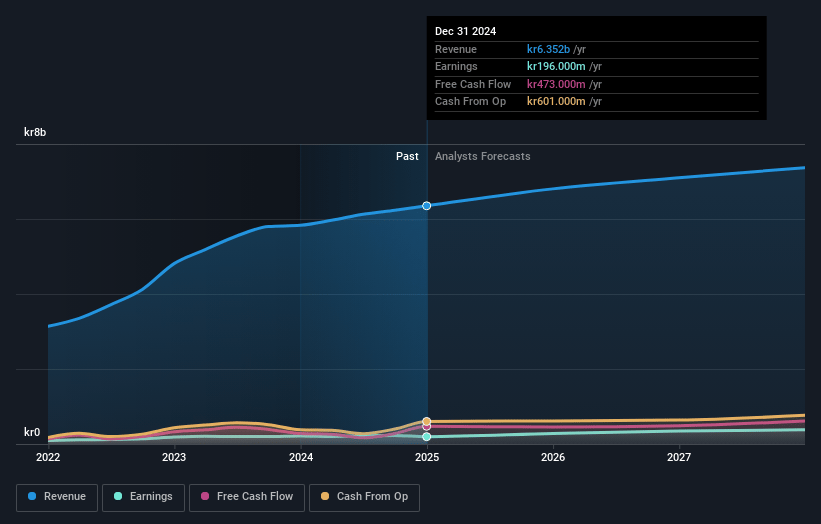

Green Landscaping Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Green Landscaping Group's revenue will grow by 6.9% annually over the next 3 years.

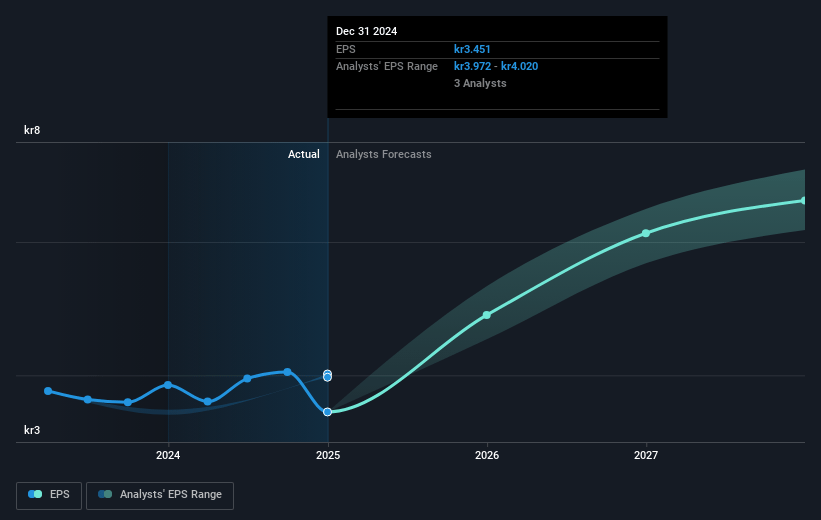

- Analysts assume that profit margins will increase from 3.7% today to 5.5% in 3 years time.

- Analysts expect earnings to reach SEK 422.2 million (and earnings per share of SEK 7.44) by about January 2028, up from SEK 229.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, down from 17.2x today. This future PE is lower than the current PE for the SE Commercial Services industry at 17.9x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.35%, as per the Simply Wall St company report.

Green Landscaping Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Underperformance in the Swedish market, with sales and profits not meeting expectations, could impact overall revenue and earnings if not addressed effectively.

- The EBITA margin decreased from 8.8% to 8.3%, which, although still strong, suggests potential challenges in maintaining or improving profitability.

- A mild winter affecting snow removal services may result in lower-than-expected revenue from this segment, affecting overall cash flow and earnings.

- The competitive market environment, with increased competition and more bidders for smaller and fewer projects, could pressure prices and profit margins, affecting net margins and future earnings.

- The company-specific events contributing to 50% of the shortfall in Sweden indicate potential risks in credit management and contract execution, which could lead to unforeseen its on EBITA and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK101.0 for Green Landscaping Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK7.6 billion, earnings will come to SEK422.2 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 6.3%.

- Given the current share price of SEK70.0, the analyst's price target of SEK101.0 is 30.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives