Narratives are currently in beta

Key Takeaways

- Swedbank faces revenue volatility and tighter margins due to reliance on timed effects for net interest income and new bank taxes in Latvia.

- Regulatory changes and potential fines could impact Swedbank's capital requirements and limit growth investments or shareholder returns.

- Swedbank's strategic focus on innovation, sustainability, and regional growth positions them for enhanced profitability and stable long-term financial performance.

Catalysts

About Swedbank- Provides various banking products and services to private and corporate customers in Sweden, Estonia, Latvia, Lithuania, Norway, the United States, Finland, Denmark, Luxembourg, and China.

- Swedbank's reliance on positively timed effects for net interest income (NII) is unsustainable as it heavily depends on declining liabilities costs ahead of asset repricing, posing a risk of revenue volatility if interest rate trends change.

- The implementation of new bank taxes in Latvia which, unlike in Lithuania, will not exclude income from new lending, creates a challenging environment. Expectations of this tax being a recurring issue could lead to tighter net margins and potentially lower earnings growth than currently anticipated.

- Swedbank's lower current mortgage market share in Sweden and decreased mortgage volumes highlight challenges in maintaining competitiveness against intensified market activity. A delayed resolution in availability issues suggests potential revenue shortfalls versus market expectations.

- The upcoming regulatory changes such as Basel IV, and adjustments related to the IRB model, pose uncertainties regarding capital requirements impacting current and future capital position assessments which could constrain earnings growth.

- Anticipated potential fines related to ongoing U.S. regulatory investigations could impact Swedbank's deployment strategy for its excess capital, limiting opportunities for growth investment or shareholder return enhancements such as buybacks or special dividends.

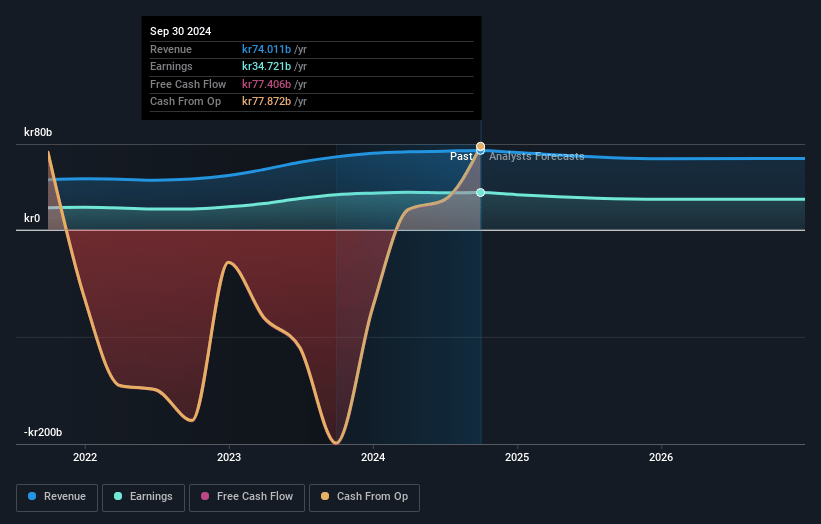

Swedbank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Swedbank's revenue will decrease by -2.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 46.9% today to 39.4% in 3 years time.

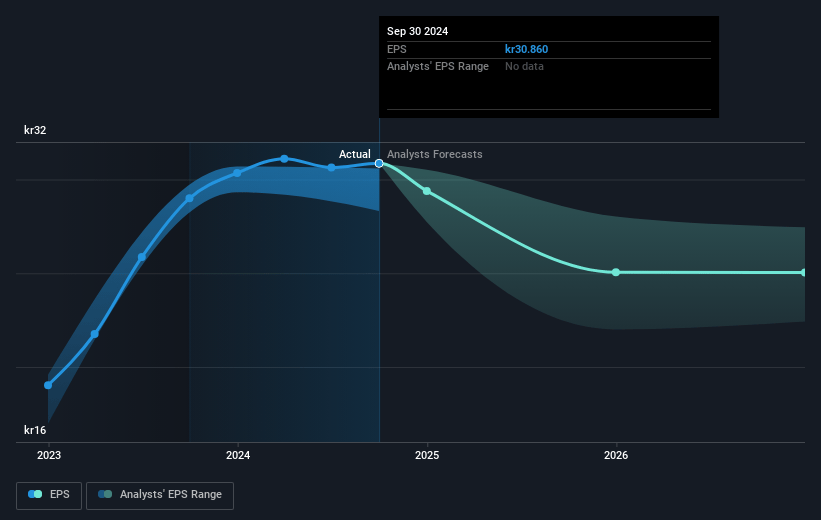

- Analysts expect earnings to reach SEK 27.0 billion (and earnings per share of SEK 24.36) by about January 2028, down from SEK 34.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK33.0 billion in earnings, and the most bearish expecting SEK16.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, up from 7.8x today. This future PE is greater than the current PE for the GB Banks industry at 9.1x.

- Analysts expect the number of shares outstanding to decline by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.88%, as per the Simply Wall St company report.

Swedbank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Swedbank has achieved a 2% increase in profit for 2024, maintained a strong return on equity, and demonstrated solid credit quality and strong capital and liquidity positions, indicating potential for continued profitability and resilience. This supports earnings stability.

- Regional economic growth prospects, particularly in Lithuania and with public investments in defense and infrastructure, offer business opportunities for Swedbank and suggest potential revenue growth as these sectors develop.

- Swedbank's implementation of a focus on innovative technologies, such as an advisory platform and omnichannel communication, aims to improve customer interaction and operational efficiency, potentially enhancing net margins by reducing operational costs.

- The bank's leadership in sustainable finance, with a significant increase in its Sustainable Asset Register, reflects Swedbank's commitment to responsible banking, potentially attracting a broader customer base and leading to increased revenue from sustainable finance initiatives.

- Swedbank's updated dividend policy, alongside a strong capital position, provides flexibility for growth and shareholder returns, suggesting confidence in stable financial performance and potential for earnings growth in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK248.59 for Swedbank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK285.0, and the most bearish reporting a price target of just SEK199.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK68.6 billion, earnings will come to SEK27.0 billion, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 8.9%.

- Given the current share price of SEK242.6, the analyst's price target of SEK248.59 is 2.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives