Last Update17 Oct 25Fair value Increased 2.02%

Analysts have slightly increased their price target for Scales from $6.20 to $6.33. They cite modest improvements in projected revenue growth and profit margins as the reason for this adjustment.

What's in the News

- Scales Corporation Limited (NZSE:SCL) has been added to the S&P Global BMI Index (Key Developments)

Valuation Changes

- Fair Value has risen slightly from NZ$6.20 to NZ$6.33.

- Discount Rate remains unchanged at 6.90%.

- Revenue Growth estimate has increased marginally from 27.38% to 27.40%.

- Net Profit Margin estimate has edged up from 6.30% to 6.30%.

- Future P/E ratio has increased from 12.7x to 12.9x.

Key Takeaways

- Expanding premium apple focus and growing protein and logistics segments strengthen revenue growth, margin expansion, and earnings resilience.

- Enhanced sustainability and traceability initiatives improve access to premium markets and mitigate regulatory risks.

- High dependence on New Zealand horticulture and apples, alongside rising competition, regulatory challenges, and cost pressures, threatens margins and long-term growth prospects.

Catalysts

About Scales- Engages in manufacturing and trading of food ingredients in New Zealand, Asia, Europe, North America, and internationally.

- Strong and growing demand for premium apples in Asia and the Middle East, combined with Scales' ongoing strategic shift toward a higher proportion of premium apple varieties (now ~75% of volumes vs. 72% last year), is likely to further enhance revenue per unit and drive future top-line growth.

- Successful commissioning and scaling up of new protein processing plants in Melbourne, North America, and the Netherlands, with further projects under consideration, pave the way for organic and inorganic expansion in the Global Proteins division, supporting sustained EBITDA and earnings growth from FY26 onward.

- Diversification efforts through growth in Proteins and Logistics segments dilute earnings volatility from horticulture, reduce revenue cyclicality, and increase the resilience of overall earnings, which should gradually improve net margins and stability of cash flows.

- Scales' established infrastructure and global footprint, especially the integration of logistics capabilities with growing export volumes, creates operational efficiencies and bargaining power, likely reducing unit costs and supporting margin expansion over the long term.

- Enhanced focus on sustainability initiatives and food traceability (e.g., decarbonization targets and materiality assessments) improves access to premium export markets and can command higher pricing, supporting both revenue growth and lower regulatory risk.

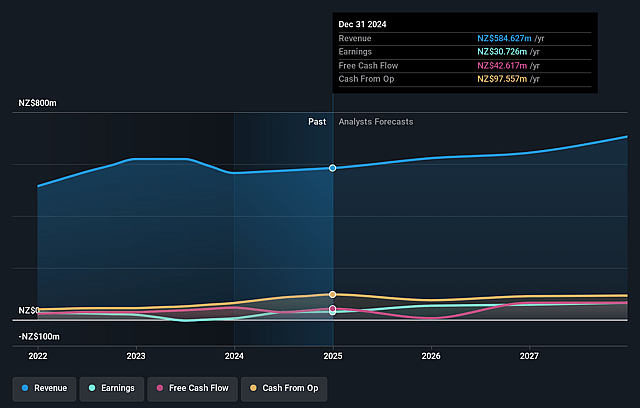

Scales Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Scales's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.0% today to 10.1% in 3 years time.

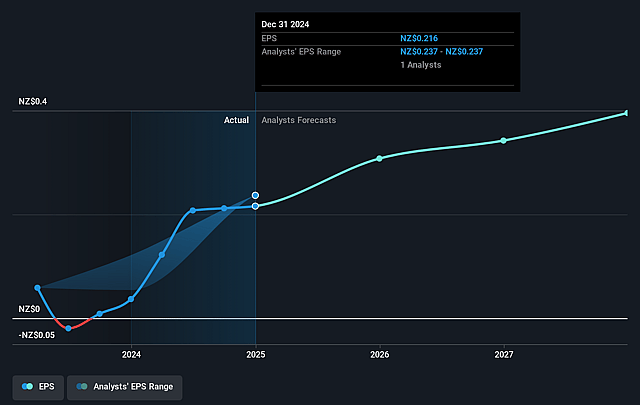

- Analysts expect earnings to reach NZ$74.2 million (and earnings per share of NZ$0.39) by about September 2028, up from NZ$51.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as NZ$56.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, down from 14.8x today. This future PE is greater than the current PE for the NZ Food industry at 11.3x.

- Analysts expect the number of shares outstanding to decline by 0.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

Scales Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant exposure to apple and horticulture markets in New Zealand creates geographic and product concentration risk; adverse weather, biosecurity threats, or climate volatility could materially reduce crop yields and impact core revenues and earnings.

- Increasing international competition-particularly from lower-cost horticultural producers in South America, South Africa, and Eastern Europe-may exert downward pressure on pricing and erode export market share, negatively affecting revenue growth and profitability.

- Ongoing and increasing regulatory risk, including higher tariffs (e.g., petfood tariffs on the U.S. market rising from 10% to 15%), uncertain trade agreements, and growing environmental compliance demands, could increase operating costs and exert pressure on net margins and export earnings.

- Rising costs in labor and inputs (driven by persistent labor shortages and wage inflation in New Zealand horticulture, as well as supply chain disruptions and tightening global freight markets) threaten to outpace productivity improvements, compressing net margins and potentially hindering earnings growth.

- Softer or more volatile demand trends in key segments (e.g., slower growth in global petfood market and possible shifts in consumer preference away from traditional apple varieties) may undermine forward revenue assumptions and limit long-term earnings growth if sectoral tailwinds do not materialize as projected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NZ$5.45 for Scales based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NZ$735.7 million, earnings will come to NZ$74.2 million, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 6.9%.

- Given the current share price of NZ$5.25, the analyst price target of NZ$5.45 is 3.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.