Last Update27 Aug 25Fair value Increased 1.16%

The consensus Analyst Price Target for Qatar Islamic Bank (Q.P.S.C.) saw a marginal upward revision, with both Future P/E and Discount Rate effectively unchanged, resulting in a new fair value target of QAR26.10.

Valuation Changes

Summary of Valuation Changes for Qatar Islamic Bank (Q.P.S.C.)

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from QAR25.80 to QAR26.10.

- The Future P/E for Qatar Islamic Bank (Q.P.S.C.) remained effectively unchanged, moving only marginally from 18.59x to 18.82x.

- The Discount Rate for Qatar Islamic Bank (Q.P.S.C.) remained effectively unchanged, moving only marginally from 19.26% to 19.29%.

Key Takeaways

- Increased infrastructure investment and global acceptance of Islamic finance are driving demand and expanding QIB's customer base, supporting market share and income diversification.

- Ongoing digitalization, robust risk management, and strong liquidity are enhancing operational efficiency, reducing volatility, and enabling sustainable, long-term growth.

- Heavy dependence on government sectors and assets exposes the bank to concentration, funding, and earnings risks amid volatile macroeconomic or regulatory conditions.

Catalysts

About Qatar Islamic Bank (Q.P.S.C.)- Provides corporate, retail, and investment banking products and services in Qatar and internationally.

- Anticipated acceleration in Qatar's economic expansion, particularly from large-scale infrastructure and LNG projects, is expected to increase demand for both personal and corporate banking services at Qatar Islamic Bank, supporting loan growth and fee income in the medium to long term, which would positively impact revenue and earnings.

- Continued shift in consumer and corporate preferences towards Sharia-compliant banking, supported by broadening acceptance of Islamic finance in Qatar and globally, is poised to expand the addressable customer base for QIB, sustaining growth in market share and fee-generating products-supporting top-line revenue and diversification of income sources.

- Sustained investments in digitalization and automation, evidenced by QIB's consistently low cost-to-income ratio and management's commitment to extracting operational efficiencies from technology spend, are likely to further enhance cost discipline and support stable or improving net margins over the long run.

- Prudent risk management and conservative provisioning policies, as demonstrated by low and stable NPL ratios and high coverage levels, reduce the risk of earnings volatility and limit downside to future net profit growth, underpinning the bank's capacity to deliver consistent returns.

- Strong liquidity position, significant capital adequacy (22% CAR), and the ability to access diversified funding sources-including robust growth in government deposits and successful international Sukuk issuance-provide ample capacity for future balance sheet expansion, enabling QIB to capitalize on opportunities that fuel sustainable long-term growth in assets and income.

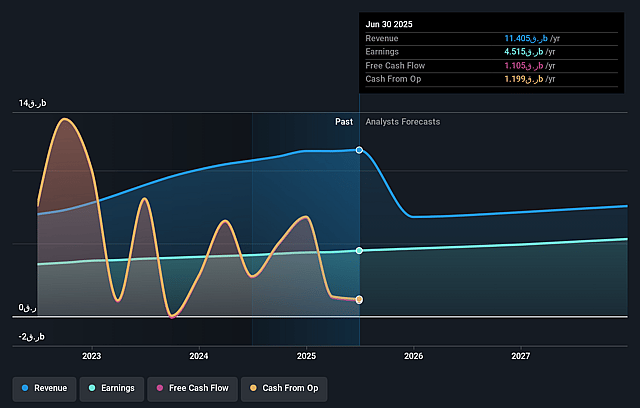

Qatar Islamic Bank (Q.P.S.C.) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Qatar Islamic Bank (Q.P.S.C.)'s revenue will decrease by 11.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 39.6% today to 70.2% in 3 years time.

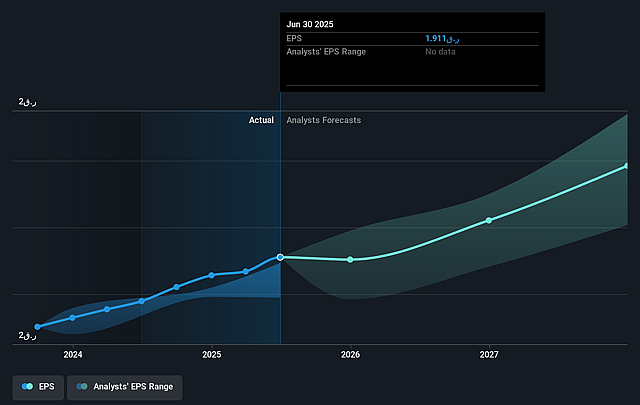

- Analysts expect earnings to reach QAR 5.6 billion (and earnings per share of QAR 2.27) by about September 2028, up from QAR 4.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as QAR4.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from 12.8x today. This future PE is greater than the current PE for the QA Banks industry at 12.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.35%, as per the Simply Wall St company report.

Qatar Islamic Bank (Q.P.S.C.) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite reported loan growth being driven by private and personal banking, management indicated that recent public sector loan growth was short-lived with repayments from the government, suggesting vulnerability to volatility in government credit demand, which could negatively impact long-term lending growth and thus constrain sustainable revenue expansion.

- The bank's growing investment in State of Qatar Sukuk increases concentration risk in a low-yield, government-linked asset class-management acknowledged this shift could compress overall net interest margins (NIMs) despite its low risk, potentially pressuring future earnings and profitability.

- Customer deposit growth is heavily reliant on government deposits, now comprising approximately 33–34% of total deposits; this exposes the bank to potential deposit flight or repricing should government funding priorities or liquidity needs shift, raising longer-term funding cost risk and undermining net margins.

- While asset quality ratios currently appear strong, the Stage 2 loan book remains elevated with little clarity on improvement; any macroeconomic stress, sectoral downturn, or migration to Stage 3 could lead to sharp rises in provisions and impairments, adversely affecting future net income and capital adequacy.

- Management's repeated provisioning for potential tax-related liabilities and reliance on strong operating performance (rather than underlying asset quality) to drive low cost of risk suggests that earnings are susceptible to regulatory or tax changes; future tax hikes, regulatory tightening, or inability to maintain strong profitability could lead to higher costs, reducing net margins and overall returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of QAR26.1 for Qatar Islamic Bank (Q.P.S.C.) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of QAR29.4, and the most bearish reporting a price target of just QAR24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be QAR7.9 billion, earnings will come to QAR5.6 billion, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 19.4%.

- Given the current share price of QAR24.4, the analyst price target of QAR26.1 is 6.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.