Key Takeaways

- Vacancy rates remain low while lease resets and high tenant demand are expected to drive continued rental income and asset value growth.

- Strong financial flexibility and a growing development pipeline position the company to benefit from increased demand for sustainable industrial properties.

- Increased exposure to speculative developments, industrial sector concentration, and competitive supply risks could pressure margins, income growth, and financial stability amidst changing market conditions.

Catalysts

About Property For Industry- Engages in the property investment and management business in New Zealand.

- The company's portfolio remains 11.5% under-rented, with upcoming lease events and market rent reviews expected to capture significant reversions as leases are reset to higher current-market rents-offering clear scope for strong future rental income and net operating income growth.

- PFI's accelerating development pipeline-with $350 million in planned projects, all targeting high-quality, sustainable (5 Green Star) assets-positions the company to benefit from growing tenant demand for modern, energy-efficient logistics space, which supports sustained rental rate and asset value growth while also further improving portfolio margins.

- Ongoing urbanization and the continued rise of e-commerce are fueling a shortage of well-located industrial land in Auckland and other primary markets, sustaining high occupancy (currently 99.9%) and underpinning persistent rental growth that should drive top-line revenue and asset values higher over the long term.

- Falling construction costs (down 15–20% from peak) are boosting development economics and margin potential for near-term projects, allowing PFI to capture higher yields on new investments relative to market cap rates, projecting improved profitability and returns on equity.

- The company's conservative balance sheet-with $320 million in available liquidity, gearing well below limits, and 76% of debt hedged-provides flexibility to capitalize on market or acquisition opportunities as funding conditions stabilize, increasing the likelihood of future earnings and dividend growth.

Property For Industry Future Earnings and Revenue Growth

Assumptions

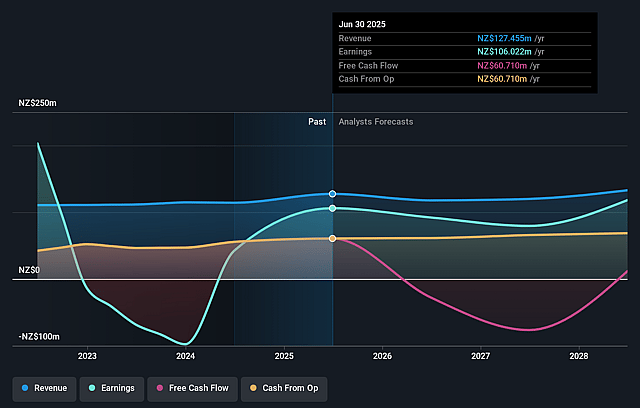

How have these above catalysts been quantified?- Analysts are assuming Property For Industry's revenue will grow by 1.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 83.2% today to 88.9% in 3 years time.

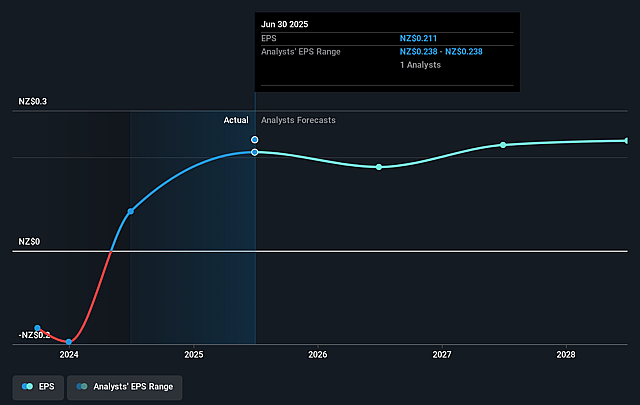

- Analysts expect earnings to reach NZ$118.1 million (and earnings per share of NZ$0.24) by about September 2028, up from NZ$106.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, up from 11.7x today. This future PE is lower than the current PE for the NZ Industrial REITs industry at 20.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

Property For Industry Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is increasing its exposure to speculative developments (such as at Spedding Road, which will commence without tenant pre-commitments), introducing the risk of extended vacancy periods and rental income uncertainty if leasing demand softens; this could negatively impact revenue and net margins.

- PFI's development pipeline is substantial relative to its balance sheet size, and while management states gearing will be "disciplined," successful delivery is contingent on market conditions, access to capital, and the ability to recycle assets-challenging environments or funding constraints could raise debt levels, increase interest costs, or necessitate asset sales at unfavorable prices, impacting earnings and return on equity.

- A modest but increasing supply of new industrial stock (as noted for some Auckland precincts and "a lot of development activity" in certain areas) may intensify competition, driving up leasing incentives and suppressing market rental growth, pressuring net operating income and margins in the long term.

- Rent reversion tailwinds (due to under-renting) may diminish as market rent growth is expected to "return to more normalized growth" after recent strong gains; if future rental uplifts disappoint, income growth and AFFO could slow significantly, impacting future dividend growth and valuation.

- While the portfolio is currently highly leased and diversified by tenant, the concentration in Auckland and high exposure to industrial sector cycles (with limited diversification) leaves PFI vulnerable to sector downturns, shifts in tenant demand due to automation, or major lease expiries-notably several large leases expiring around FY '27-which, if not re-leased promptly, may cause volatility in revenue and cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NZ$2.463 for Property For Industry based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NZ$132.9 million, earnings will come to NZ$118.1 million, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 8.4%.

- Given the current share price of NZ$2.46, the analyst price target of NZ$2.46 is 0.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.