Key Takeaways

- Native AI-powered product suite and cloud migration drive growth, cost efficiency, and expansion into new markets and customer segments.

- Emphasis on security, SaaS transition, and enterprise focus enhances recurring revenues, contract values, and market positioning.

- Market saturation, margin compression, lagging innovation, and reduced transparency threaten future growth, profitability, and competitive positioning in an increasingly AI-driven industry.

Catalysts

About Text- Develops and distributes online text communication software for businesses worldwide.

- The recent launch of Text App, a fully integrated suite designed from the ground up with native AI features (e.g., AI assistants, automation, Copilot) positions the company well to capture rising demand for AI-powered software and next-gen digital transformation, potentially accelerating top-line growth and improving pricing power over time (impact: revenue, margins).

- Completion of the new cloud infrastructure migration enables cost reduction in the coming quarters, unlocks additional functionalities for enterprise clients, and sets the stage for further expansion into new geographies and customer segments, which can drive both revenue growth and improved operating margins.

- Increasing share of large customers (MRR > $500), multiproduct adoption, and upselling (e.g., $1M annual contract signed) reflect successful expansion into higher-value enterprise accounts-supporting higher average contract values, stronger recurring revenues, and ultimately, earnings growth.

- Ongoing investments in AI-driven product innovation and the transition to a SaaS subscription model (with focus on MRR/ARR) provide greater revenue predictability and margin stability, aligning Text with industry trends favoring scalable, cloud and subscription-based software businesses.

- The pursuit of SOC2 certification and new security features caters to heightened regulatory and security demands, which can enhance customer retention, support premium pricing, and position Text as a trusted long-term partner for business-critical applications (impact: recurring revenue, net margins).

Text Future Earnings and Revenue Growth

Assumptions

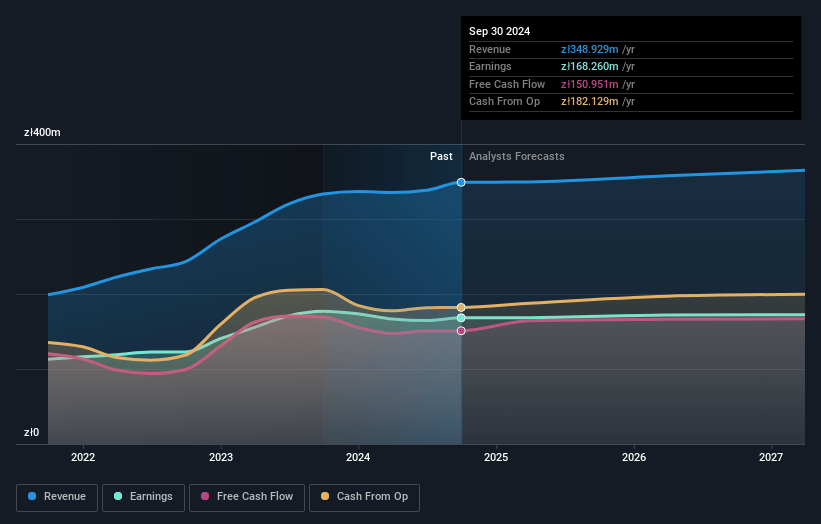

How have these above catalysts been quantified?- Analysts are assuming Text's revenue will decrease by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 46.4% today to 45.9% in 3 years time.

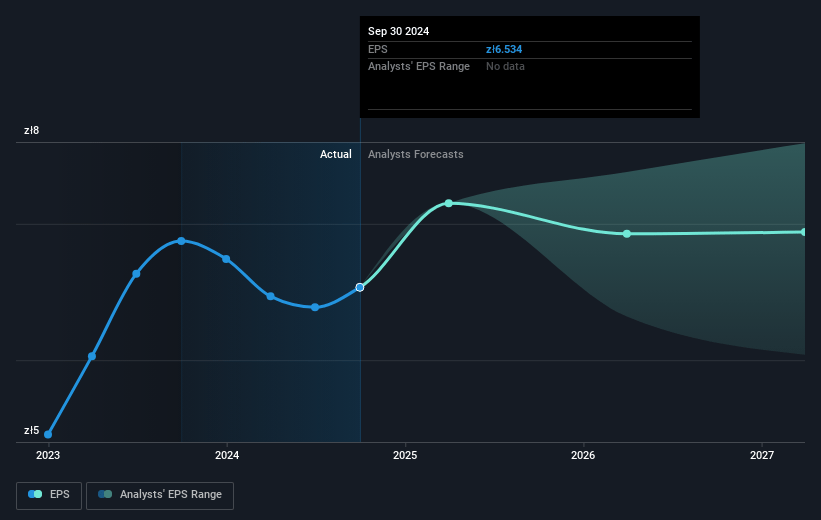

- Analysts expect earnings to reach PLN 154.8 million (and earnings per share of PLN 7.7) by about July 2028, down from PLN 164.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from 9.2x today. This future PE is lower than the current PE for the GB Software industry at 21.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.7%, as per the Simply Wall St company report.

Text Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining customer count in the core LiveChat product, offset only partially by higher ARPL, signals underlying market saturation or competitive pressures, which could threaten future revenue growth if not reversed.

- Slower-than-expected MRR and ARR growth-explicitly noted as below internal targets and currently in single-digit percentages-puts the company's long-term revenue and earnings growth ambitions at risk, especially if macroeconomic headwinds or extended sales cycles for enterprise deals persist.

- Increasing cost base related to competitive customer acquisition (SEO overhaul, sales team expansion, offline presence), FX fluctuations (PLN/USD), and ongoing investments in product development have already led to decreasing EBIT margins over the past five years, risking further compression of net margins and profitability.

- Transition to reporting only aggregated MRR (discontinuing detailed product-level disclosure) may reduce transparency, potentially causing reduced investor confidence, and could mask future declines in customer acquisition, ARPL, or churn-all of which could negatively impact revenues and earnings quality.

- A lagging innovation pipeline or inability to fully embed or capitalize on AI-especially as existing products were not initially built with AI at their core-raises the risk of falling behind disruptive, cloud-native, or AI-first competitors, ultimately putting long-term revenue, market share, and margins under pressure.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of PLN69.96 for Text based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PLN85.1, and the most bearish reporting a price target of just PLN56.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be PLN337.5 million, earnings will come to PLN154.8 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 10.7%.

- Given the current share price of PLN58.8, the analyst price target of PLN69.96 is 16.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.