Narratives are currently in beta

Key Takeaways

- Diversification with new products and increased manufacturing capacity may drive revenue, but risks include overestimating demand and resulting profit margin pressures.

- Long-term growth strategies in surgical and home care technologies could alter short-term earnings expectations, while hospital segment growth may be unpredictable.

- Successful new product launches, operational efficiency, and expanded manufacturing capacity drive strong revenue growth, improved profit margins, and enhanced earnings potential.

Catalysts

About Fisher & Paykel Healthcare- Designs, manufactures, markets, and sells medical device products and systems in North America, Europe, the Asia Pacific, and internationally.

- The introduction of new products such as the 950 system and Airvo 3 in the US, along with the Optiflow Duet cannula in major markets, signifies a focus on expanding product offerings, which could drive future revenue growth. However, there may be over-anticipation of market uptake and future growth potential. (Revenue Impact)

- The opening of a new manufacturing site in Guangzhou represents increased production capacity. While this supports operational efficiency, there is a potential risk of overestimating demand, which could impact profit margins if fixed costs increase without corresponding revenue growth. (Net Margins Impact)

- Gross margin improvement driven by overhead efficiency and production volume scaling could be seen as temporary. If efficiency gains cannot be sustained at the same rate, it could lead to future profit margin pressure. (Net Margins Impact)

- The expectation of future revenue growth from the hospital consumables segment, due to changing clinical practices and new product introductions, might not fully materialize if seasonal hospitalization patterns show volatility, affecting predictable revenue streams. (Revenue Impact)

- The focus on long-term growth opportunities, like the development of surgical technologies and respiratory support in home care over a multi-year horizon, could result in varying short-term earnings expectations if investments don't lead to immediate returns. (Earnings Impact)

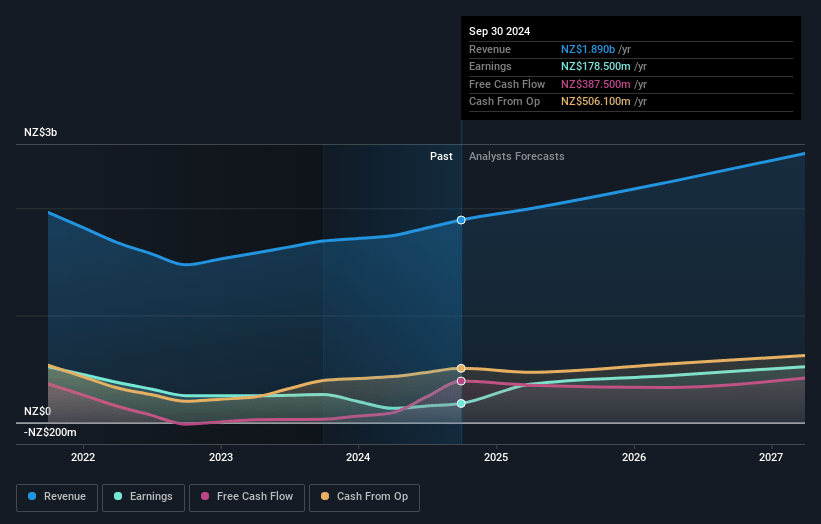

Fisher & Paykel Healthcare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fisher & Paykel Healthcare's revenue will grow by 12.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.4% today to 20.8% in 3 years time.

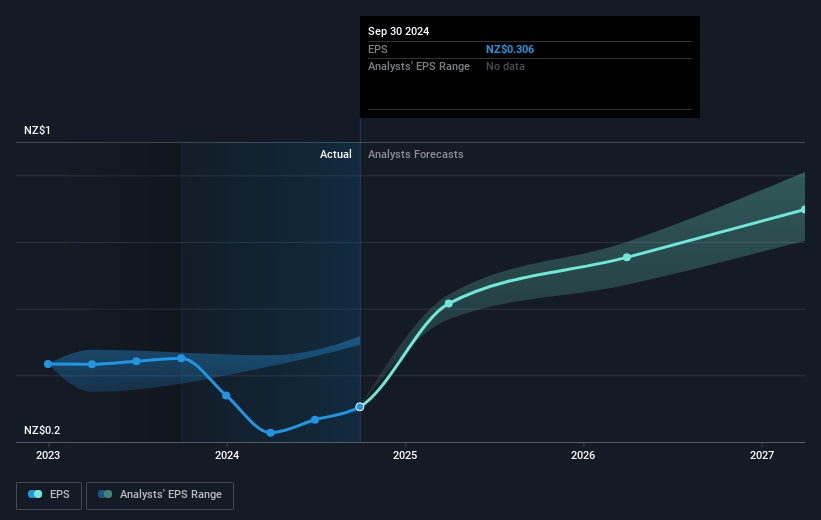

- Analysts expect earnings to reach NZ$557.7 million (and earnings per share of NZ$0.98) by about January 2028, up from NZ$178.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as NZ$469.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.5x on those 2028 earnings, down from 126.1x today. This future PE is greater than the current PE for the NZ Medical Equipment industry at 34.5x.

- Analysts expect the number of shares outstanding to decline by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Fisher & Paykel Healthcare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The successful launch of new products like the 950 system, Airvo 3, and the Optiflow Duet cannula has contributed to strong revenue growth in the Hospital business, suggesting potential for continued revenue and earnings improvements.

- The company achieved an 18% increase in operating revenue and a 43% rise in net profit after tax for the first half, attributable to increased efficiency and successful product rollouts, indicating potential for sustained profit growth and improved net margins.

- Gross margin improvement to 61.9% due to overhead efficiency and margin improvements reflects operational effectiveness, which could positively impact earnings and net margins going forward.

- Expanding manufacturing capacity, such as the operational site in Guangzhou, positions the company to potentially reduce costs and improve profit margins by optimizing supply chain efficiencies.

- Strong growth in Optiflow and new applications consumables driven by changing clinical practices and successful new product introductions suggests ongoing revenue growth opportunities and enhanced long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NZ$33.45 for Fisher & Paykel Healthcare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$41.7, and the most bearish reporting a price target of just NZ$20.14.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NZ$2.7 billion, earnings will come to NZ$557.7 million, and it would be trading on a PE ratio of 41.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of NZ$38.4, the analyst's price target of NZ$33.45 is 14.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives