Key Takeaways

- Accelerated renewable expansion and long-term contracts position Aboitiz Power for sustained top-line and margin outperformance amid market liberalization and growing demand.

- Early investment in smart grids and battery storage enhances earnings resilience, premium pricing, and diversification, supporting a stronger, less volatile earnings profile.

- Heavy reliance on coal, execution risks in renewables, industry competition, revenue pressures, and exposure to currency and input cost volatility threaten long-term earnings and stability.

Catalysts

About Aboitiz Power- Through its subsidiaries, engages in the power generation and distribution, and electricity retail businesses in the Philippines.

- While analyst consensus expects Aboitiz Power's renewable growth to drive revenue and margin expansion, the acceleration in energizing new solar, wind, and battery projects, combined with a massive rise in RE-focused CapEx, suggests the company could not only exceed its 2030 renewable capacity mix target ahead of schedule but also capture premium power purchase agreement rates in a rapidly greening market, potentially unlocking above-consensus top-line growth and higher margins for multiple years.

- Analysts broadly agree that increasing contracted baseload capacity to over 90% will stabilize margins, but this may significantly understate the impact; by effectively locking in healthy long-term contracts amidst a period of declining spot prices and regulatory incentives for renewables, Aboitiz Power can achieve exceptional earnings predictability and virtually eliminate volatility, supporting structurally higher sustainable net margins than peers.

- The company's early leadership in smart grid infrastructure, battery storage, and grid digitalization positions it to capitalize on rising reliability requirements, allowing it to command premium pricing and capture added revenues from value-added services, which could make its earnings profile more resilient and diversified over time.

- With robust population and economic growth in the Philippines and Southeast Asia set to outpace the rest of the region, Aboitiz Power is uniquely placed to capture secular demand expansion, especially in the fast-growing residential and commercial customer segments, creating substantial long-term upside in sales volumes.

- Regulatory moves towards market liberalization and demand aggregation, combined with Aboitiz Power's proven ability to secure new contracts with both large and smaller utilities, mean the addressable market for bilateral and retail supply deals is expanding, giving the company increased room to grow recurring revenues and cement market share gains, translating to outperformance in both top-line revenue and market leadership.

Aboitiz Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Aboitiz Power compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Aboitiz Power's revenue will grow by 10.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.7% today to 17.1% in 3 years time.

- The bullish analysts expect earnings to reach ₱44.7 billion (and earnings per share of ₱6.07) by about July 2028, up from ₱30.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, up from 10.2x today. This future PE is greater than the current PE for the PH Renewable Energy industry at 8.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.57%, as per the Simply Wall St company report.

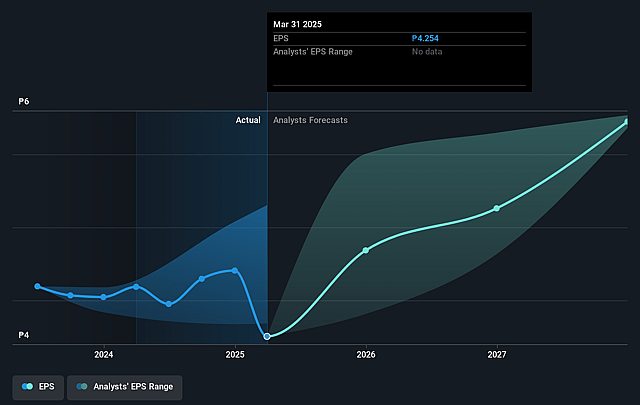

Aboitiz Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on coal and thermal assets, with most of its current generation mix still coal-heavy and only 1.4 gigawatts of renewables out of a 5 gigawatt portfolio, exposes it to the risk that stricter global and local decarbonization standards could force an accelerated phase-out or impairment of these assets, negatively affecting net income and book value over the long term.

- Execution risk in the rollout and completion of renewable energy projects remains significant, given that the projected renewable capacity additions by 2030 require timely and successful project delivery; any delays or underperformance could result in missed government incentives, loss of market share, and stagnating revenues compared to more agile competitors.

- Intensifying competition from both new domestic entrants and foreign renewable players, as well as independent power producers and retail electricity suppliers, could result in aggressive pricing and shrinking industry margins, posing a threat to Aboitiz Power's future profitability and ability to grow earnings.

- Revenue from the generation segment already declined 11% year-on-year despite flat sales volumes, illustrating industry-wide price softening due to increased grid supply and lower spot market tariffs; the proliferation of distributed energy resources and the ongoing softening of demand from industrial clients may further erode longstanding revenue streams.

- A significant exposure to Philippine peso volatility, rising global input costs (including imported coal, equipment, and operations), and ongoing dependence on power purchase agreements with incomplete pass-through provisions could compress operating margins, thereby impacting future net earnings and financial resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Aboitiz Power is ₱60.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Aboitiz Power's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱60.0, and the most bearish reporting a price target of just ₱30.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₱261.3 billion, earnings will come to ₱44.7 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 13.6%.

- Given the current share price of ₱43.5, the bullish analyst price target of ₱60.0 is 27.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.