Last Update 11 Aug 25

Fair value Increased 20%The notable increase in Asseco Poland’s consensus price target primarily reflects a substantial upward revision in its future P/E multiple despite unchanged revenue growth forecasts, with fair value raised from PLN105.46 to PLN123.22.

What's in the News

- Asseco Poland has completed the share buyback program announced in June 2023, repurchasing 14,808,872 shares (17.84%) for PLN 1,184.71 million, with no additional shares repurchased in subsequent tranches.

Valuation Changes

Summary of Valuation Changes for Asseco Poland

- The Consensus Analyst Price Target has significantly risen from PLN105.46 to PLN123.22.

- The Future P/E for Asseco Poland has significantly risen from 14.83x to 17.41x.

- The Consensus Revenue Growth forecasts for Asseco Poland remained effectively unchanged, at 5.8% per annum.

Key Takeaways

- Optimistic growth and margin expectations may overlook one-off gains, integration risks, and structural wage pressures that threaten long-term profitability.

- Heavy dependence on custom software for the public sector and exposure to global competition could erode revenue stability and margin resilience over time.

- Diversified growth across sectors, geographies, and high-margin proprietary software, supported by active M&A and disciplined management, strengthens sustainable revenue and profitability resilience.

Catalysts

About Asseco Poland- Produces and sells software products worldwide.

- The current valuation may be reflecting overly optimistic expectations for continued double-digit growth in software demand from public sector and enterprise digitalization, even though management highlighted that some recent profitability gains are due to one-off catch-up effects from previously signed contracts and a favorable cost cycle, which are unlikely to be sustained; this could result in slower future revenue and margin growth.

- Investors may be pricing in sustained high recurring revenues and margin expansion due to the apparent resilience in cloud, cybersecurity, and regulatory-driven software demand; however, competitive threats from global SaaS and hyperscale cloud providers and customers' shift to standardized solutions could gradually erode Asseco Poland's custom software business, impacting future revenue and net margins.

- The market may be overestimating the benefits of accelerating M&A, assuming acquired companies will integrate seamlessly and cumulatively drive long-term earnings growth, while the growing operational complexity and integration risks from a federated group structure could increase costs and ultimately weigh on group profitability.

- Share price strength could be based on the expectation that wage pressures have abated for good and cost discipline will further improve margins, yet technology sector wage inflation remains a structural threat; a reversal could compress net margins in the medium to long-term.

- The backlog growth and recent strong government contract wins may be driving bullish top-line expectations, but heavy reliance on public sector spending and the slow roll-out of EU recovery funds introduce volatility in revenue flows due to political cycles or changes in regulatory/budgetary regimes, risking less predictable future earnings.

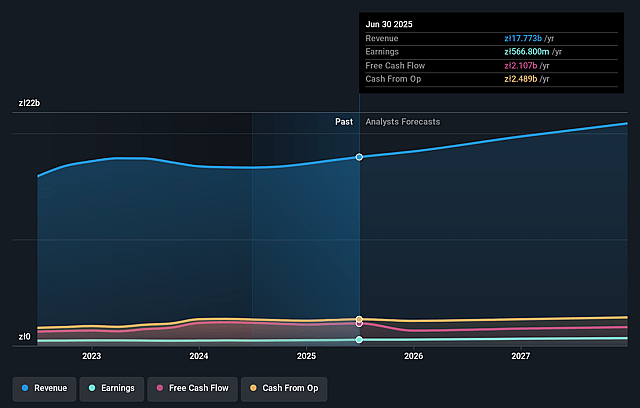

Asseco Poland Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Asseco Poland's revenue will grow by 7.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 3.5% in 3 years time.

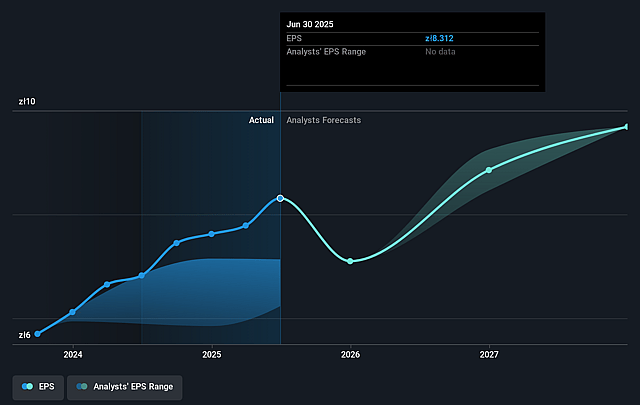

- Analysts expect earnings to reach PLN 745.9 million (and earnings per share of PLN 9.48) by about September 2028, up from PLN 531.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as PLN654 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.3x on those 2028 earnings, down from 23.1x today. This future PE is lower than the current PE for the GB Software industry at 21.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.02%, as per the Simply Wall St company report.

Asseco Poland Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong double-digit growth in public sector solutions, a diversified client base with no overreliance on any single customer, and robust backlogs in Poland and internationally-especially in government and enterprise sectors-reflect long-term demand that supports revenue growth and stability.

- Ongoing, successful M&A activity (eight new companies joined the group recently, with continued acquisition plans) demonstrates sustained inorganic growth potential, contributing to increasing group revenues and margin improvement through synergies and broadening product capabilities.

- Expansion across diverse industries (finance, healthcare, energy, ERP, and HR/payments) and geographies (Central/Eastern/Western Europe, Israel, Africa, and the U.S.) reduces dependency on individual markets, providing natural hedges against localized downturns and boosting resilient earnings.

- Emphasis on proprietary software and services with recurring revenues (notably, 9% CAGR in this segment), contractual order backlogs (PLN 12.5 billion for 2025), and a shift to more predictable, high-margin business models position the company for improved net margins and solid free cash flow generation.

- The group's demonstrated ability to improve profitability (rentability) in core and international segments, adjust operational spending to project cycles, and leverage pricing indexation in contracts indicates ongoing management discipline and resilience-allowing for sustained or expanding net profit margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of PLN126.924 for Asseco Poland based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PLN185.0, and the most bearish reporting a price target of just PLN89.12.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be PLN21.5 billion, earnings will come to PLN745.9 million, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 12.0%.

- Given the current share price of PLN180.2, the analyst price target of PLN126.92 is 42.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.