Key Takeaways

- Expansion into new provincial markets and investments in store upgrades enhance Wilcon's retail leadership and long-term growth prospects.

- Margin expansion and profitability are supported by improved inventory costs, supply chain efficiencies, and increased focus on higher-margin in-house brands.

- Ongoing discounting, inventory issues, and reliance on physical store expansion threaten profitability, as competitive pressures and shifting consumer preferences challenge Wilcon’s pricing power and growth strategy.

Catalysts

About Wilcon Depot- Wilcon Depot, Inc., doing business as WILCON DEPOT and WILCON HOME ESSENTIALS, operates as a home improvement and construction supplies retailer in the Philippines.

- An uptick in construction permit approvals and intensified residential building activity—especially in South Luzon, Visayas, and Mindanao—is expected to drive higher demand for home improvement products in the coming quarters, directly supporting potential revenue acceleration as Wilcon Depot captures this renewed construction momentum.

- Store expansions into untapped provincial cities and underserved areas are set to unlock new markets and consolidate Wilcon's retail leadership, laying the groundwork for sustained, long-term revenue growth as urbanization trends continue.

- Strategic investments in merchandising, renovation of legacy stores, product mix optimization, and upgrades to in-store digital tools are expected to improve customer experience and operational efficiency, supporting higher same-store sales growth, inventory turns, and potentially better gross margins over time.

- As higher-cost inventory from prior periods gets converted to lower-cost stock in coming quarters, and as supplier relationships enable additional price concessions, gross profit margins are poised for a structural recovery, strengthening overall earnings.

- Enhanced focus on in-house and exclusive brands, together with ongoing supply chain and operational improvements, are expected to support margin expansion and improved profitability by shifting the sales mix toward higher-margin products.

Wilcon Depot Future Earnings and Revenue Growth

Assumptions

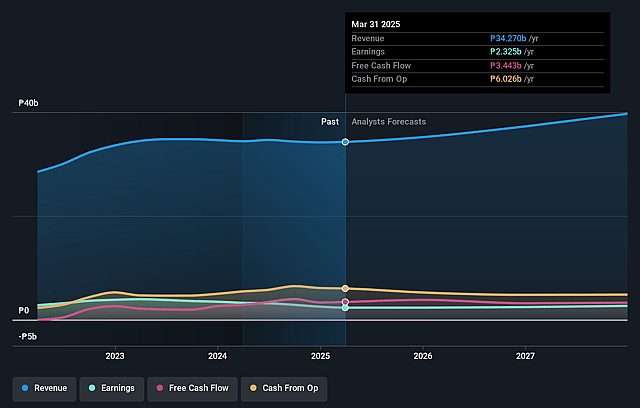

How have these above catalysts been quantified?- Analysts are assuming Wilcon Depot's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.8% today to 6.6% in 3 years time.

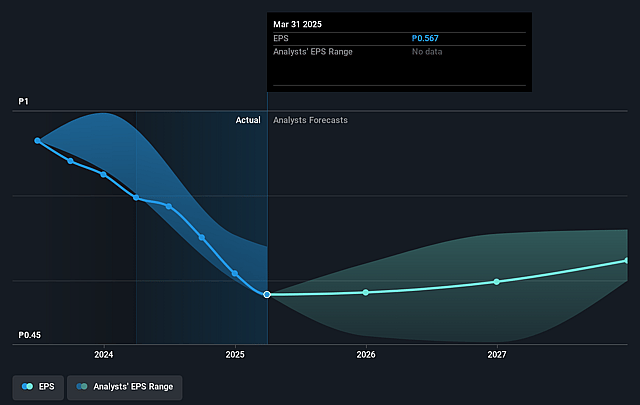

- Analysts expect earnings to reach ₱2.6 billion (and earnings per share of ₱0.63) by about July 2028, up from ₱2.3 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₱3.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.8x on those 2028 earnings, up from 17.2x today. This future PE is greater than the current PE for the PH Specialty Retail industry at 5.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.82%, as per the Simply Wall St company report.

Wilcon Depot Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s heavy use of aggressive discounts (7–8% on average, with some SKUs as high as 20%) and continuing “best deals” programs may permanently compress gross profit margins, especially as competition and consumer downtrading persist—directly impacting long-term net margins and earnings growth.

- A notable decline in comparable sales (-3.6% for Q1) and ticket size (-4.5%), despite increasing transaction counts, signals ongoing softness in underlying demand, indicating that store expansions may face diminishing returns and possibly lead to growing SG&A expenses outweighing revenue growth.

- The company is experiencing inventory management challenges, carrying high-cost inventory into a deflationary cost environment, which creates a drag on gross margin recovery and raises working capital requirements, with inventory turnover reportedly as long as 8 months—potentially limiting free cash flow and profitability for an extended period.

- Wilcon faces intensified competition from lower-cost imports (particularly Chinese goods) and informal channels, which enables both formal and informal competitors to undercut its prices. This threatens Wilcon’s pricing power and could force further erosion of margins and revenue if the trend persists or if the consumer focus on value intensifies.

- The company’s growth strategy is still heavily reliant on physical store network expansion, at a time when e-commerce penetration is rising and digital retail formats may gain more share in home improvement; a lack of urgent, transformative omnichannel investment could risk market share loss and pressure long-term revenue and margin growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₱9.44 for Wilcon Depot based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱17.0, and the most bearish reporting a price target of just ₱6.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₱39.9 billion, earnings will come to ₱2.6 billion, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₱9.78, the analyst price target of ₱9.44 is 3.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.