Key Takeaways

- Allegro's expansion into Hungary and focus on international markets could drive significant GMV growth and diversify revenue streams.

- Strategic improvements in marketing, logistics, and inventory management are expected to enhance operational efficiency and positively impact net margins.

- Increased marketing and logistical expenses could decrease margins, while international consumer spending challenges and capital investments may hinder short-term revenue and profitability.

Catalysts

About Allegro.eu- Operates a go-to commerce platform for consumers in Poland and internationally.

- Allegro's expansion of its marketplace model into Hungary and additional focus on international markets like the Czech Republic and Slovakia is expected to drive future GMV (Gross Merchandise Volume) growth. This expansion could significantly increase revenue streams as user bases in diversified markets begin to contribute more significantly.

- The continued investment in marketing, logistics, and technology infrastructure, including the shift to a product-based view, is anticipated to enhance operational efficiencies and customer loyalty. This development is likely to have a positive impact on both revenue growth and net margins as these enhancements solidify Allegro's market position.

- Allegro's successful reduction in inventory and SKU (Stock Keeping Unit) rationalization in its Mall segment is expected to reduce costs and improve profitability as it aligns the product offering with customer demand. This strategic adjustment may enhance net margins as operations become more streamlined.

- The growth of Allegro's advertising revenue and FinTech solutions, which outperform GMV growth and maintain low loan write-offs respectively, is projected to be substantial contributors to future earnings. These high-margin services could positively impact overall earnings growth as they expand.

- The expected participation of additional courier services in Allegro's delivery network and progress toward cost parity with Allegro One operations are foreseen to lower delivery costs. This advancement could lead to improved net margins and operational cost efficiency as the company leverages a broader logistics infrastructure.

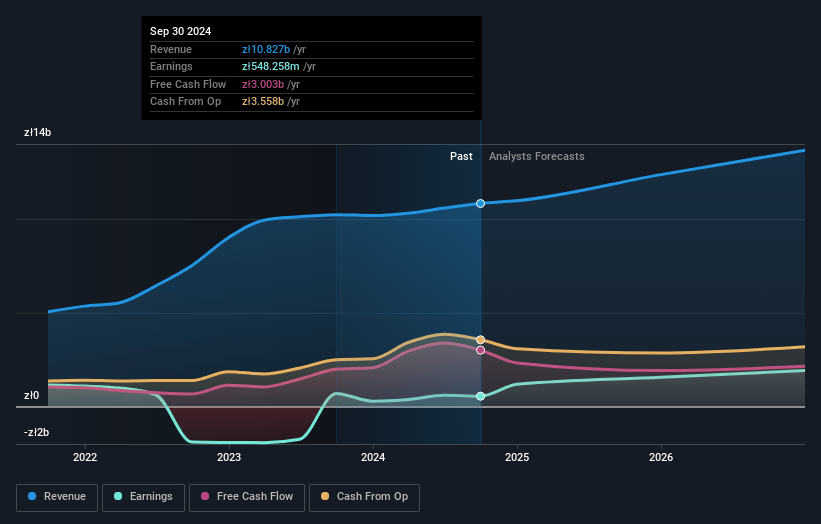

Allegro.eu Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Allegro.eu's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.1% today to 14.9% in 3 years time.

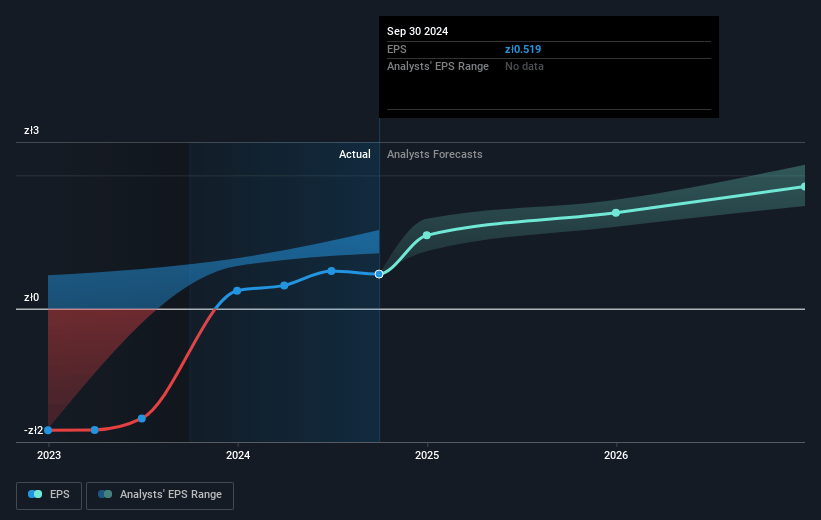

- Analysts expect earnings to reach PLN 2.2 billion (and earnings per share of PLN 2.17) by about January 2028, up from PLN 548.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.3x on those 2028 earnings, down from 55.6x today. This future PE is lower than the current PE for the PL Multiline Retail industry at 55.1x.

- Analysts expect the number of shares outstanding to decline by 1.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.66%, as per the Simply Wall St company report.

Allegro.eu Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increased focus on marketing and logistics spending in Poland could lead to reduced margins, impacting net earnings, particularly if the competitive market pressures continue.

- The financial performance and GMV growth are being affected by weaker-than-expected consumer spending internationally, especially in the newly expanded markets like the Czech Republic and Slovakia, posing a risk to revenue growth.

- Allegro's significant capital expenditure increase and investment in multiple growth areas like lockers and technology might not yield immediate returns, potentially impacting cash flows and profitability in the short term.

- The substantial transformation in international segments, especially the reduction and cancellation of certain offerings in the Mall segment, could lead to increased short-term losses and pressure on adjusted EBITDA.

- Allegro’s plans include expansion in recent markets, but challenges with product offering localization and customer frequency may lead to slower than anticipated revenue generation and profitability in those areas.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of PLN37.72 for Allegro.eu based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PLN45.0, and the most bearish reporting a price target of just PLN30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be PLN14.8 billion, earnings will come to PLN2.2 billion, and it would be trading on a PE ratio of 22.3x, assuming you use a discount rate of 8.7%.

- Given the current share price of PLN28.87, the analyst's price target of PLN37.72 is 23.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives