Narratives are currently in beta

Key Takeaways

- Positive 2025 outcomes are expected from NIBE's action program, with improved margins and profitability, aided by stabilized inventory levels.

- Progress in North American expansion and sector diversification supports revenue and profitability amidst challenging market conditions.

- Sales contraction and high inventory levels, alongside political uncertainties and operational challenges, threaten NIBE Industrier's revenue growth and profitability.

Catalysts

About NIBE Industrier- Develops, manufactures, markets, and sells various energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control in Nordic countries, rest of Europe, North America, and internationally.

- The completion of NIBE's action program is anticipated to yield positive results in 2025, potentially raising operating margins back to historical levels. This will likely improve net margins and overall profitability.

- Inventory levels are stabilizing, which should better align production with actual demand. This could enhance operational efficiency and improve revenue as production ramps up to meet market demand.

- The company is making significant progress in cost reduction, which should lead to improved operating margins by maintaining agility and flexibility in challenging markets.

- The recovery in certain sectors, such as rail and semiconductors, is expected to offset downturns in others like HVAC. This diversification may support revenue stability and growth.

- Expansion into the North American market is progressing well, and this geographical diversification should contribute to revenue growth and enhanced profitability.

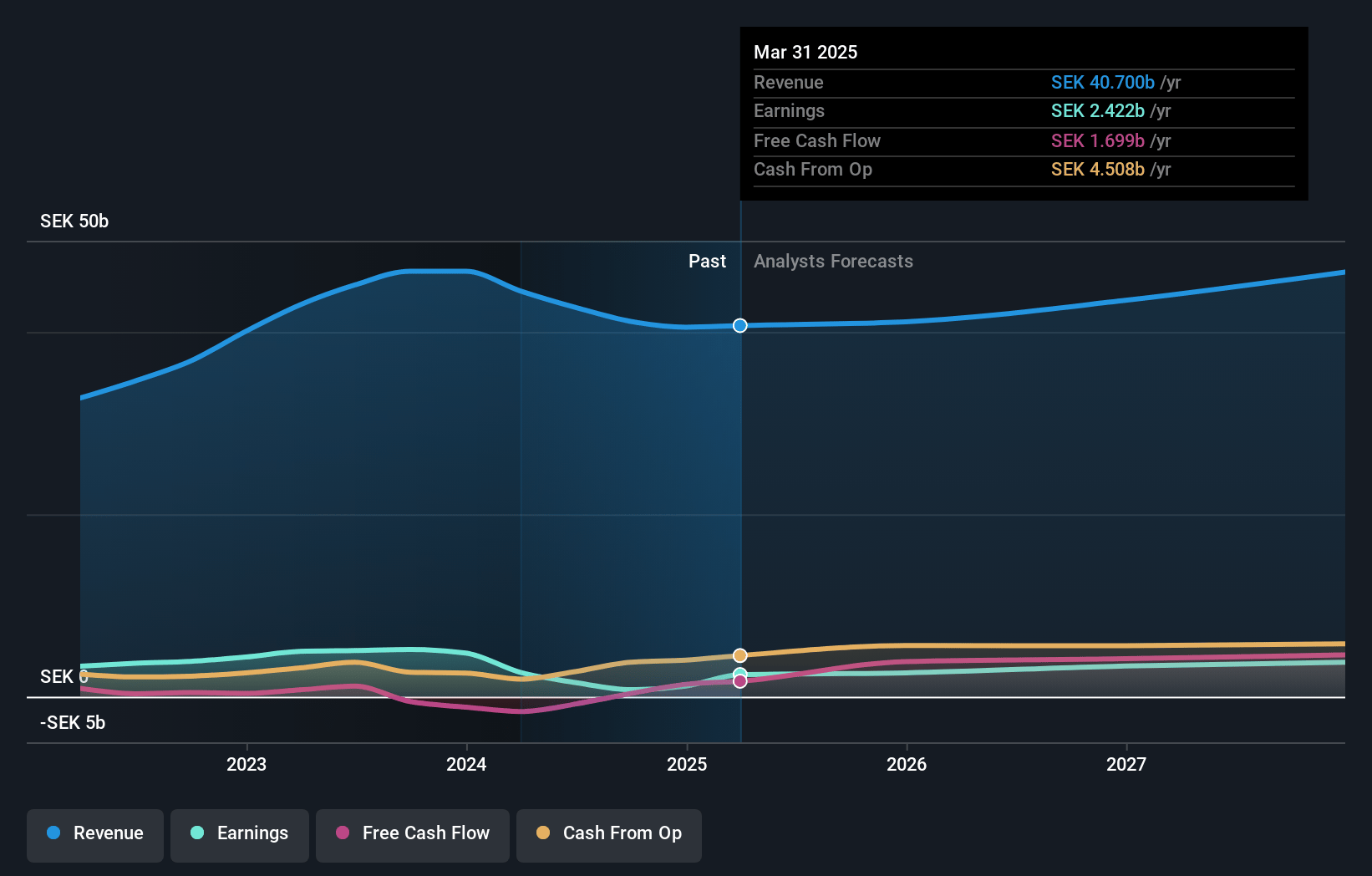

NIBE Industrier Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NIBE Industrier's revenue will grow by 7.7% annually over the next 3 years.

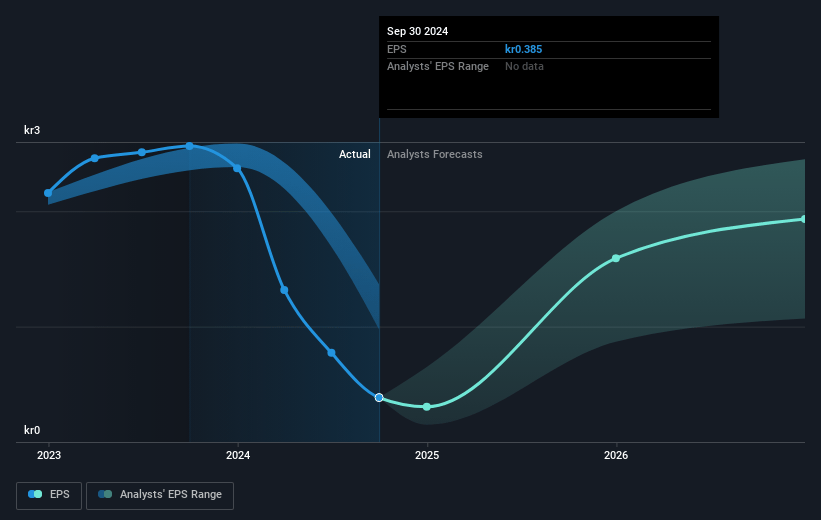

- Analysts assume that profit margins will increase from 1.9% today to 8.8% in 3 years time.

- Analysts expect earnings to reach SEK 4.5 billion (and earnings per share of SEK 2.21) by about January 2028, up from SEK 776.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SEK 3.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.4x on those 2028 earnings, down from 112.3x today. This future PE is greater than the current PE for the GB Building industry at 21.0x.

- Analysts expect the number of shares outstanding to grow by 0.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.43%, as per the Simply Wall St company report.

NIBE Industrier Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The report mentions a contraction in sales of 20% compared to the previous year, leading to decreased operating margins, which indicates a risk to future revenue growth and profitability.

- Inventory levels, particularly in Germany, remain high, suggesting lingering issues with demand and supply chain balance, potentially affecting revenue forecasting and cost management.

- The gross margin has taken a hit, and remains below last year's levels, posing a challenge to net margins and overall profitability.

- The ongoing cost-saving measures imply operational challenges, which may impact employee morale and productivity, affecting future earnings.

- Political and market uncertainties, particularly in Europe and North America, could influence demand for key products like heat pumps, affecting both revenue and long-term growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK 57.54 for NIBE Industrier based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK 120.0, and the most bearish reporting a price target of just SEK 24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK 51.4 billion, earnings will come to SEK 4.5 billion, and it would be trading on a PE ratio of 31.4x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK 43.24, the analyst's price target of SEK 57.54 is 24.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives