Key Takeaways

- Tightening environmental regulations and changing traveler behavior threaten long-term passenger growth, putting pressure on both core and discretionary revenue streams.

- Major infrastructure spending and airline industry constraints risk raising debt burdens and slowing earnings recovery amid volatile global tourism conditions.

- Rising passenger volumes, upgraded infrastructure, diversified property income, improved customer experience, and ongoing aviation recovery all drive resilient long-term growth and margin expansion.

Catalysts

About Auckland International Airport- Provides airport facilities, supporting infrastructure, and aeronautical services in New Zealand.

- Persistent global environmental scrutiny and increasing regulatory pressure to decarbonize air travel present a substantial risk, which could lead to higher carbon costs and greater operational restrictions, threatening future passenger volume growth and potentially reducing both aeronautical and non-aeronautical revenue streams.

- The structural decline in business travel due to widespread adoption of virtual meeting technologies and remote work is expected to result in a prolonged drag on domestic passenger numbers, dampening recovery of pre-pandemic traffic and limiting growth in high-margin non-aeronautical revenues.

- Intensifying capital expenditure requirements for large-scale terminal integration and other infrastructure projects risk elevating Auckland Airport's debt and interest costs in the coming years, which could compress net margins and erode long-term earnings even if top-line revenues increase.

- The company's growth is highly exposed to the airline industry's ongoing capacity constraints arising from global aircraft fleet delays and engine issues, delaying full recovery in passenger throughput and potentially curbing revenue and EBITDA growth over the medium term.

- Heightened geopolitical instability or travel restrictions in Asia-Pacific key markets, combined with slower-than-expected global tourism recovery, could constrain international arrivals and limit upside to passenger-driven and concession-based revenue, directly impacting earnings visibility.

Auckland International Airport Future Earnings and Revenue Growth

Assumptions

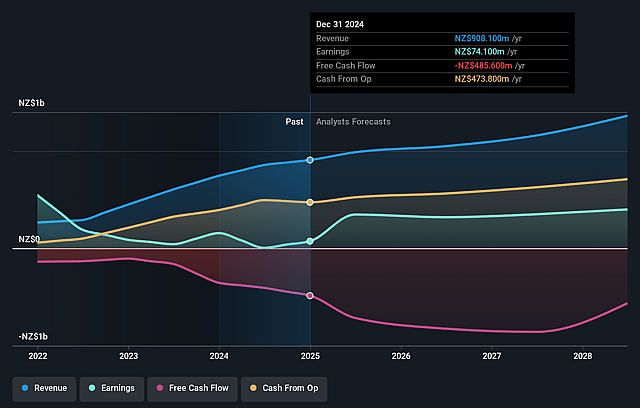

How have these above catalysts been quantified?- Analysts are assuming Auckland International Airport's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 44.1% today to 30.0% in 3 years time.

- Analysts expect earnings to reach NZ$381.9 million (and earnings per share of NZ$0.23) by about September 2028, down from NZ$420.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NZ$469.4 million in earnings, and the most bearish expecting NZ$316 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 46.8x on those 2028 earnings, up from 30.4x today. This future PE is greater than the current PE for the AU Infrastructure industry at 23.6x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.24%, as per the Simply Wall St company report.

Auckland International Airport Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing international passenger volumes-up 2.5% year-on-year, with key source markets such as Australia (+9%) and China (+8%) rebounding, paired with anticipated new routes (e.g., Shanghai-Auckland-Buenos Aires), suggest secular demand tailwinds likely to support medium

- to long-term revenue and earnings growth.

- Large ongoing infrastructure upgrades (e.g., integrated domestic jet terminal, expanded airfield, new cargo precinct) are increasing capacity and operational efficiency, positioning Auckland Airport to capture further passenger and cargo market share, which is positive for long-term net margins and top-line growth.

- High occupancy rates and long weighted-average lease terms (over 99% occupancy, ~9 years WALE) in the commercial property portfolio, combined with new developments like the Manawa Bay outlet, provide diversified, stable, and inflation-linked income that mitigates aeronautical industry cyclicality, undergirding earnings resilience.

- Enhanced customer experience, recognized with awards and improved corporate reputation, alongside continued digital transformation (e.g., contactless solutions, data-driven operations), are boosting competitiveness, operational leverage, and the ability to increase non-aeronautical revenues and margin expansion.

- Post-pandemic aviation sector tailwinds, seen in international seat capacity stabilizing at 92% of pre-COVID levels and the return/expansion of airline services, plus evidence of strong outbound and inbound tourism demand and air cargo growth, point to a sustained recovery that supports both revenue and EBITDA improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NZ$8.248 for Auckland International Airport based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$9.3, and the most bearish reporting a price target of just NZ$6.89.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NZ$1.3 billion, earnings will come to NZ$381.9 million, and it would be trading on a PE ratio of 46.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of NZ$7.57, the analyst price target of NZ$8.25 is 8.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.