Last Update20 Oct 25Fair value Increased 33%

Analysts have raised their price target for Jastrzebska Spólka Weglowa from PLN 15.66 to PLN 20.86, citing improved revenue growth forecasts and stronger projected profit margins.

Valuation Changes

- Fair Value: Increased from PLN 15.66 to PLN 20.86, reflecting a higher estimated worth.

- Discount Rate: Decreased from 14.75% to 13.60%, indicating a modest decline in perceived risk.

- Revenue Growth: The updated projection has risen from 9.04% to 10.62%.

- Net Profit Margin: Increased from 3.51% to 7.61%.

- Future P/E: Declined significantly from 5.88x to 3.52x, suggesting potentially stronger earnings expectations relative to price.

Key Takeaways

- Structural decline in coking coal demand and regulatory pressures threaten long-term revenue, margin stability, and access to capital.

- Reliance on the European steel sector and constrained spending jeopardize profitability, future growth, and ability to sustain premium valuations.

- Strategic transformation, efficiency investments, and diversification position JSW for greater resilience, stable cash flows, and potential revenue growth despite ongoing market and industry challenges.

Catalysts

About Jastrzebska Spólka Weglowa- Engages in the extraction, production, and sale of coal, coke, and hydrocarbons in Poland, Austria, Czech Republic, Germany, Slovakia, Belgium, Spain, Norway, Switzerland, Romania, Singapore, Italy, Luxembourg, Holland, France, and internationally.

- Expectations of accelerating global decarbonization efforts and EU policies shifting the steel industry toward greener production methods (e.g., hydrogen-based DRI, increased EAF adoption) threaten the long-term demand for coking coal, which is likely to reduce JSW's future revenues and compress earnings as its main product faces structural decline.

- Heightened pressure from ESG-focused regulators, investors, and financial institutions may further restrict JSW's access to affordable capital and prompt higher compliance costs, which would erode net margins over time.

- The company's heavy dependence on the volatile European steel sector, exacerbated by rising imports from Asia (notably China and Indonesia), exposes JSW to significant demand cyclicality and price competition, increasing the risk of revenue volatility and lower margins.

- Ongoing declines in coking coal and coke prices, as well as saturated inventories and limited pricing power evidenced by Q1 results, suggest that any recovery in profitability will be slow; this weighs on forward earnings and challenges the sustainability of current valuation multiples.

- Reduced CapEx and strategic cost-saving plans, while preserving near-term liquidity, could undermine future production growth, modernization, and diversification-hindering long-term EBITDA stability and justifying skepticism around any premium currently ascribed to future cash flows.

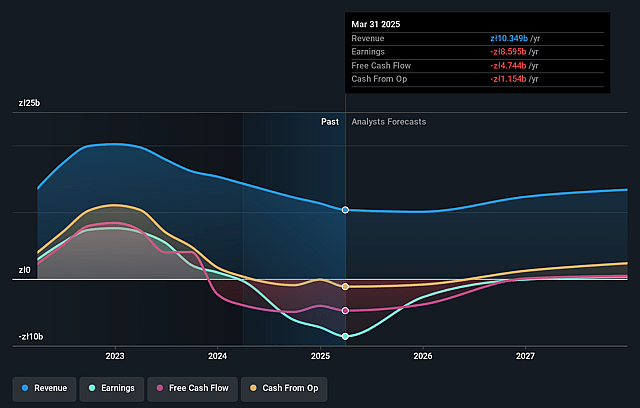

Jastrzebska Spólka Weglowa Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jastrzebska Spólka Weglowa's revenue will grow by 9.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -83.1% today to 3.5% in 3 years time.

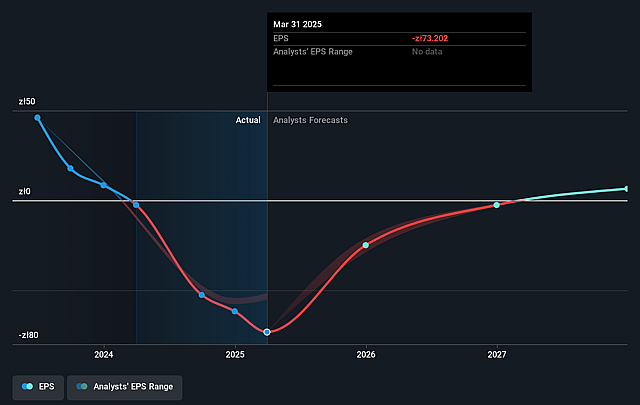

- Analysts expect earnings to reach PLN 470.5 million (and earnings per share of PLN 6.5) by about September 2028, up from PLN -8.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting PLN1.3 billion in earnings, and the most bearish expecting PLN-1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.9x on those 2028 earnings, up from -0.3x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 15.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.75%, as per the Simply Wall St company report.

Jastrzebska Spólka Weglowa Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite short-term market challenges, JSW is executing a strategic transformation plan focused on cost reductions, operational efficiency, and modernization (such as the revamped incentive system for mining crews and coking battery modernization), which could lead to sustained improvements in unit costs, productivity, and operating margins, thus positively impacting long-term earnings.

- JSW continues to make investments in efficiency and CapEx projects even while scaling back spending, including upgrading critical production assets and power generation units, positioning the company to potentially capitalize on any cyclical recovery in steel and coking coal demand, benefitting future revenues and profitability.

- Long-term contracts for coking coal sales to European steelmakers and JSW's position as a primary supplier in this segment provide forward revenue visibility and reduce earnings volatility, which supports more stable long-term cash flows and earnings even amid cyclical market downturns.

- Structural trends like protectionist policies in Europe (such as new limitations on steel imports and support for the domestic steel industry) could help shelter JSW from global oversupply pressures and imports, safeguarding market share and supporting top-line sales resilience.

- Continued emphasis on diversification into value-added coke products and expanding into new international markets, backed by geographic diversification of buyers, helps mitigate single-commodity risk and may create new revenue streams, thus supporting overall sales growth and mitigating risks to net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of PLN15.66 for Jastrzebska Spólka Weglowa based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PLN23.1, and the most bearish reporting a price target of just PLN7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be PLN13.4 billion, earnings will come to PLN470.5 million, and it would be trading on a PE ratio of 5.9x, assuming you use a discount rate of 14.7%.

- Given the current share price of PLN22.7, the analyst price target of PLN15.66 is 45.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.