Key Takeaways

- Accelerating digital adoption, strong regional data demand, and shifting competition dynamics position the company for faster-than-expected revenue and margin expansion.

- Operational efficiencies, balance sheet flexibility, and potential asset monetization provide significant upside for strategic investment and shareholder returns.

- Intensifying competition, declining legacy revenues, and high investment demands threaten earnings stability, free cash flow, and future shareholder returns amid limited diversification.

Catalysts

About Omani Qatari Telecommunications Company SAOG- Develops, operates, and maintains mobile and fixed telecommunications services in the Sultanate of Oman.

- Analyst consensus anticipates continued B2B, wholesale, and data center growth-but current figures show data2cloud achieving 37% year-on-year revenue growth, and data center occupancy at 90%, indicating that accelerating digital adoption and robust utilization may drive an outsized top-line inflection much sooner than anticipated.

- Whereas analysts broadly expect network investment and cost discipline to gradually improve margins, ongoing 3G shutdowns, automation efforts, and a 10% net profit margin already realized alongside persistent cost efficiencies suggest a faster-than-modeled lift in both EBITDA and earnings.

- Surging regional data demand, enhanced by Oman's role as a hyperscaler cable landing hub and supportive government digitalization initiatives, should uniquely position Ooredoo Oman to capture a supernormal increase in high-margin international wholesale and cloud revenues, strengthening both revenue growth and operating margins.

- The company's recently stabilized market share in both mobile and fixed segments, paired with population growth and increased internet penetration among a young demographic, underpins a likely reacceleration in subscriber additions and ARPU expansion as value-based competition replaces price wars-enabling stronger core revenue uplift.

- Unlocked balance sheet flexibility, ample operating cash flow, and the prospect of asset optimization (such as potential tower monetization) create incremental firepower for further strategic investments or capital returns, pointing to upside for both earnings growth and shareholder value creation well above current market expectations.

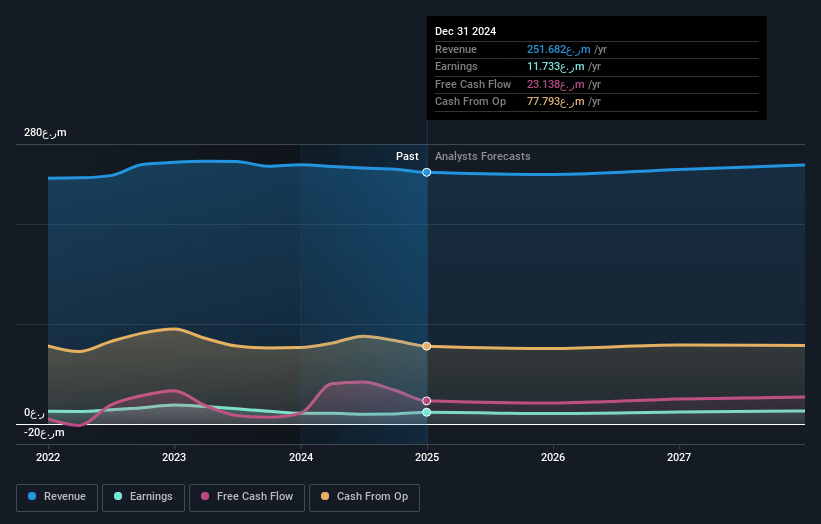

Omani Qatari Telecommunications Company SAOG Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Omani Qatari Telecommunications Company SAOG compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Omani Qatari Telecommunications Company SAOG's revenue will grow by 1.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.2% today to 5.4% in 3 years time.

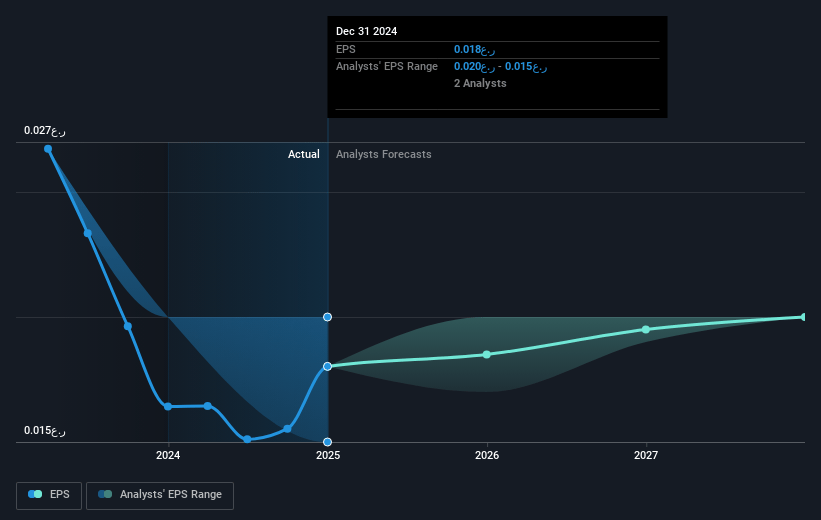

- The bullish analysts expect earnings to reach OMR 13.7 million (and earnings per share of OMR 0.02) by about July 2028, up from OMR 10.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.9x on those 2028 earnings, up from 15.1x today. This future PE is greater than the current PE for the OM Wireless Telecom industry at 15.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.96%, as per the Simply Wall St company report.

Omani Qatari Telecommunications Company SAOG Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent decline in mobile revenue, reflected by a 2.9% year-on-year decrease in the company's top line and a 9.8% drop in total subscriber base, signals ongoing threats from digital disruption and intensified competition, which could continue to pressure future revenue and market share.

- Heightened market competition in a saturated market with more than three operators serving a population of only around 4 million people is resulting in value-destroying activities and squeezed margins, potentially leading to further net margin compression and diminished earnings.

- The exit of Vodafone as a network customer is reducing wholesale and fixed revenue streams, highlighting risks associated with limited geographic diversification, and the company's overreliance on core Omani business lines, which could further slow revenue growth if similar large customers leave or reduce their commitments.

- Ongoing industry shifts towards OTT services and alternative connectivity options, coupled with migration between technologies and ARPU declines in both mobile and fixed broadband segments, suggest legacy revenue streams will keep eroding, challenging the company's ability to offset this loss with higher-margin digital or data revenues, thus impacting earnings stability.

- The capital intensity of continued 5G, fiber, and data center investments-alongside cash flow pressures from rising employee costs and uncertain depreciation/amortization relief-could strain free cash flow and limit dividend payout flexibility, ultimately putting downward pressure on net margins and shareholder returns over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Omani Qatari Telecommunications Company SAOG is OMR0.38, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Omani Qatari Telecommunications Company SAOG's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of OMR0.38, and the most bearish reporting a price target of just OMR0.22.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be OMR256.2 million, earnings will come to OMR13.7 million, and it would be trading on a PE ratio of 31.9x, assuming you use a discount rate of 21.0%.

- Given the current share price of OMR0.24, the bullish analyst price target of OMR0.38 is 36.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.