Narratives are currently in beta

Key Takeaways

- Expansion into surface mining and strategic acquisitions in China drive growth and enhance market presence and earnings.

- Innovative product launches and restructuring boost sales, improve margins, and offer long-term revenue opportunities despite short-term pressures.

- Sandvik faces challenges from declining sales in China, weak European demand, and automotive sector pressures, impacting revenue momentum and margins.

Catalysts

About Sandvik- An engineering company, provides products and solutions for mining and rock excavation, metal cutting, and materials technology worldwide.

- Sandvik's strategic expansion into the surface mining business, marked by significant deals in Peru and a focus on rotary drill rigs and surface boom drills, is expected to drive future revenue growth.

- The acquisition of Suzhou Ahno, which shows high single-digit growth, is poised to bolster Sandvik's presence in China's local premium market, potentially enhancing earnings and market share in the region.

- Sandvik's introduction of the upgraded 800 series cone crusher with automation features could lead to increased sales and improved margins, as it helps customers reduce energy consumption and operational costs.

- The ongoing ramp-up of a new greenfield inserts factory in China represents a significant potential for revenue growth and regionalization, although currently it poses short-term margin pressures.

- Execution of restructuring programs continues to yield cost savings, potentially improving net margins and overall earnings as market conditions stabilize.

Sandvik Future Earnings and Revenue Growth

Assumptions

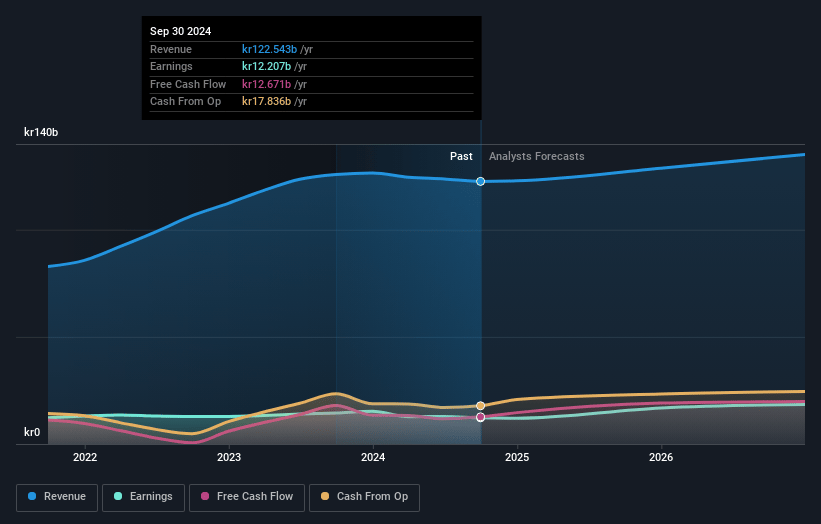

How have these above catalysts been quantified?- Analysts are assuming Sandvik's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.0% today to 14.2% in 3 years time.

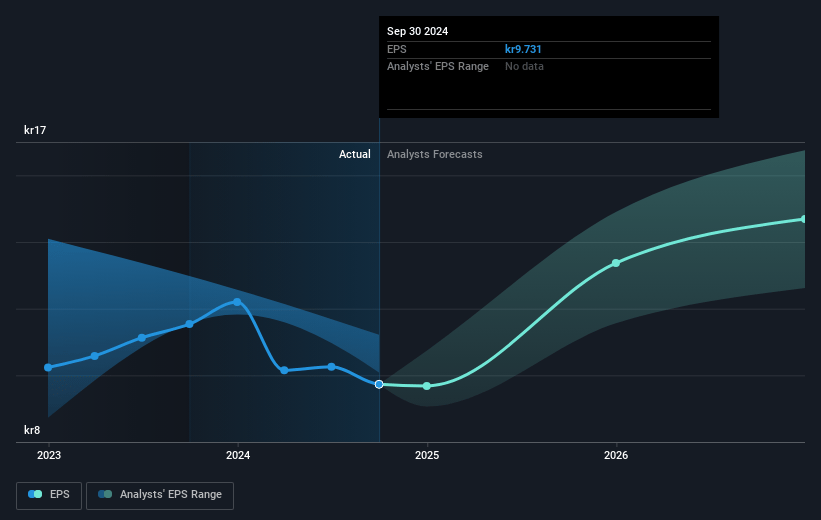

- Analysts expect earnings to reach SEK 20.2 billion (and earnings per share of SEK 16.24) by about January 2028, up from SEK 12.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK22.8 billion in earnings, and the most bearish expecting SEK17.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, down from 23.7x today. This future PE is lower than the current PE for the GB Machinery industry at 28.5x.

- Analysts expect the number of shares outstanding to decline by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.72%, as per the Simply Wall St company report.

Sandvik Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sandvik's growth in China is hampered by high single-digit declines in organic cutting tool sales, indicating potential challenges in maintaining revenue momentum in the region.

- The weak demand in Europe and the automotive sector, with auto segment revenues down low double digits, may continue to pressure overall revenue growth and net earnings.

- The SRP division experienced margin pressure partly due to price competition in infrastructure and inventory obsolescence provisions, which could impact net margins if not managed appropriately.

- Order intakes, although positive, are bolstered by weak comparables and potential market restocking, which may not sustain long-term revenue growth.

- The timing discrepancy between increased production levels in the automotive sector and Sandvik's sales suggests ongoing risks to cutting tool revenue and margin pressures in this segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK236.81 for Sandvik based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK290.0, and the most bearish reporting a price target of just SEK179.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK142.8 billion, earnings will come to SEK20.2 billion, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 5.7%.

- Given the current share price of SEK231.4, the analyst's price target of SEK236.81 is 2.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives