Narratives are currently in beta

Key Takeaways

- Expansion in long life dairy and new flavored juices aims to boost revenue by aligning with consumer preferences and increasing market share.

- Strategic diversification into ice cream and international acquisitions like in Jordan are set to enhance product offerings and geographical market presence.

- Increased operational costs, currency devaluation, and high capital expenditure could pressure margins and cash flow without effective pricing and efficiency strategies.

Catalysts

About Almarai- Operates as an integrated consumer food and beverage company in Saudi Arabia, Egypt, Jordan, and other Gulf Cooperation Council countries.

- Almarai's expansion in the Long Life Dairy and the launch of new flavored juices are expected to drive future revenue growth by leveraging consumer preferences and expanding market share in these categories.

- The company's strategic entry into the ice cream segment highlights its capability to diversify its product line, which should bolster revenue through increased product offerings and capitalize on market opportunities.

- Future improvement in operational efficiencies, especially within the poultry sector, is anticipated to uplift net margins by reducing cost per unit and enhancing production output.

- International expansion, particularly the acquisition in Jordan, is set to strengthen Almarai's market presence and increase revenue from new regions, offering geographical diversification benefits.

- Planned capital expenditure in expanding poultry operations and dairy infrastructure reveals Almarai's commitment to sustaining earnings growth by meeting high market demand and building a future-ready operational base.

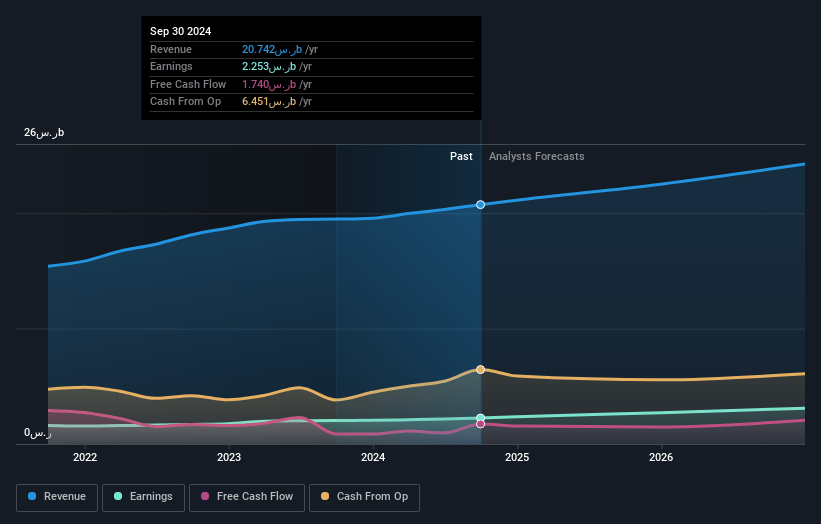

Almarai Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Almarai's revenue will grow by 7.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.9% today to 13.3% in 3 years time.

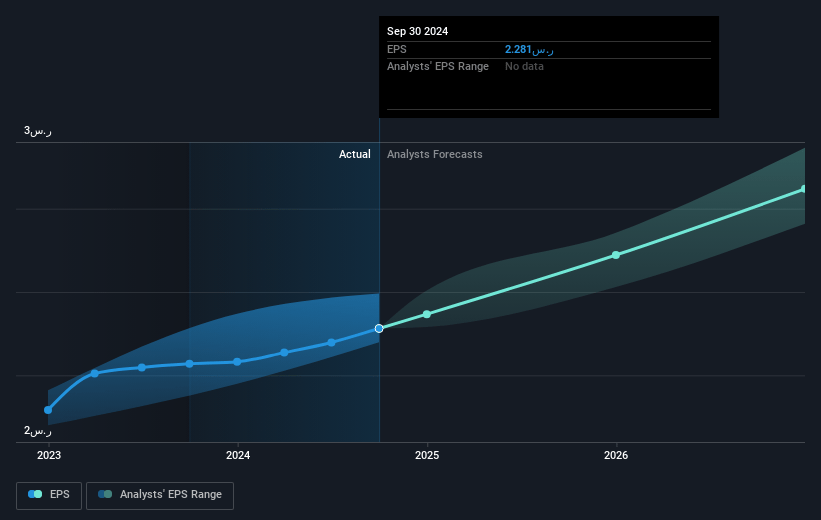

- Analysts expect earnings to reach SAR 3.4 billion (and earnings per share of SAR 3.31) by about December 2027, up from SAR 2.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.9x on those 2027 earnings, up from 26.9x today. This future PE is greater than the current PE for the SA Food industry at 20.5x.

- Analysts expect the number of shares outstanding to grow by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.71%, as per the Simply Wall St company report.

Almarai Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's increase in operational costs, mainly due to higher diesel expenses and volume-related operating expenses, could pressure net margins if not offset by efficiency gains or pricing strategies.

- The devaluation of currency in Egypt, where there was a 57% growth in local currency but a decline when converted to Saudi Riyal, could negatively impact net earnings due to potential exchange rate losses.

- Concern over future commodity costs, particularly with oil price fluctuations affecting packaging and diesel costs, might impact net margins if prices rise.

- Expansion plans, like the SAR 18 billion investment over five years, require significant capital expenditure, potentially impacting free cash flow and increasing financial risk if expected returns are not realized.

- With high growth in traditional trade versus modern trade, potential shifts in consumer buying preferences or increased competition in modern trade could adversely affect revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SAR 66.93 for Almarai based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SAR 71.5, and the most bearish reporting a price target of just SAR 60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be SAR 25.7 billion, earnings will come to SAR 3.4 billion, and it would be trading on a PE ratio of 33.9x, assuming you use a discount rate of 18.7%.

- Given the current share price of SAR 60.7, the analyst's price target of SAR 66.93 is 9.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives