Narratives are currently in beta

Key Takeaways

- Strong positioning in the U.S. data center market and a robust order backlog offer prospects for stable revenue and cash flow growth.

- Restructuring efforts and a solid financial stance may enhance margins and enable investment in high-margin opportunities.

- Continued financial challenges in BoKlok and Residential Development could impact Skanska's profitability and revenue growth amid high tax rates and market recovery uncertainties.

Catalysts

About Skanska- Operates as a construction and project development company in the Nordic region, Europe, and the United States.

- Skanska is well-positioned in the booming data center market, particularly in the U.S., which is expected to drive future order intake and revenue growth.

- The strong order backlog and high book-to-bill ratio suggest a solid pipeline of future construction projects, which may bolster future revenues and provide stable cash flows.

- Improving leasing activity in commercial property development, especially in the U.S., indicates a positive trend that can enhance future revenue and returns on capital employed.

- The company is taking restructuring actions in its BoKlok division to reduce losses, which could improve net margins as operations become more efficient.

- Maintaining a robust financial position and liquidity provides Skanska the ability to invest in new projects selectively, potentially leading to increased future earnings through higher-margin opportunities.

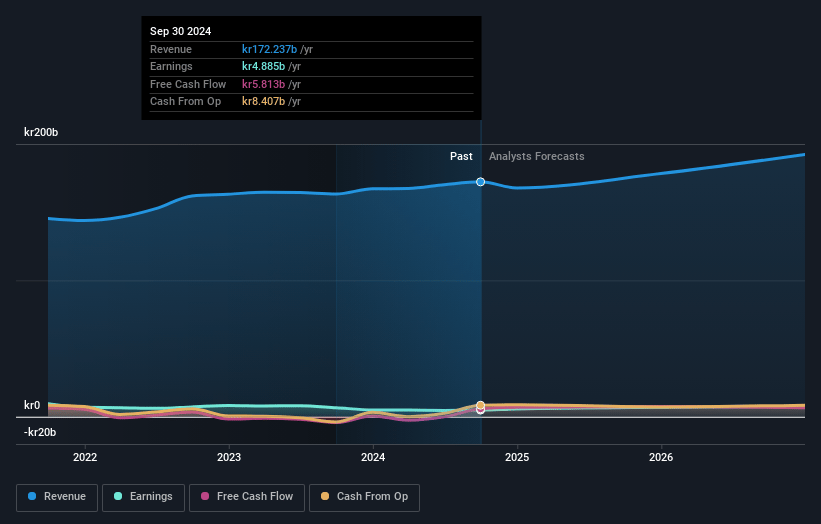

Skanska Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Skanska's revenue will grow by 5.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.8% today to 4.3% in 3 years time.

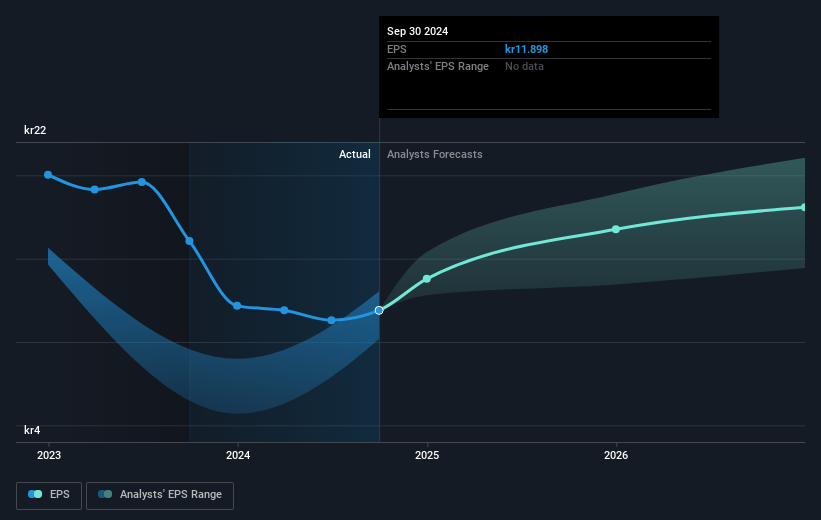

- Analysts expect earnings to reach SEK 8.7 billion (and earnings per share of SEK 20.99) by about January 2028, up from SEK 4.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, down from 19.9x today. This future PE is lower than the current PE for the GB Construction industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Skanska Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Restructuring costs and impairment charges, especially in the BoKlok low-cost segment, indicate ongoing challenges and financial strain that could affect future net margins and earnings.

- Negative operating income in Residential Development and continued BoKlok losses highlight risks in these areas, impacting overall revenue growth and profitability.

- Challenges in Commercial Property Development, including minimal gains from recent asset sales and property asset impairments, could continue to impact earnings and return on capital employed.

- The property market's gradual recovery signals slow improvement, risking delayed revenue realization and cash flow generation from divestments in commercial assets.

- High tax rates in recent quarters due to a change in income mix, especially from U.S. construction, could impact net income and overall earnings if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK228.66 for Skanska based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK275.0, and the most bearish reporting a price target of just SEK160.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK203.2 billion, earnings will come to SEK8.7 billion, and it would be trading on a PE ratio of 12.9x, assuming you use a discount rate of 5.9%.

- Given the current share price of SEK236.3, the analyst's price target of SEK228.66 is 3.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives