Key Takeaways

- Geographic expansion and recent acquisitions are set to diversify sales, enable cross-selling, and support sustained revenue and margin growth.

- Operational resilience and pricing power position the company to benefit from rising global demand for efficient transport solutions.

- Heavy reliance on traditional products, FX headwinds, and lagging M&A synergies risk dampening growth and profitability amid shifting market and electrification trends.

Catalysts

About VBG Group- Develops, manufactures, markets, and sells various industrial products in Sweden, Germany, rest of the Nordic countries and Europe, the United States, rest of North America, Brazil, Australia, New Zealand, China, and internationally.

- Improvements in order intake and a completed destocking cycle in the North American off-road segment are set to drive higher volumes in the second half of 2025, reversing recent revenue decline and supporting a rebound in earnings.

- The ongoing expansion into new geographic markets, including recent growth outside Europe and North America (notably Brazil), and the integration of strategic acquisitions are expected to diversify the sales mix and support sustained top-line revenue growth.

- Cross-selling synergies from the recent acquisitions of Ledson (vehicle lighting), Malmedie (industrial power transmission), and Italytec (Brazil) are poised to boost revenue and contribute to mid-term EBITDA margin expansion as integration progresses.

- The company's ability to sustain gross margins above 32% despite recent volume declines and adverse FX impacts demonstrates operational resilience and pricing power, which position VBG Group well to benefit from increasing demand for safer and more efficient transport solutions-potentially lifting future net margins.

- Increased demand for commercial transport solutions and continued expansion of e-commerce and last-mile delivery requirements globally provide a supportive backdrop for consistent demand for VBG's products and services, which is likely to drive long-term revenue growth.

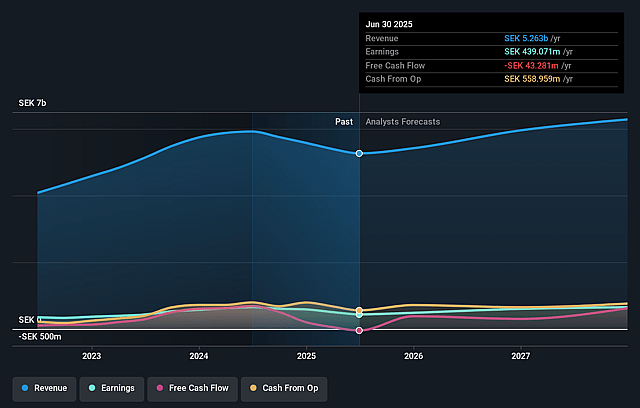

VBG Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming VBG Group's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.3% today to 11.2% in 3 years time.

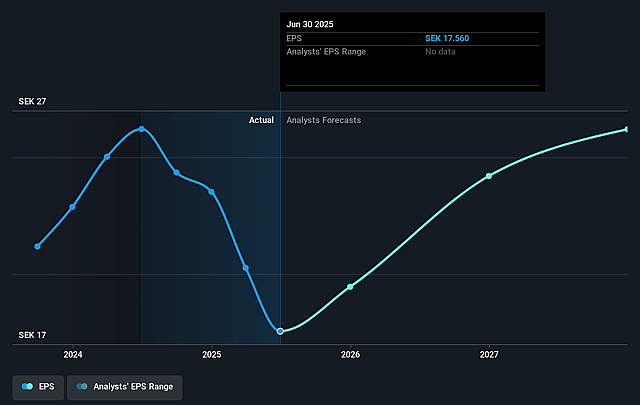

- Analysts expect earnings to reach SEK 732.9 million (and earnings per share of SEK 26.19) by about September 2028, up from SEK 439.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, up from 16.4x today. This future PE is lower than the current PE for the GB Machinery industry at 22.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.43%, as per the Simply Wall St company report.

VBG Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged strength of the Swedish krona is negatively impacting reported revenues and EBITA margins through significant FX headwinds, which could further erode earnings if currency trends persist.

- Structural declines in certain end markets, including lower sales volumes in the compact off-road vehicle and public transit bus segments (due to demand weakness and major customer losses), heighten VBG Group's exposure to cyclical downturns and pressure top-line revenue growth.

- The company's focus remains strongly geared toward traditional mechanical couplings and conventional drivetrains; the accelerating shift toward electrification, particularly in the school bus segment and broader commercial vehicle space, risks rendering their core product lines less relevant-potentially reducing long-term revenue and requiring costly product adaptation.

- Increasing working capital requirements (notably higher accounts receivable) and declining operative cash flow, combined with integration costs from multiple acquisitions, could strain net margins and limit future reinvestment or M&A capacity.

- Slow realization of anticipated acquisition synergies, alongside rising advisory, reorganization, and compliance costs, threatens to offset benefits from M&A activity and constrain profitability growth in the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK405.0 for VBG Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK6.6 billion, earnings will come to SEK732.9 million, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK287.6, the analyst price target of SEK405.0 is 29.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.