Last Update 15 Aug 25

Fair value Increased 7.14%Despite a notable decline in revenue growth forecasts and a sharp increase in the future P/E multiple, the consensus analyst price target for Nyab has been raised from SEK7.35 to SEK7.88.

What's in the News

- NYAB, with partner Azvi, secured the general contractor role for Phase 1 of the Uppsala Tramway project via joint venture, with a value of SEK 150-200 million, and is well positioned for the significantly larger Phase 2 valued at approximately SEK 5 billion.

- Awarded a SEK 366 million contract by Stockholm Public Transport (SL) to replace waterproofing on the Green line subway tunnel between Medborgarplatsen and Skanstull; work begins autumn 2025.

- Dovre, NYAB’s subsidiary, secured a five-year extension of its frame agreement with Aker BP ASA, covering consultancy and personnel services for major energy projects through 2030.

Valuation Changes

Summary of Valuation Changes for Nyab

- The Consensus Analyst Price Target has risen from SEK7.35 to SEK7.88.

- The Future P/E for Nyab has significantly risen from 16.44x to 183.18x.

- The Consensus Revenue Growth forecasts for Nyab has significantly fallen from 16.6% per annum to 14.0% per annum.

Key Takeaways

- Robust infrastructure demand and strong contract wins position NYAB for stable revenue growth and exposure to government-backed green investments.

- Efficiency improvements, successful acquisitions, and financial strength support expanding margins and enable pursuit of larger, complex projects.

- Margin dilution from acquisitions, weak consulting returns, sluggish renewable demand, and scaling risks threaten profitability and earnings growth amid uncertain market recovery and integration challenges.

Catalysts

About Nyab- Provides engineering, construction, and maintenance services to energy, infrastructure, and industrial construction projects for public and private sectors in Finland and Sweden.

- NYAB's strong and growing order backlog, record order intake, and high book-to-bill ratio (especially in Civil Engineering) are set against a backdrop of increasing urbanization and population growth, which will likely drive consistent revenue growth and support long-term earnings stability as infrastructure demand rises.

- The company's strategic positioning and recent contract wins in large-scale infrastructure and sustainable energy (e.g., grid projects, tramways, and battery energy storage systems) provide robust exposure to government-driven infrastructure investment and the green transition, which can unlock new revenue streams and premium-margin contracts.

- Ongoing improvements in operating efficiency-boosted by cross-border collaboration, digitalization, and targeted cost control-are expected to gradually expand margins, as reflected by recent improvements in Civil Engineering margins despite high topline growth.

- Successful integration and synergy extraction from acquisitions like Dovre and the ongoing shift toward higher-value, collaborative, and perennial contracts are likely to provide operational leverage and further margin improvement, supporting future net profit growth.

- A strong balance sheet, high cash conversion, and room to lever up for expansion enable NYAB to continue capturing larger and more complex projects, facilitating sustained revenue growth and improving return on capital over the medium to long term.

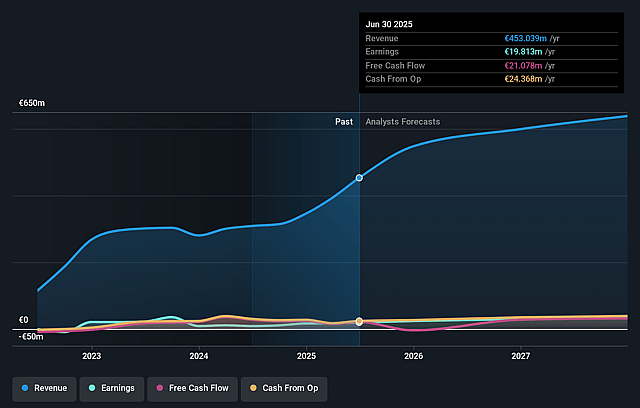

Nyab Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nyab's revenue will grow by 14.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 5.5% in 3 years time.

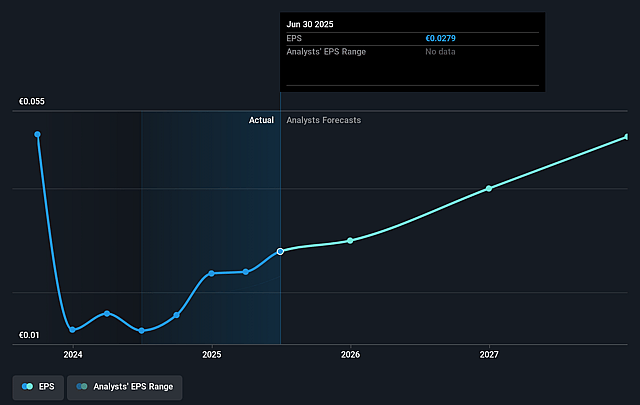

- Analysts expect earnings to reach €36.9 million (and earnings per share of €0.05) by about September 2028, up from €19.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, down from 22.7x today. This future PE is greater than the current PE for the SE Construction industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.29%, as per the Simply Wall St company report.

Nyab Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Dovre acquisition has led to a significant dilution of NYAB's EBIT margin, and despite management optimism, the Consulting segment continues to post much lower margins than Civil Engineering. Persistently low or slow-to-improve operating margins in the Consulting business could erode overall profitability and hinder earnings growth over the long term.

- Demand in the renewable energy sector-a market aligned with long-term green transition trends-remains "slow" and is expected to stay soft for the next few years, according to management. This could delay NYAB's ability to benefit from secular sustainability trends, impacting future revenue growth if the segment does not recover as anticipated.

- The Finnish market's recovery, while contributing some growth, is not yet broad-based; NYAB's strong Finland performance is attributed more to internal agility than market improvement. Any prolonged stagnation or downturn in Finland, or in other key Nordic economies, may result in project pipeline delays and reduced revenue potential.

- Rapid expansion-reflected in the 22% increase in full-time employees and aggressive acquisitive growth-has led to increased costs and periodic negative scaling, especially in Sweden. If growth outpaces organizational capacity, there is a risk of operational inefficiency, project delays, or cost overruns, each of which could suppress net margins and earnings.

- Management's stated inability to achieve their long-term EBIT margin target (7.5%) within the near term, due to margin dilution and integration delays from acquisitions, points to a challenging path toward sustainable margin improvement. This introduces medium-term uncertainty to shareholder returns and could constrain valuation expansion if not resolved.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK7.875 for Nyab based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €671.1 million, earnings will come to €36.9 million, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 6.3%.

- Given the current share price of SEK6.94, the analyst price target of SEK7.88 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.