Narratives are currently in beta

Key Takeaways

- Expansion in Asian markets and continued investments in Medical Solutions are expected to drive future revenue growth and bolster sales.

- Strategic acquisitions and operational efficiencies are enhancing market positions, contributing to revenue growth and improved EBITA margins.

- Weakness in construction and automotive segments in North America and uncertainties in Europe could impact revenue and margins amid supply chain and geopolitical risks.

Catalysts

About Trelleborg- Provides engineered polymer solutions for seal, damp, and protect critical applications worldwide.

- Expansion in Asian markets, particularly strong growth in China, India, and Korea, is expected to drive future revenue growth. The company is capitalizing on marine and semiconductor sectors, especially in Korea with the build-out on the Marine sector related to LNG development. This geographical diversification and sector focus are likely to bolster sales.

- Continued investments in infrastructure and capacity expansion in the Medical Solutions segment, including new facilities in Malta, Switzerland, Costa Rica, and Boston, are positioned to drive future sales growth. This strategic expansion aims to capture synergies and meet increased demand in the biopharma sector, leading to enhanced future revenue and margin improvement.

- Bolt-on acquisitions, such as Magee in aerospace and Mampaey in the marine segment, are expected to enhance the company's strong market positions. These acquisitions are likely to contribute to revenue growth by providing access to new submarkets, and also aid in margin stability through strengthened offerings.

- Strong project sales in Industrial Solutions, particularly in the Marine segment with subsegments related to LNG and oil and gas, are expected to continue. These larger-scale projects, although often one-time in nature, contribute to revenue stability and improvement in net margins due to their higher contribution margin.

- Operational efficiencies and cost management are contributing to improved EBITA margins (from 16.9% to 18.1%). Continued focus on factory efficiency, cost control, and operational excellence initiatives are expected to sustain this margin improvement, positively impacting overall earnings going forward.

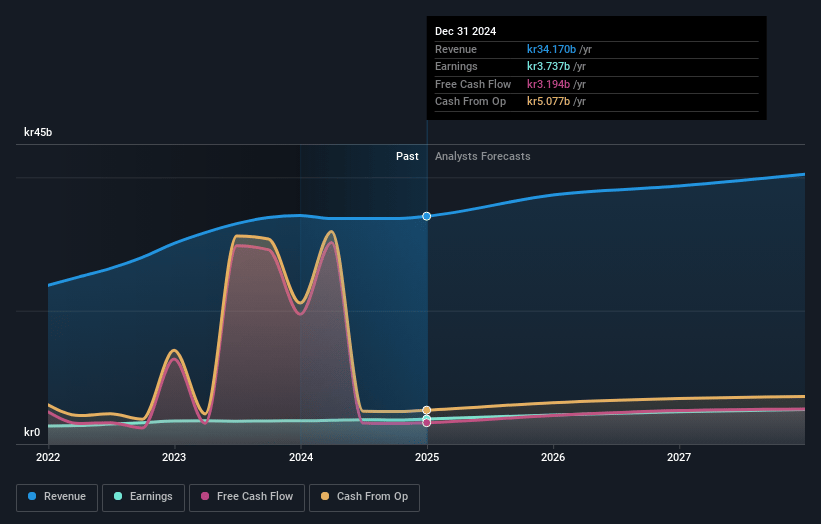

Trelleborg Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Trelleborg's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 13.1% in 3 years time.

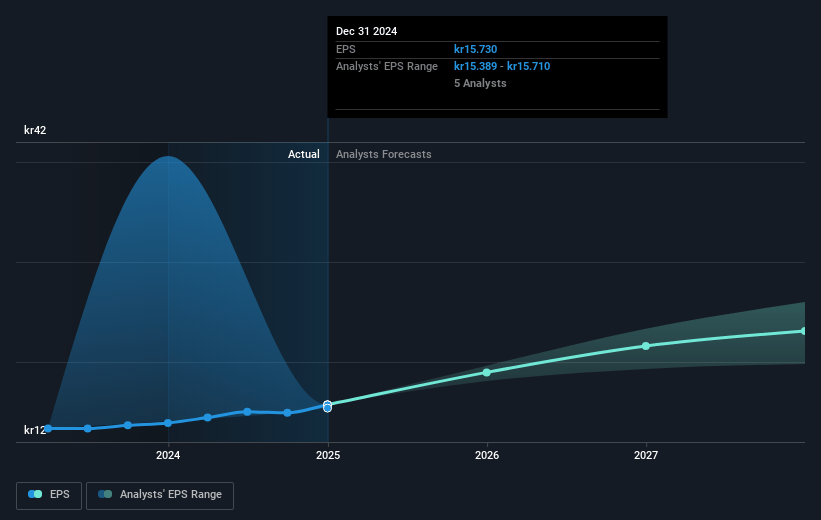

- Analysts expect earnings to reach SEK 5.3 billion (and earnings per share of SEK 23.5) by about January 2028, up from SEK 3.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.0x on those 2028 earnings, down from 27.2x today. This future PE is lower than the current PE for the GB Machinery industry at 28.5x.

- Analysts expect the number of shares outstanding to decline by 1.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.53%, as per the Simply Wall St company report.

Trelleborg Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued weakness in the construction and automotive segments, particularly in North America, could negatively impact revenue growth and margins as these areas face challenges.

- Uncertainty in Europe, with portfolio actions affecting core industrial sales, could hinder long-term revenue and profitability if the market does not improve.

- High current investment levels leading to potential dilution from depreciation before achieving adequate load could impact earnings and margins in the short term.

- Dependence on strong growth in certain Asian markets, such as China and India, could pose risks if economic conditions or geopolitical tensions in those regions change, affecting revenue stability.

- Potential disruptions in supply chains, partly due to geopolitical uncertainties, could influence operational efficiency and lead to increased costs, impacting net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK419.38 for Trelleborg based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK40.2 billion, earnings will come to SEK5.3 billion, and it would be trading on a PE ratio of 21.0x, assuming you use a discount rate of 5.5%.

- Given the current share price of SEK421.0, the analyst's price target of SEK419.38 is 0.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives