Key Takeaways

- Strategic process improvements and focus on client security could enhance trust, leading to potentially higher revenue and better net margins.

- Strong mortgage sector positioning and conservative risk provisioning enhance stability, potentially boosting future revenue and safeguarding profitability.

- Economic stagnation and increased costs are squeezing net margins, while uncertainty about interest rates and credit risks may impact future earnings.

Catalysts

About ING Bank Slaski- Together with our subsidiaries, provides various banking products and services for retail clients and businesses in Poland.

- ING Bank Slaski is implementing projects to streamline processes and enhance client security, which may not be immediately visible in financial figures but can lead to increased client trust and potentially higher revenue and reduced costs over time, potentially impacting net margins positively.

- The bank is maintaining a strong position in the mortgage sector, with high volumes driven by state aid programs and expectations of rising property demand and prices, which could boost future revenue streams as well as impact earnings positively.

- The bank's focus on conservative risk provisioning, particularly in anticipation of potential economic disturbances, ensures stability and could safeguard future net margins and earnings by preventing significant hits to profitability.

- ING Bank Slaski's strategic moves to offer mortgages with changing interest rates in a volatile rate environment, while maintaining its position as a market leader, could result in enhanced future revenues due to increased demand for flexible mortgage products suited to client preferences.

- The bank's emphasis on optimizing operational costs amidst high-interest rates and inflation, along with aggressive NPL sales, indicates a focus on improving operational efficiency and profitability, potentially leading to better net margins and earnings growth in future periods.

ING Bank Slaski Future Earnings and Revenue Growth

Assumptions

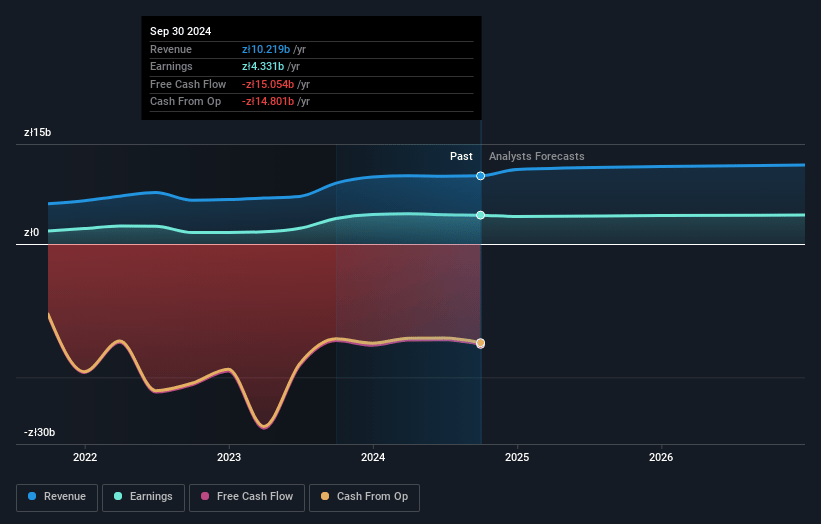

How have these above catalysts been quantified?- Analysts are assuming ING Bank Slaski's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 42.4% today to 36.9% in 3 years time.

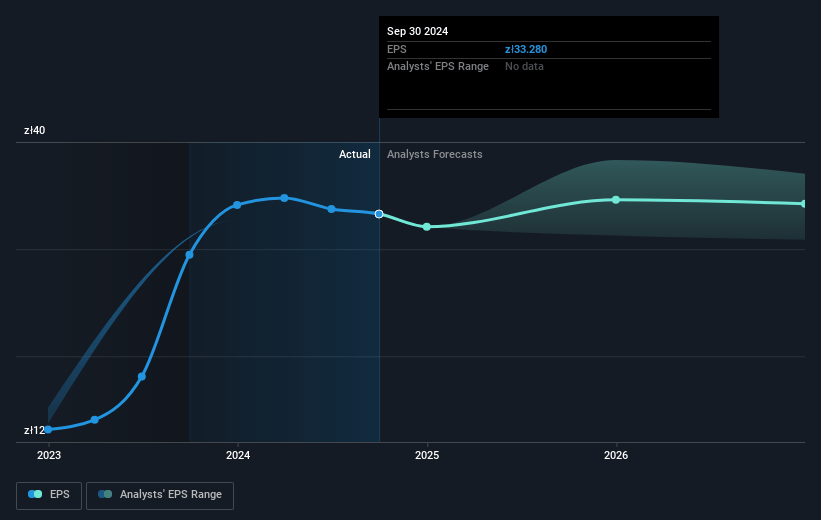

- Analysts expect earnings to remain at the same level they are now, that being PLN 4.3 billion (with an earnings per share of PLN 32.43). However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as PLN4.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, up from 8.3x today. This future PE is greater than the current PE for the GB Banks industry at 9.1x.

- Analysts expect the number of shares outstanding to grow by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.76%, as per the Simply Wall St company report.

ING Bank Slaski Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Economic stagnation and low demand, particularly in the corporate loans sector, suggest limited growth opportunities, potentially constraining revenue growth.

- Increased costs and provisions are impacting net income, as operational costs and risk provisioning rise, thus squeezing net margins.

- Investment constraints and lack of clear economic policies are limiting ING Bank Slaski's ability to capitalize on growth opportunities, possibly affecting future earnings.

- The ongoing uncertainty about interest rates and regulatory changes may lead to fluctuations in interest income, impacting financial performance and net margins.

- Heightened provisions for credit risks, despite current economic stability, indicate potential looming issues that could further pressure net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of PLN308.83 for ING Bank Slaski based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of PLN363.0, and the most bearish reporting a price target of just PLN256.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be PLN11.7 billion, earnings will come to PLN4.3 billion, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 9.8%.

- Given the current share price of PLN275.0, the analyst's price target of PLN308.83 is 11.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives