Key Takeaways

- The company's eco-focused, flexible fleet faces risks from volatile niche demand, industry consolidation, and the threat of new shipping technologies impacting earnings resilience.

- Rising regulatory and operating costs could offset benefits from strategic contracts and expansion, challenging margin improvement despite tight emissions policies and potential market share gains.

- Exposure to global trade risks, regulatory costs, aging fleet, market cyclicality, and limited scale challenge margins, capital use, and long-term competitiveness amid industry changes.

Catalysts

About Klaveness Combination Carriers- Owns and operates combination carriers for the dry bulk shipping and product tanker industries in the Middle East, Australia, Oceania, North East Asia, South America, North America, Europe, Africa, Southeast Asia, and South Asia.

- While the company's modern, fuel-efficient combination fleet is positioned to benefit from tightening global emissions rules and higher fuel prices-which could drive an uplift of approximately $4,000 per day in earnings by 2035-volatile dry bulk demand from energy transition policies, trade protectionism, and geopolitical uncertainty threaten to undermine utilization rates and revenue stability over the long term.

- Although CEO commentary highlights the growing advantages of cargo flexibility and digital voyage optimization to maximize vessel utilization and mitigate ballast days, Klaveness faces ongoing headwinds from operating a small, specialized fleet that may struggle to achieve the economies of scale and margin resilience of larger, more diversified competitors as industry consolidation intensifies.

- While industry-wide decarbonization and fleet renewal cycles set to accelerate over the next decade could favor Klaveness' focus on eco-friendly vessels-potentially supporting future market share and revenue growth-the company's heavy exposure to niche markets leaves it vulnerable to demand swings, particularly if alternative shipping technologies or cleaner vessels outcompete existing tonnage and suppress asset values.

- Strategic contracts with blue-chip clients in both liquid and dry markets do help smooth out cash flows and reduce volatility, but elevated counterparty risk and potential contract renegotiations in a period of high market and policy uncertainty could materially weaken revenue predictability and impair earnings quality.

- Despite ongoing expansion of the CLEANBU and CABU fleets and timely newbuild deliveries, persistent regulatory-driven cost increases from IMO rules, emission taxes, and dry-docking requirements will likely continue to put upward pressure on operating costs and capex, potentially squeezing net margins and limiting the positive impact of any cyclical recovery in freight rates.

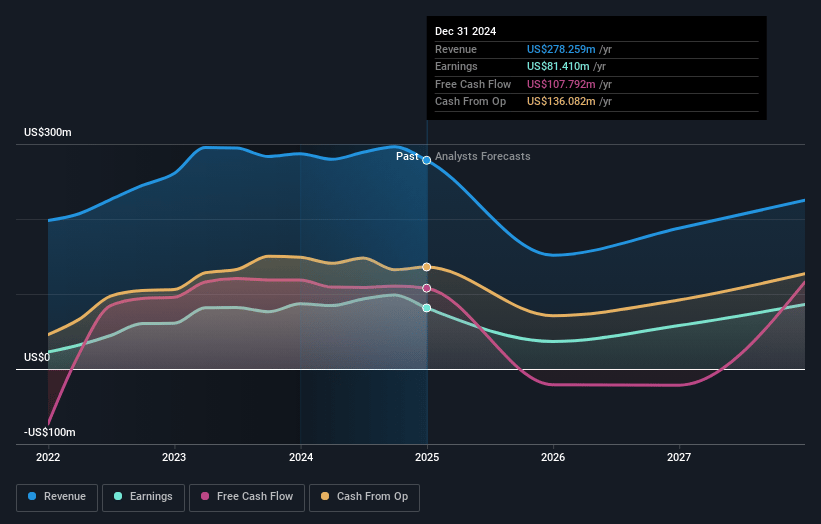

Klaveness Combination Carriers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Klaveness Combination Carriers compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Klaveness Combination Carriers's revenue will decrease by 6.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 23.1% today to 39.1% in 3 years time.

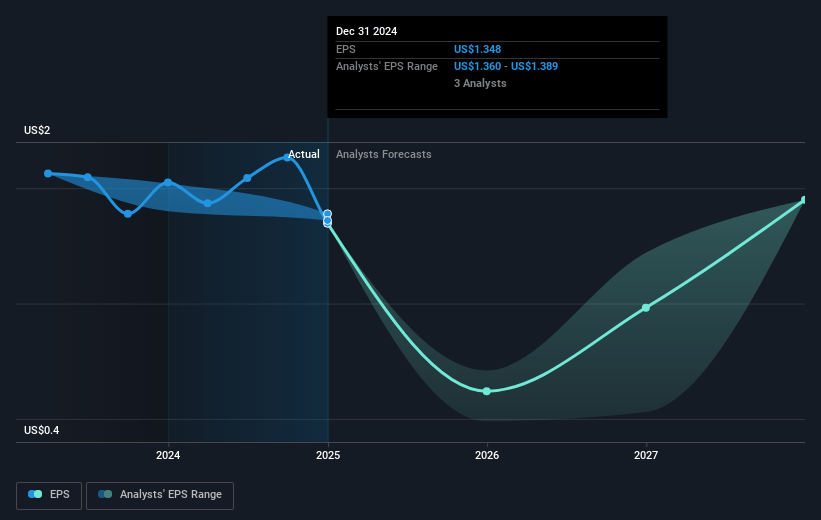

- The bearish analysts expect earnings to reach $82.5 million (and earnings per share of $1.39) by about July 2028, up from $59.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.9x on those 2028 earnings, down from 6.7x today. This future PE is greater than the current PE for the NO Shipping industry at 3.6x.

- Analysts expect the number of shares outstanding to decline by 1.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

Klaveness Combination Carriers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on trade flows between the US, China, and other major economies exposes Klaveness to risks from escalating trade wars, shifting port fee regimes, and protectionist measures, which could structurally disrupt established shipping patterns and pressure both revenue and earnings volatility.

- Increasing regulatory costs, such as carbon taxes and requirements to use alternative fuels under incoming IMO environmental frameworks, are likely to drive up operating expenses and capital requirements, potentially compressing net margins and reducing future profitability, especially if fuel cost savings from efficiency are not fully captured in market rates.

- The aging segment of the fleet, with five vessels approaching their 25-year operational limits and customer restrictions on vessel age, creates fleet replacement pressure and risks under-utilization or costly green recycling, impacting return on capital employed and putting downward pressure on net income if replacement is not timely or accretive.

- Market cyclicality in both the dry bulk and tanker segments, with recent periods of weak dry bulk performance and high earnings volatility, highlights susceptibility to downtrends in end-market demand, which could reduce fleet utilization and pose sustained pressure on revenue and EBITDA.

- Operating a relatively specialized and small fleet compared to major industry peers increases exposure to niche market slowdowns and limits economies of scale, raising the risk of higher unit costs and thinner long-run margins as the industry consolidates and technology investments become critical for competitive advantage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Klaveness Combination Carriers is NOK72.62, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Klaveness Combination Carriers's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK107.28, and the most bearish reporting a price target of just NOK72.62.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $210.9 million, earnings will come to $82.5 million, and it would be trading on a PE ratio of 5.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of NOK69.3, the bearish analyst price target of NOK72.62 is 4.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.