Narratives are currently in beta

Key Takeaways

- Strategic transformation, including acquisitions and business splits, aims to align resources and enhance profitability through focused operations and improved margins.

- Strong prospects in aerospace and Chinese EV markets indicate significant future growth potential, impacting future revenue streams positively.

- Weak demand and structural changes may challenge SKF's revenue and profitability, with risks arising from economic difficulties and strategic restructuring.

Catalysts

About AB SKF- Designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide.

- The strategic portfolio transformation, including new bolt-on acquisitions and divestments, like the planned split of automotive and industrial businesses, is expected to better align resources and improve focus, potentially enhancing revenue and profitability in the future.

- The company is investing in regionalization and streamlining its manufacturing footprint, which should lead to enhanced efficiencies and potentially improve operating margins over time.

- The planned separation of the automotive and industrial businesses into standalone entities is aimed at unlocking value through focused resource allocation and is expected to positively impact earnings and capital deployment.

- Despite weak markets, SKF has maintained solid operating margins due to effective cost management strategies and positive price/mix activities, which could continue to sustain profit margins even in a challenging demand environment.

- Positive prospects in strategic industrial segments like aerospace and continued strength in EVs, particularly in China, suggest areas of future growth, contributing positively to future revenue streams.

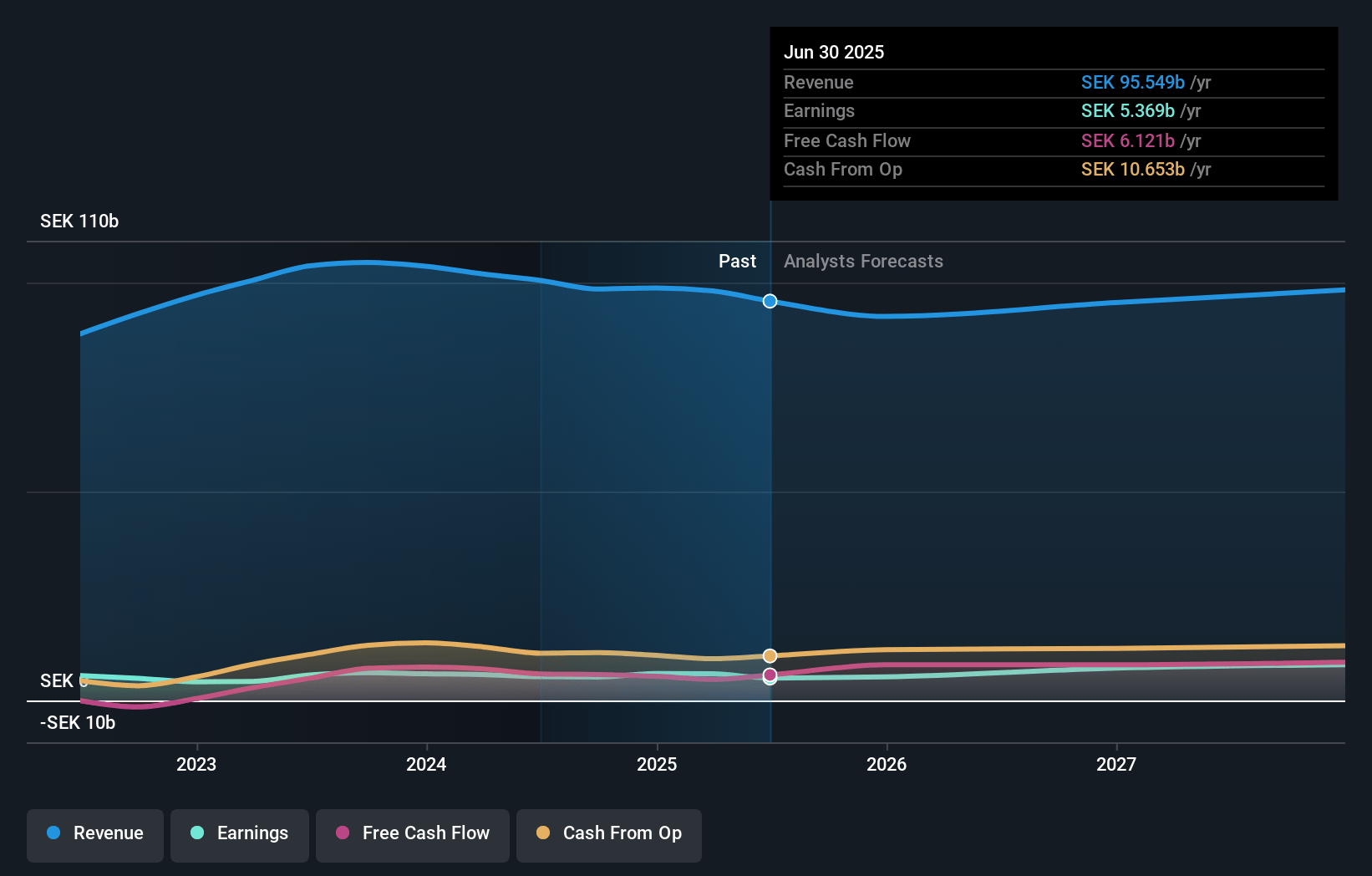

AB SKF Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AB SKF's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.7% today to 8.5% in 3 years time.

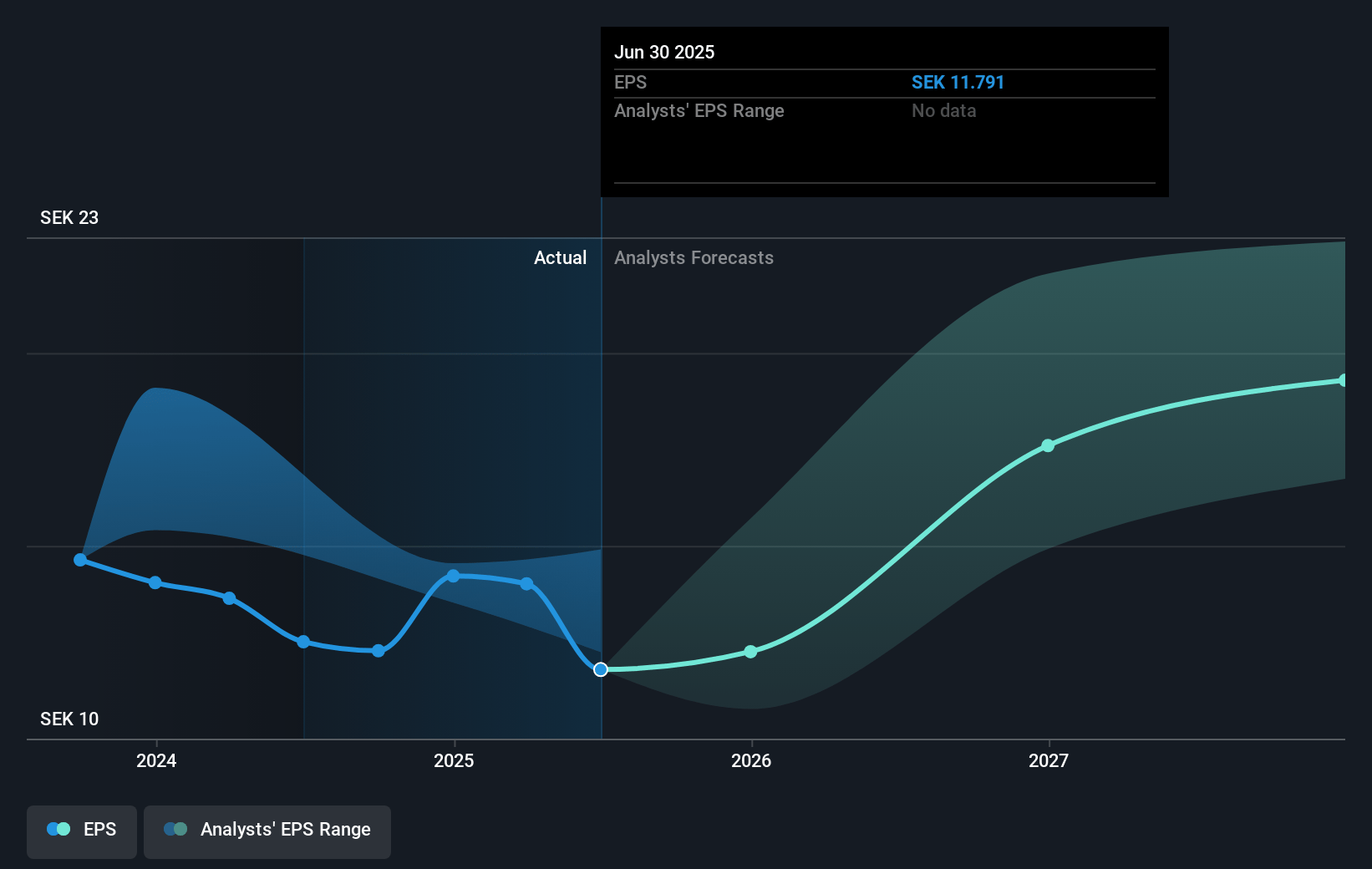

- Analysts expect earnings to reach SEK 9.1 billion (and earnings per share of SEK 19.79) by about January 2028, up from SEK 5.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK 10.1 billion in earnings, and the most bearish expecting SEK 7.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, down from 16.9x today. This future PE is lower than the current PE for the GB Machinery industry at 22.4x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.75%, as per the Simply Wall St company report.

AB SKF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weak demand across geographies, with significant negative organic growth in key markets like China and the automotive sector, could potentially impact SKF’s future revenue and earnings.

- Economic challenges in EMEA, coupled with extended factory closures by OEM customers, may hinder growth and negatively affect revenue and net margins.

- Customer confidence issues and investment hesitancy in China, particularly in industrial distribution, could lead to reduced revenue growth in that region.

- Structural inefficiencies due to ongoing manufacturing footprint changes might affect short-term operating margins and overall profit margins.

- The strategic separation into two entities (Industrial and Automotive) presents execution risks, potentially affecting operating efficiencies and incurring transition costs that might impact earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK 236.51 for AB SKF based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK 275.0, and the most bearish reporting a price target of just SEK 165.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK 107.6 billion, earnings will come to SEK 9.1 billion, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 5.7%.

- Given the current share price of SEK 207.6, the analyst's price target of SEK 236.51 is 12.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives