Catalysts

About D&L Industries

D&L Industries is a Philippines based manufacturer of customized food ingredients, oleochemicals including biodiesel, specialty plastics and consumer products, serving both domestic and export markets.

What are the underlying business or industry changes driving this perspective?

- Although the shift to higher biodiesel blends has structurally lifted oleochemical volumes and export gross profits, uncertainty over the timing of the move from a 3 percent to 4 percent mandated blend and potential policy delays could cap further volume driven revenue growth in this segment.

- While the new Batangas and Quezon facilities are already profitable and benefit from tax holidays that support net income and cash flow, the eventual expiry of incentives and lingering elevated net debt of roughly PHP 22 billion raise the risk that future earnings growth is offset by a rising effective tax rate and higher interest costs.

- Although management expects coconut oil prices to normalize after a period of extreme volatility, a slower than anticipated correction in the price gap versus palm oil and prolonged inventory cost overhang could keep food segment gross margins below historical double digit levels and restrain earnings recovery.

- While D&L continues to gain market share as weaker competitors struggle with working capital and financing needs, an industry wide recovery in balance sheets and capacity investment could erode this advantage over time, limiting the uplift to long term revenue growth and net margins.

- Despite healthy demand trends in higher value food safety, specialty ingredients and personal care products that should favor mix improvement, customer price sensitivity after a period of very high input costs may constrain the company’s ability to fully re price upward, moderating the rebound in gross margin and overall earnings.

Assumptions

This narrative explores a more pessimistic perspective on D&L Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

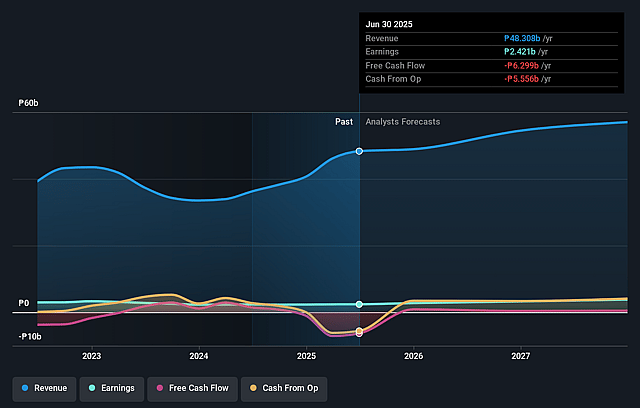

- The bearish analysts are assuming D&L Industries's revenue will remain fairly flat over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.7% today to 7.5% in 3 years time.

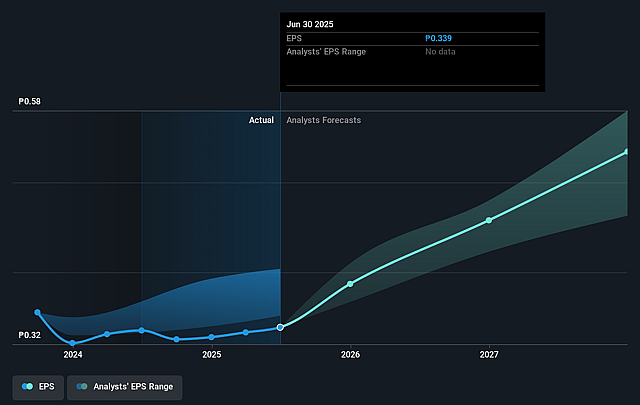

- The bearish analysts expect earnings to reach ₱3.9 billion (and earnings per share of ₱0.54) by about December 2028, up from ₱2.5 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₱4.9 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 10.8x today. This future PE is greater than the current PE for the PH Chemicals industry at 10.8x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.5%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Persistently elevated and volatile coconut oil prices relative to palm oil, combined with long inventory lags, could keep food segment gross profit margins depressed for longer than expected and delay a full recovery in group earnings and net margins.

- If the mandated biodiesel blend remains at 3 percent for an extended period or if future increases are postponed again, volume growth in the oleochemicals segment may slow structurally, limiting revenue expansion and constraining export driven earnings growth.

- High working capital needs tied to expensive raw materials and long cash conversion cycles, together with net debt around PHP 22 billion and rising interest expense, could pressure free cash flow and reduce the incremental benefit of higher operating income on net income.

- The expiry of income tax holidays at the Batangas and Quezon plants over the coming decade, even with some reduced rates, may structurally raise the effective tax rate, eroding net margins and tempering growth in earnings even if operating performance improves.

- If new customers gained during this period of industry stress revert to former suppliers once conditions normalize, especially in lower margin refined oils, the company’s recent market share gains could prove temporary and weaken the sustainability of revenue and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for D&L Industries is ₱4.6, which represents up to two standard deviations below the consensus price target of ₱6.67. This valuation is based on what can be assumed as the expectations of D&L Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₱8.1, and the most bearish reporting a price target of just ₱4.6.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₱51.6 billion, earnings will come to ₱3.9 billion, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₱3.77, the analyst price target of ₱4.6 is 18.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on D&L Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.