Catalysts

About Jastrzebska Spólka Weglowa

Jastrzebska Spólka Weglowa is a Polish mining group focused on the production of coking coal and coke for the steel industry.

What are the underlying business or industry changes driving this perspective?

- Structural decline in European steel production, combined with rising imports from regions not covered by EU carbon and environmental regimes, threatens sustained pressure on demand and pricing for JSW's coking coal and coke. This weighs on revenue and EBITDA over the medium term.

- Global oversupply of steel and coke, highlighted by higher Chinese steel exports and rapidly growing Indonesian coke exports into Europe, increases competitive pressure on JSW's products and could lock in lower realized prices and weaker net margins.

- Heavy reliance on cost cutting, mine consolidation and voluntary redundancies to restore profitability risks operational disruption, loss of key skills and higher one-off restructuring charges. This may depress earnings and delay any improvement in cash flow.

- High fixed labor and energy costs, coupled with the need to maintain safety critical CapEx and develop new mining panels, limit JSW's ability to flex its cost base in weak markets. This may keep unit mining and conversion costs elevated relative to falling selling prices and further compress margins.

- Dependence on state support, tax refunds and bank waivers to stabilize liquidity underlines a fragile balance sheet. Any delay or shortfall in external support could force deeper asset sales or equity-like solutions that dilute future earnings per share.

Assumptions

This narrative explores a more pessimistic perspective on Jastrzebska Spólka Weglowa compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

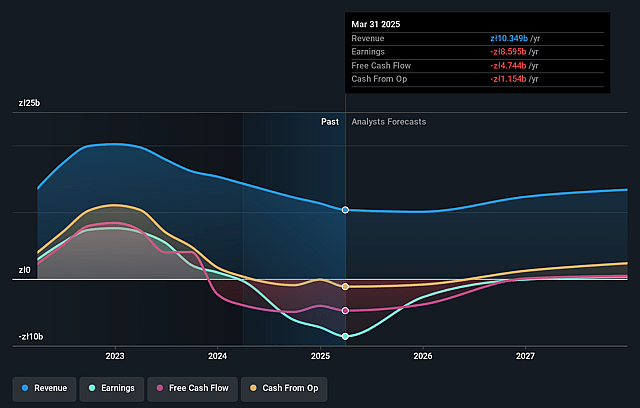

- The bearish analysts are assuming Jastrzebska Spólka Weglowa's revenue will grow by 11.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -40.2% today to 10.7% in 3 years time.

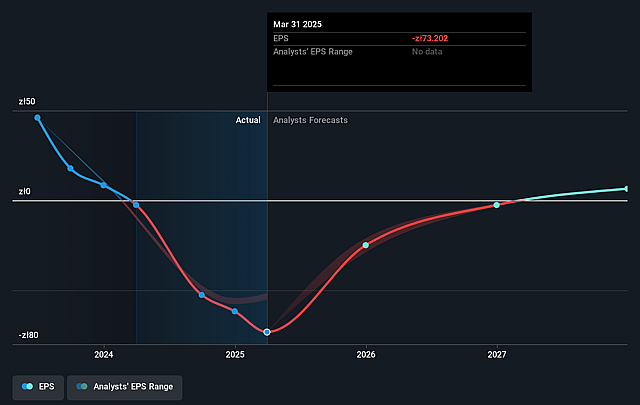

- The bearish analysts expect earnings to reach PLN 1.4 billion (and earnings per share of PLN 11.04) by about December 2028, up from PLN -3.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as PLN2.5 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 2.0x on those 2028 earnings, up from -0.7x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 13.8x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.93%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company is executing a broad restructuring program that targets significant reductions in operating expenses, external services and headcount while preserving safety critical and production sustaining CapEx. If successful, this could structurally lower the cost base and lift net margins and earnings over the long term.

- Management continues to prioritize investment in new mining panels, coking battery number 4 and the Radlin power plant, which supports a long term production plan of around 13.5 million tons. This could allow JSW to capitalize on any cyclical or structural recovery in coking coal and coke prices, boosting revenue and EBITDA.

- Planned support mechanisms from the state treasury, including potential inclusion under the hard coal mining law, windfall tax refunds and ZUS contribution deferrals, may materially improve liquidity and reduce financial stress. This could limit dilution risk and support future earnings.

- Ongoing consolidation of mines into two mining centers and divestment of noncore assets aim to simplify the group structure and improve asset utilization. This could enhance operational efficiency, stabilize production volumes and improve unit costs and net margins over time.

- Despite the current downturn in European steel, JSW has already demonstrated volume resilience with coal production up 5.1% year to date and coal sales volumes up 15.5% quarter on quarter. Any eventual stabilization or modest recovery in steel demand could then translate into higher realized volumes and a rebound in revenue and EBITDA.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Jastrzebska Spólka Weglowa is PLN16.0, which represents up to two standard deviations below the consensus price target of PLN20.66. This valuation is based on what can be assumed as the expectations of Jastrzebska Spólka Weglowa's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PLN32.0, and the most bearish reporting a price target of just PLN16.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be PLN13.1 billion, earnings will come to PLN1.4 billion, and it would be trading on a PE ratio of 2.0x, assuming you use a discount rate of 13.9%.

- Given the current share price of PLN21.91, the analyst price target of PLN16.0 is 36.9% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Jastrzebska Spólka Weglowa?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.