Key Takeaways

- Digital disruption, rising competition, and regulatory demands threaten revenue growth, margin stability, and force higher compliance and operating costs.

- Heavy infrastructure investments and new technologies risk straining cash flow, limiting dividends, and eroding Globe's traditional market advantages.

- Diversified growth from fintech, enterprise data, and digital adoption supports profitability, stronger cash flow, and less reliance on traditional telecom revenues.

Catalysts

About Globe Telecom- Engages in the provision of telecommunications services to individual consumers, corporate, and small and medium enterprise clients in the Philippines.

- The rapid commoditization of data services and intensifying digital disruption from alternative communications platforms such as WhatsApp, Messenger, and Viber are expected to further erode Globe Telecom's legacy SMS and voice revenues, while growing data usage will bring lower margin products to the forefront, creating sustained pressure on ARPU and overall revenue growth.

- Persistently high capital expenditure demands for 5G, data centers, and ongoing digital infrastructure build-out will continue to strain free cash flow and increase leverage, even as headline CapEx moderates, which threatens to depress net margins and constrain future dividend growth.

- Ongoing regulatory scrutiny-including heightened requirements for data privacy, SIM registration, and ESG compliance-will increase operational burdens and may accelerate opex and compliance costs, weighing further on earnings stability and EBIT margins.

- Rising competition from new market entrants and the risk of price wars, especially as PLDT's management refreshes its strategy and DITO Telecommunity scales, threaten Globe's ability to sustain subscriber growth without cutting prices or raising marketing expenses, which could squeeze EBITDA margins and push down profitability.

- Disruptive technologies such as satellite internet and fixed wireless access have the potential to bypass Globe's existing network investments, undermining the company's conventional network-centric model and threatening long-term revenue streams from both B2C and enterprise segments.

Globe Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Globe Telecom compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Globe Telecom's revenue will grow by 1.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 12.7% today to 17.3% in 3 years time.

- The bearish analysts expect earnings to reach ₱32.3 billion (and earnings per share of ₱191.93) by about July 2028, up from ₱23.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from 10.3x today. This future PE is greater than the current PE for the PH Wireless Telecom industry at 9.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.9%, as per the Simply Wall St company report.

