Last Update15 Aug 25Fair value Increased 66%

The significant increase in consensus analyst price target for ArcticZymes Technologies is primarily driven by notably higher forecasts for revenue growth and a rising future P/E multiple, resulting in an upward revision from NOK17.50 to NOK24.50.

What's in the News

- Launched M-SAN HQ GMP, a new GMP-grade nuclease tailored for viral vector manufacturing, enabling high activity in physiological salt conditions and improving DNA removal without harsh buffers.

- The new product is positioned to support advanced therapies like in vivo CAR-T and vaccines, addressing regulatory needs for nuclease and host cell DNA contamination reduction.

- Extended a three-year research partnership with the Austrian Centre of Industrial Biotechnology (acib) to enhance purification methods for bionanoparticles, critical for gene therapies and cancer treatments.

- Demonstrated that ArcticZymes’ M-SAN enzyme outperforms conventional nucleases in digesting chromatin under process-relevant conditions, strengthening product differentiation in bioprocessing.

- Collaboration will focus on optimizing high-salt nuclease treatments, developing improved chromatin detection methods, and fostering enzyme innovation, backed by industry-academic funding and PhD training initiatives.

Valuation Changes

Summary of Valuation Changes for ArcticZymes Technologies

- The Consensus Analyst Price Target has significantly risen from NOK17.50 to NOK24.50.

- The Future P/E for ArcticZymes Technologies has significantly risen from 33.09x to 41.93x.

- The Consensus Revenue Growth forecasts for ArcticZymes Technologies has significantly risen from 15.5% per annum to 18.7% per annum.

Key Takeaways

- Strong biomanufacturing growth and broader revenue streams are fueled by robust product adoption and expansion into new advanced therapeutics markets.

- Enhanced commercial execution, geographic reach, and operational scalability position the company for stable, long-term, high-margin revenue growth.

- Heavy reliance on a few large customers, slow commercial adoption, and shrinking non-core revenues threaten stable growth and margin improvements amidst rising costs and currency risks.

Catalysts

About ArcticZymes Technologies- A life sciences company, develops, manufactures, and commercializes recombinant enzymes for use in molecular research, in vitro diagnostics, and biomanufacturing.

- Accelerating growth in biomanufacturing revenues, driven by robust adoption of the new M-SAN HQ GMP product, positions ArcticZymes to benefit from expanding demand in gene and cell therapies, vaccine manufacturing, and advanced therapeutics-supporting both top-line revenue growth and improved diversification of the customer base.

- The ongoing expansion into adjacent high-growth applications such as metagenomics, RNA technologies, and next-generation sequencing (NGS) aligns with broader increases in global precision medicine and biotechnology R&D investment, providing a platform for sustained long-term revenue growth.

- Improved commercial execution-including geographic expansion in EMEA, the U.S., and India-has led to higher average order values and a more diversified, less concentrated customer mix, enhancing revenue stability and earnings visibility.

- Investments in operational scalability (e.g., expanded bioreactor capacity and flexible external partnerships) ensure the company can efficiently meet rising market demand, supporting further improvements in EBITDA margins and operating leverage as sales expand.

- Early-stage adoption of ArcticZymes' enzymes by multiple CDMO partners in clinical development pipelines increases the likelihood of eventual incorporation into commercial products, creating future inflection points for recurring, high-margin revenues.

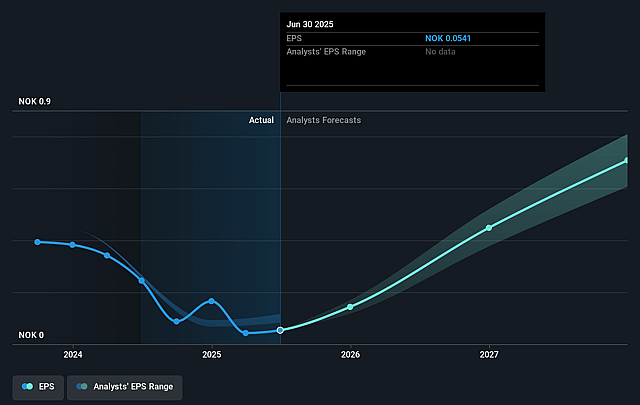

ArcticZymes Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ArcticZymes Technologies's revenue will grow by 22.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 28.2% in 3 years time.

- Analysts expect earnings to reach NOK 53.5 million (and earnings per share of NOK 0.71) by about August 2028, up from NOK 2.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.1x on those 2028 earnings, down from 537.5x today. This future PE is lower than the current PE for the GB Biotechs industry at 266.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.16%, as per the Simply Wall St company report.

ArcticZymes Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's molecular tools segment remains vulnerable to customer concentration risk, as illustrated by a significant drop in Q2 revenues due to the absence of a single key customer; while the segment's main partner has resumed orders, continued dependence on a few large accounts could expose future revenues and earnings to unpredictable fluctuations.

- Despite recent diversification in the biomanufacturing customer base, broader long-term market adoption is still in early phases, with most CDMO customers only in clinical or test phases and no ArcticZymes enzyme yet integrated into any commercial end product; this introduces ongoing uncertainty and potential delays in achieving significant, recurring revenue and margin expansion.

- The company acknowledges that the main driver for future growth-namely, design-in and adoption by large CDMOs for commercial manufacturing-will take longer than initially anticipated, which could limit the pace of top-line growth and delay improvements in net margins over the next several years.

- Short-term revenue gains were magnified by contributions from grants, tax credits, and project-based other income (such as the ADEPT project), with management explicitly stating these non-operating revenue streams will decrease in coming quarters, potentially reducing overall earnings and cash flow until core business growth compensates.

- Heightened expenses in international commercial efforts and growing exposure to unfavorable currency fluctuations could continue to depress operating margins and net income, especially since most of the revenue base is in USD and EUR while cost structures fluctuate, making financial results more volatile and potentially impacting earnings quality.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK29.0 for ArcticZymes Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK189.9 million, earnings will come to NOK53.5 million, and it would be trading on a PE ratio of 33.1x, assuming you use a discount rate of 6.2%.

- Given the current share price of NOK29.5, the analyst price target of NOK29.0 is 1.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.