Last Update27 Aug 25Fair value Decreased 4.37%

A slight decline in WOQOD’s future P/E ratio suggests more cautious growth expectations, driving the consensus analyst price target down from QAR16.92 to QAR16.18.

Valuation Changes

Summary of Valuation Changes for Qatar Fuel Company Q.P.S.C. (WOQOD)

- The Consensus Analyst Price Target has fallen slightly from QAR16.92 to QAR16.18.

- The Future P/E for Qatar Fuel Company Q.P.S.C. (WOQOD) has fallen slightly from 28.05x to 26.83x.

- The Discount Rate for Qatar Fuel Company Q.P.S.C. (WOQOD) remained effectively unchanged, moving only marginally from 18.89% to 18.91%.

Key Takeaways

- Expansion of stations and value-added services boosts accessibility and diversifies income, supporting future earnings stability and improved profitability.

- Investment in alternative energy and infrastructure aligns the company for long-term growth despite potential declines in traditional fuel margins.

- Heavy reliance on traditional fuel sales, limited diversification, and weak non-fuel growth expose WOQOD to significant risks from declining fuel demand and industry transition.

Catalysts

About Qatar Fuel Company Q.P.S.C. (WOQOD)- Sells, markets, and distributes oil, gas, and refined petroleum products in State of Qatar.

- Government-backed infrastructure and logistics projects, such as the Simaisma project, are expected to drive incremental demand for bulk diesel and related products, directly supporting sales volume growth and revenue in future quarters.

- Continued population growth and rising car ownership in Qatar and the Gulf region are likely to underpin steady increases in retail fuel sales, providing a solid base for long-term revenue and market share stability.

- The company is expanding its fuel station network, including underserved areas, which will improve access and convenience, supporting higher throughput and revenue growth over time.

- Development of alternative energy services, including the installation of EV chargers across its station network, positions WOQOD to capture future non-fuel earnings streams, helping to offset any long-term declines in traditional fuel margins and supporting net margins.

- WOQOD's strategic focus on optimizing non-fuel retail offerings and value-added services signals potential for improved profitability and diversification of earnings, positively impacting future net margins and overall earnings stability.

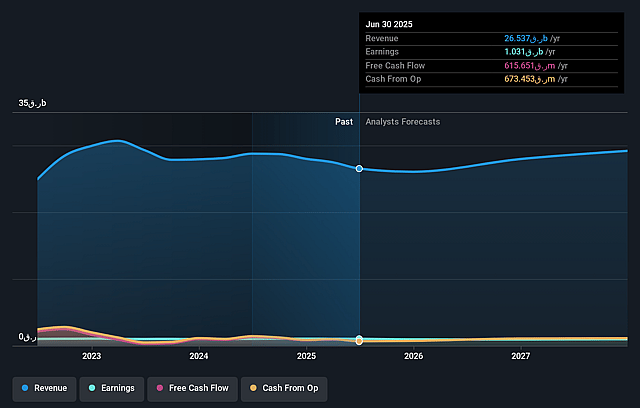

Qatar Fuel Company Q.P.S.C. (WOQOD) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Qatar Fuel Company Q.P.S.C. (WOQOD)'s revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.9% today to 3.4% in 3 years time.

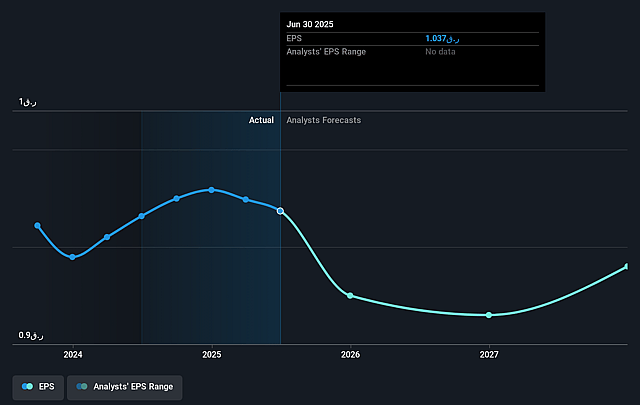

- Analysts expect earnings to remain at the same level they are now, that being QAR 1.0 billion (with an earnings per share of QAR 1.01).

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.0x on those 2028 earnings, up from 14.7x today. This future PE is greater than the current PE for the QA Oil and Gas industry at 15.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.89%, as per the Simply Wall St company report.

Qatar Fuel Company Q.P.S.C. (WOQOD) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Revenue from fuel sales, which constitutes 97% of WOQOD's total revenue, declined by 11% year-on-year in the first half of 2025 due to both lower overall fuel sales volumes (-1%) and a significant decrease in average sales prices (-10%), indicating the company's high vulnerability to secular declines in fuel consumption and price volatility-both of which can negatively impact future revenues and earnings.

- Nonfuel retail sales experienced a sharp 9% decline in the first half of 2025, following a double-digit decline the year before; continued weakness or lack of significant strategic turnaround in these segments increases the company's reliance on traditional fuel sales and limits earnings diversification, putting added pressure on net margins and long-term profitability.

- Jet fuel sales volumes dropped 2% year-on-year in the first half, and jet fuel prices fell sharply by 15% amid volatile market conditions; heavy dependence on a few large customers (i.e., Qatar Airways) and exposure to the cyclical nature and price volatility of the airline industry raise risks to stable revenue streams from this segment.

- Despite ongoing investment in expanding its fuel station network and EV charging infrastructure, management's comments point to limited near-term payback from these expenditures, suggesting high capital expenditures may not yield proportionate growth in revenue or margins if overall fuel demand continues to stagnate or decline, posing a risk of diminishing returns on assets and capital.

- External long-term trends, such as the global shift towards renewables and increased adoption of electric vehicles (noted by management's small-scale deployment of only 25 EV chargers), could erode core gasoline and diesel volumes; WOQOD's current low level of diversification into alternative energy or significant non-fuel businesses increases the risk that future secular declines in fossil fuel use will cause sustained revenue and net income pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of QAR16.92 for Qatar Fuel Company Q.P.S.C. (WOQOD) based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be QAR29.6 billion, earnings will come to QAR1.0 billion, and it would be trading on a PE ratio of 28.0x, assuming you use a discount rate of 18.9%.

- Given the current share price of QAR15.28, the analyst price target of QAR16.92 is 9.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.