Catalysts

About Kitron

Kitron is an electronics manufacturing services company focused on sectors such as Defense Aerospace, Industry, Electrification, Connectivity and Medical Devices.

What are the underlying business or industry changes driving this perspective?

- Surging Defense Aerospace activity, including 82% year-over-year revenue growth in the quarter and a doubling of the sector backlog. This helps underpin future revenue visibility and supports earnings resilience.

- Large new defense contract wins, such as the €100 million UAV related order where about two thirds is already in the backlog and a meaningful part is linked to the raised 2025 guidance. This can support revenue growth and EBIT development.

- Expansion of production capacity across Sweden, Norway, Lithuania and Poland, including new factories and additional footprint. This is expected to support higher throughput and could help protect EBIT margins as volumes scale.

- Growing exposure to energy storage and transmission equipment for data center related demand through new U.S. electrification customers. This can support longer term revenue and potentially lift operating margins if utilization remains high.

- Consistently strong cash generation and tighter working capital, with operating cash flow of €44 million in Q3 and a shorter cash conversion cycle. This can support returns on capital and provide flexibility for future earnings accretive growth initiatives.

Assumptions

This narrative explores a more optimistic perspective on Kitron compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

- The bullish analysts are assuming Kitron's revenue will grow by 27.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.7% today to 7.7% in 3 years time.

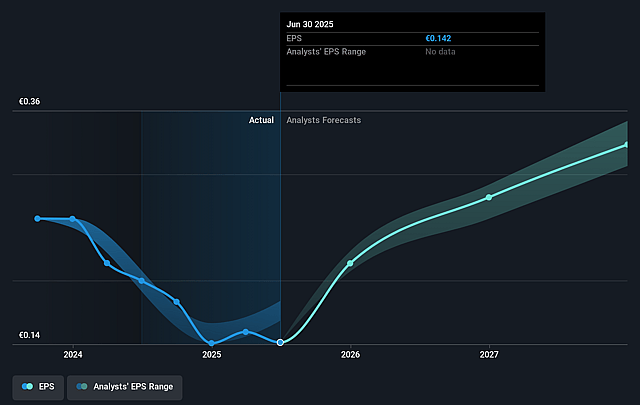

- The bullish analysts expect earnings to reach €105.1 million (and earnings per share of €0.48) by about January 2029, up from €31.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.3x on those 2029 earnings, down from 49.2x today. This future PE is lower than the current PE for the GB Electronic industry at 50.6x.

- The bullish analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.88%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Heavy reliance on Defense Aerospace as the clear growth engine, with 82% year over year revenue growth and a doubling of the backlog, leaves Kitron exposed if defense spending, program priorities or UAV related demand slow or are delayed. This would hit revenue and EBIT.

- Capacity constraints and expansion risks in Norway, Lithuania and Poland, including reliance on new facilities and added footprint, could lead to execution issues, cost overruns or underutilized sites if demand timing shifts. This would pressure net margins and earnings.

- Electrification demand is currently described as stabilizing with a temporary pause as some customers expand capacity, and one large customer has already taken its foot off the gas. A prolonged pause in energy storage and transmission orders would limit revenue growth and could weigh on EBIT.

- Some regions, particularly China and parts of infrastructure and construction, face weaker demand or no growth. If this persists it may offset gains in other sectors and reduce the benefit of a 31% higher total backlog, limiting revenue and earnings progression.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Kitron is NOK94.59, which represents up to two standard deviations above the consensus price target of NOK79.67. This valuation is based on what can be assumed as the expectations of Kitron's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK94.59, and the most bearish reporting a price target of just NOK67.79.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be €1.4 billion, earnings will come to €105.1 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 7.9%.

- Given the current share price of NOK81.85, the analyst price target of NOK94.59 is 13.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Kitron?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.