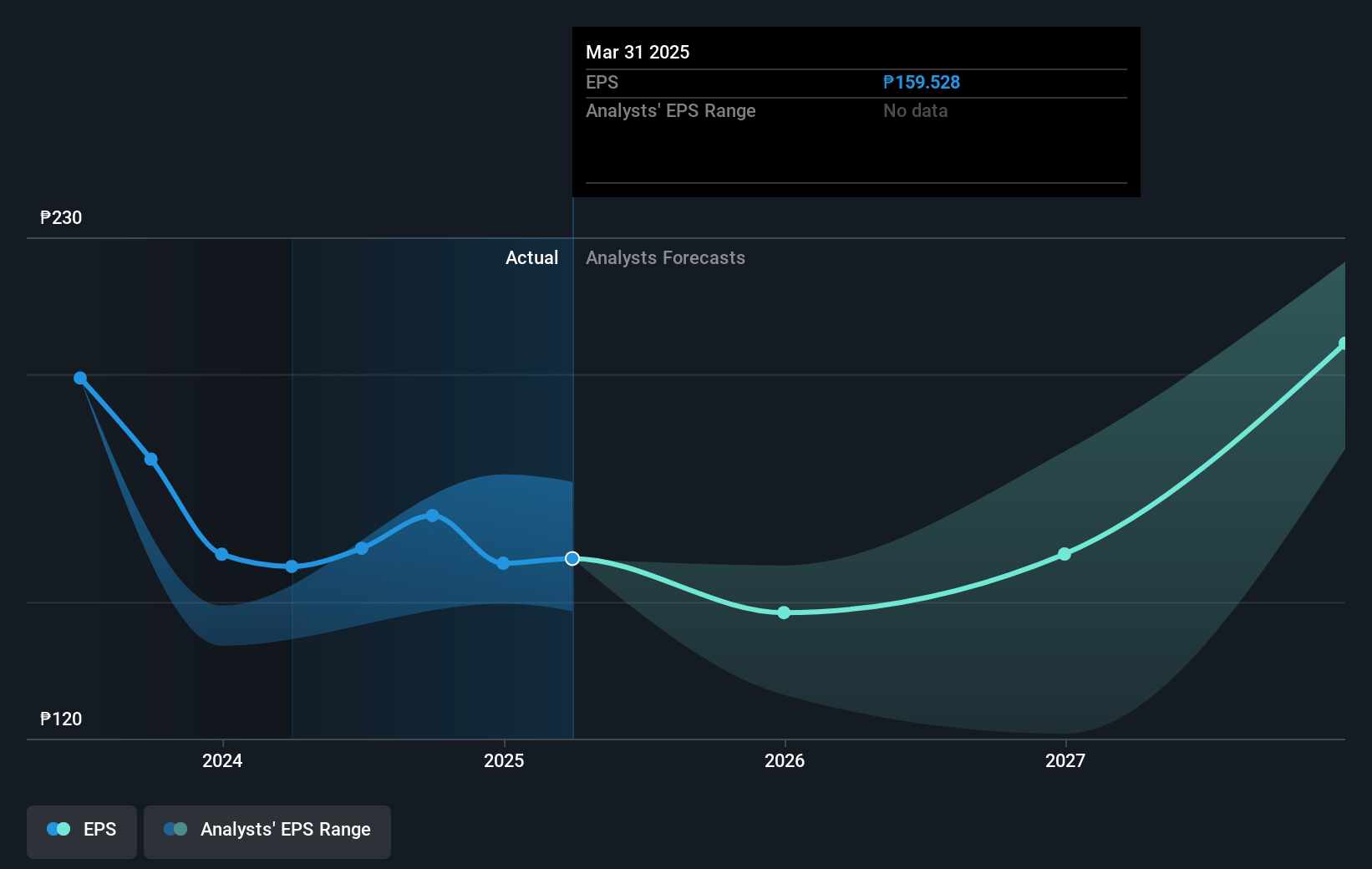

Globe Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Globe Telecom is experiencing robust growth in high-margin segments such as mobile data, fiber broadband, and corporate data, with year-on-year service revenue, EBITDA, and core net income all reaching record or near-record levels, which supports ongoing expansion in revenue and sustained profitability.

- The rapid adoption and continued dominance of Mynt (GCash) as the leading fintech platform in the Philippines, contributing 12% of Globe's net income before tax and poised for an IPO, provides a new growth engine and significant diversification, potentially supporting higher earnings and mitigating the impact of declining legacy revenues.

- Globe's strategic shift from aggressive capital expenditure to optimizing existing network utilization has resulted in a material reduction in capital intensity and significant improvements in free cash flow, enhancing the company's ability to sustain dividends and reduce reliance on debt, ultimately supporting net margins and shareholder value.

- Expansion in data center infrastructure through STT GDC Philippines, with strong customer demand pipelines and leadership in AI-ready, sustainable facilities, positions Globe to benefit from surging enterprise and cloud service demand, driving long-term revenue and EBITDA growth from non-traditional telco channels.

- High smartphone penetration (93%), increasing mobile data usage habits, and the accelerating digitalization of Filipino society are fueling a larger, more-engaged subscriber base, underpinning both higher ARPU and top-line revenue resilience in spite of short-term economic pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Globe Telecom is ₱1729.47, which represents two standard deviations below the consensus price target of ₱2396.0. This valuation is based on what can be assumed as the expectations of Globe Telecom's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱2750.0, and the most bearish reporting a price target of just ₱1550.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₱187.0 billion, earnings will come to ₱32.3 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 11.9%.

- Given the current share price of ₱1650.0, the bearish analyst price target of ₱1729.47 is 4.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.