Key Takeaways

- Expanding digital services, advanced data centers, and broadband initiatives position PLDT for durable revenue growth, improved margins, and stronger competitive advantage in a digitalizing economy.

- Growing fintech adoption, robust postpaid segment growth, and rising enterprise digitalization offset legacy declines, sustaining improvements in profitability and revenue mix over time.

- Elevated costs, heavy debt, sluggish revenue growth, and uncertainty in new ventures may constrain PLDT’s earnings trajectory and limit upside from planned innovations.

Catalysts

About PLDT- Provides telecommunications and digital services in the Philippines.

- The rapid growth and profitability of Maya, PLDT’s digital financial services arm, position the company to capture value from expanding fintech, e-payments, and digital banking adoption in the Philippines, leading to new, high-margin revenue streams and steady net margin improvement as Maya scales.

- Aggressive fiber-to-the-home rollout and rising net subscriber additions, especially in high-ARPU postpaid segments, capitalize on increasing internet penetration and secular demand for fast connectivity, driving recurring revenue growth and higher earnings quality over time.

- The launch of VITRO Santa Rosa, the first AI-ready hyperscale data center in the Philippines, places PLDT at the center of accelerating enterprise digitalization and regional cloud demand, supporting structural uplift in enterprise and ICT revenues with potential for robust margin expansion.

- The onboarding of anchor tenants and ongoing hyperscaler/customer negotiations at major new data centers and enhancements like the Asia Direct Cable increase network resilience and international capacity, enhancing PLDT’s competitive advantage and enabling future top-line and EBITDA growth.

- Scaling data services and 5G adoption—along with stable or rising ARPUs in wireless and data—offset ongoing legacy revenue declines and set the stage for sustained improvements in revenue mix, margin resilience, and long-term profitability as consumer and enterprise data usage intensifies.

PLDT Future Earnings and Revenue Growth

Assumptions

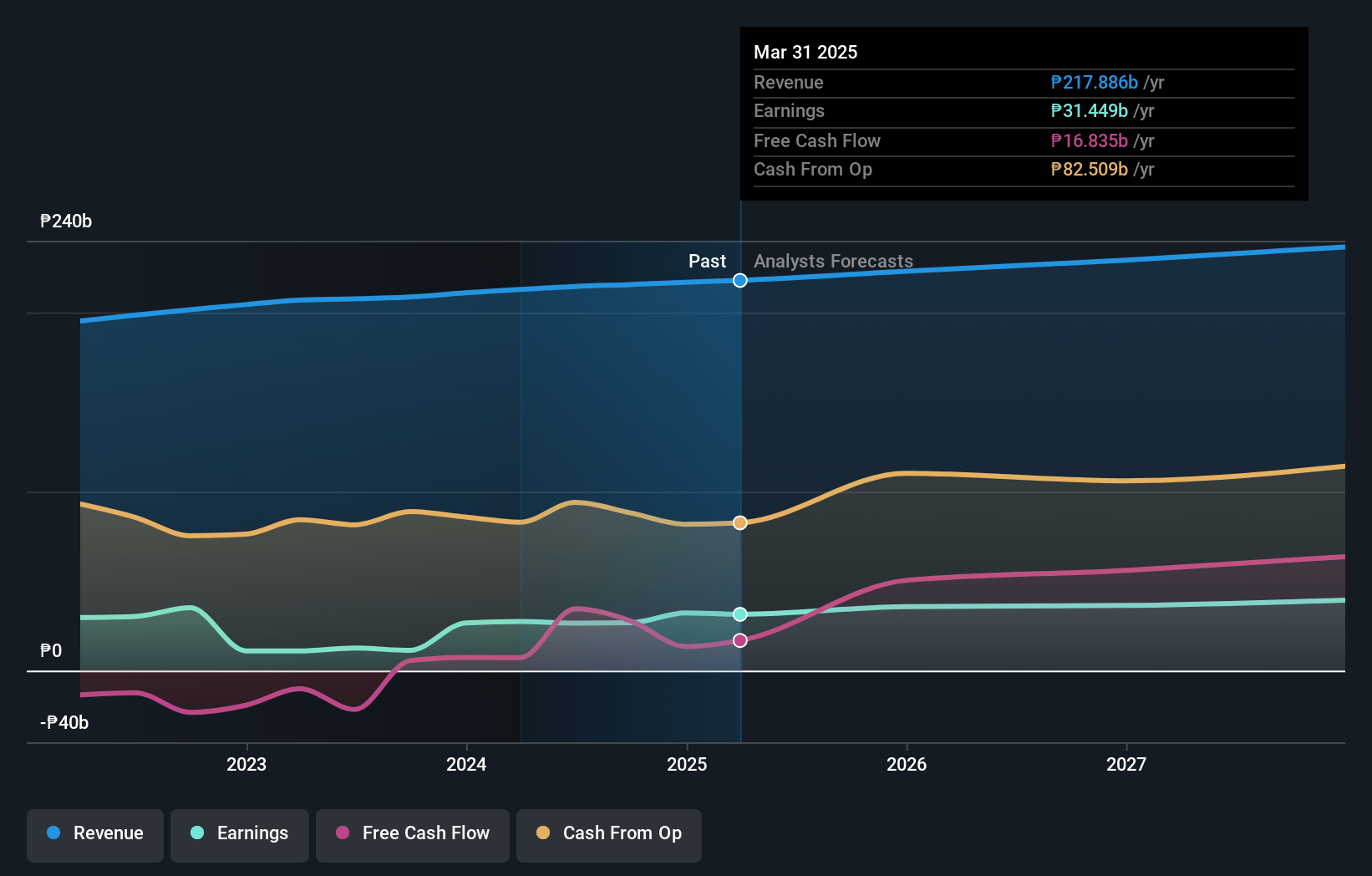

How have these above catalysts been quantified?- Analysts are assuming PLDT's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.4% today to 16.6% in 3 years time.

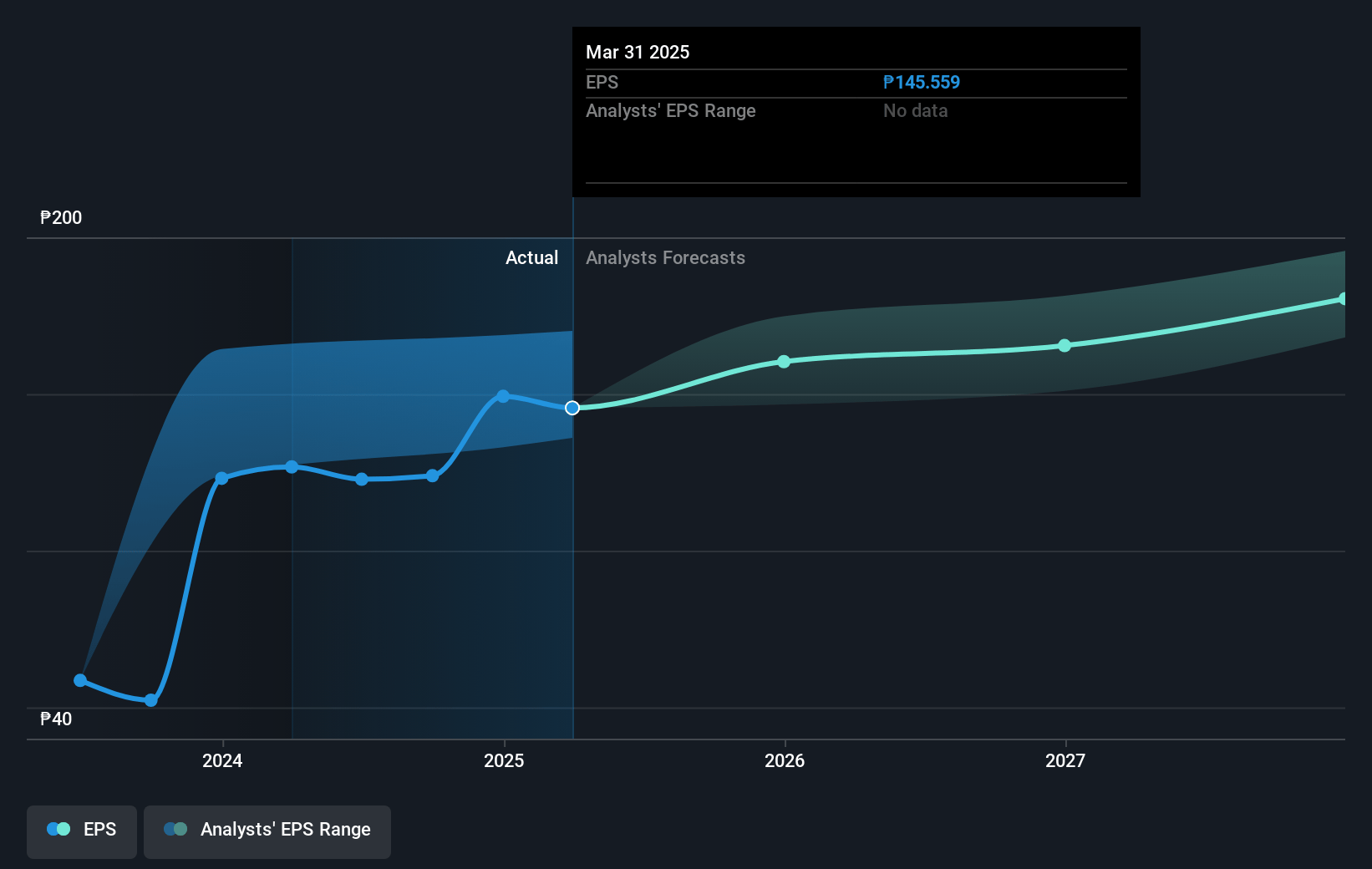

- Analysts expect earnings to reach ₱39.9 billion (and earnings per share of ₱176.96) by about July 2028, up from ₱31.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, up from 8.4x today. This future PE is greater than the current PE for the US Wireless Telecom industry at 9.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.55%, as per the Simply Wall St company report.

PLDT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent high capital expenditures and recent network investments have led to increased depreciation and financing costs, which have already caused a 6% decline in Telco Core income year-on-year and are expected to remain at current elevated levels, posing a continued risk to net margins and earnings growth.

- Sustained heavy debt load (net debt at ₱270.7 billion, net debt-to-EBITDA ratio of 2.48x) and negative net working capital may constrain financial flexibility, limit capacity for further investments, and potentially hinder shareholder returns if leverage is not reduced as targeted.

- Ongoing softness and slight year-on-year decline in mobile segment revenues, alongside intensifying competition from other local telcos and new digital entrants, increases risk of further ARPU pressure and market share loss, potentially capping future revenue growth.

- Enterprise segment revenue growth remains subdued due to the continued drag from POGO-related business losses and connectivity program terminations, with management expecting the adverse impact to persist at least until Q3, delaying any meaningful acceleration in enterprise revenue contribution.

- Despite strong narrative around growth drivers (data centers and Maya fintech), substantial uncertainty remains around ramp-up pace, scale, and profitability; Maya, while newly profitable, does not expect hockey stick growth in earnings, and data center utilization is not yet fully visible, which could limit positive earnings impact in the near-to-medium term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₱1727.083 for PLDT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱2070.0, and the most bearish reporting a price target of just ₱1400.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₱239.8 billion, earnings will come to ₱39.9 billion, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 11.6%.

- Given the current share price of ₱1229.0, the analyst price target of ₱1727.08 is 28.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.