Key Takeaways

- Expanding presence in high-growth biomanufacturing and drug development markets, driven by strong customer acquisition, innovation, and targeted commercial strategies.

- Diversification across geographies and product segments reduces reliance on single customers, supporting stable revenues and long-term margin improvements.

- ArcticZymes faces revenue decline, high customer concentration, increased competition, rising costs, and geopolitical exposure, threatening profitability and financial stability in the near term.

Catalysts

About ArcticZymes Technologies- A life sciences company, develops, manufactures, and commercializes recombinant enzymes for use in molecular research, in vitro diagnostics, and biomanufacturing in Norway, Germany, Lithuania, France, Italy, the United Kingdom, rest of Europe, the United States, and internationally.

- The onboarding of ArcticZymes' enzymes by leading CDMOs (with more planned), growing commercial traction in cell and gene therapy biomanufacturing, and entry into later-stage drug development projects signal a rising pipeline of recurring, higher-margin platform revenue that should materially expand the company's total addressable market and drive future top-line growth.

- The global growth in genomics, personalized medicine, and biopharmaceuticals—including strong secular demand for specialty enzymes—continues to be reflected in ArcticZymes’ expanding customer base (all-time high) and order volumes (up 14% YoY), positioning the company for structurally higher revenues in years ahead.

- The upcoming launch of GMP-grade M-SAN HQ and ongoing product innovation (such as RNA restriction enzymes) are poised to unlock access to larger regulated markets and attract new customer segments, boosting both revenue potential and long-term margin improvement as higher-value products are commercialized.

- The company’s strategic investments in commercial transformation—increased US commercial headcount, marketing campaigns, and customer-centric funnels—have already led to a 42% YoY increase in unique customers and are expected to further enhance operating leverage and drive accelerated revenue growth and earnings as customer programs progress toward commercialization.

- ArcticZymes’ diversification across geographies (notably strong North America and APAC growth) and a deliberate focus on biomanufacturing help reduce revenue volatility from single OEM customers, mitigating downside risks and supporting greater earnings stability and margin expansion over the long term.

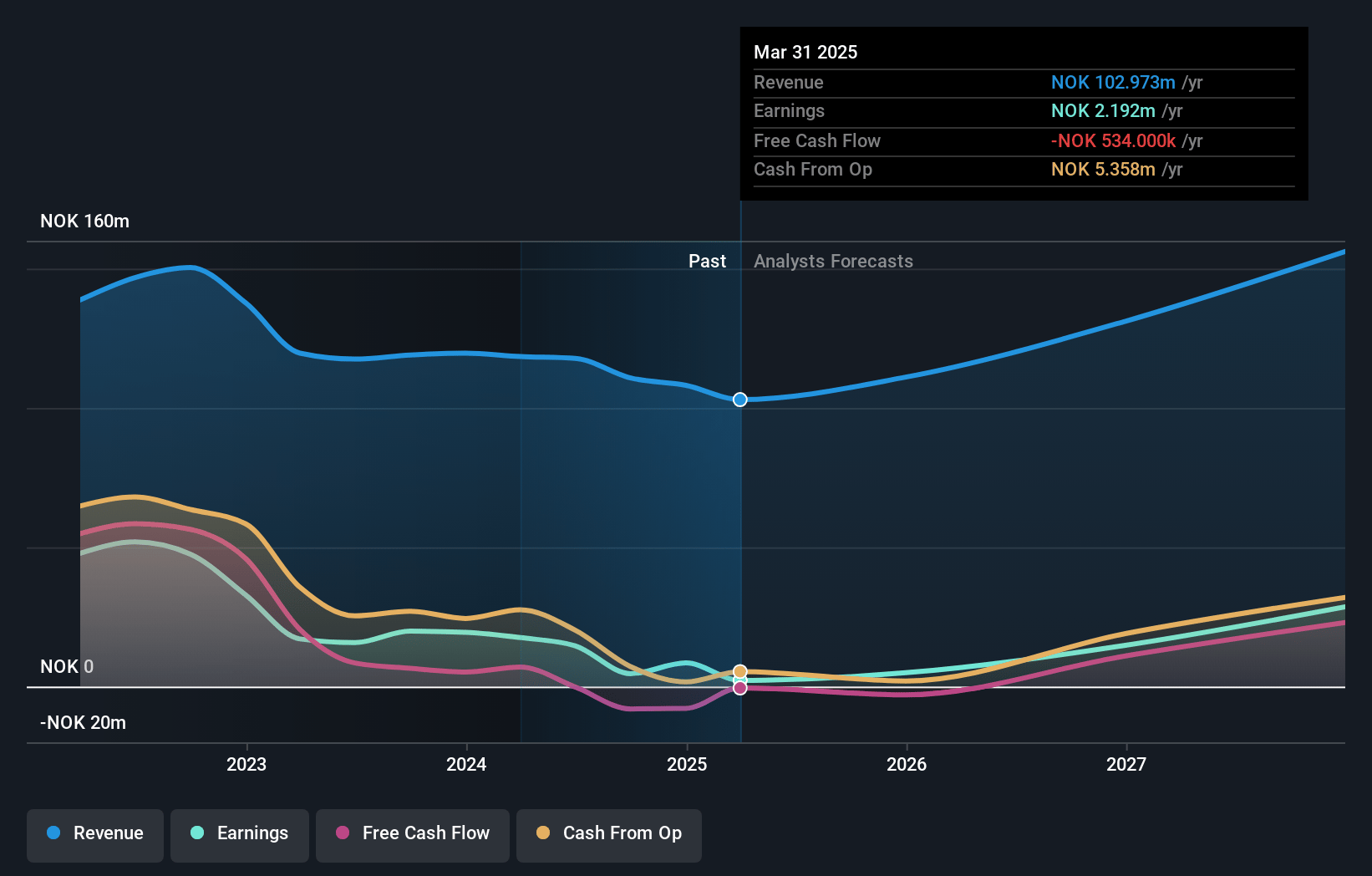

ArcticZymes Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ArcticZymes Technologies's revenue will grow by 15.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 20.3% in 3 years time.

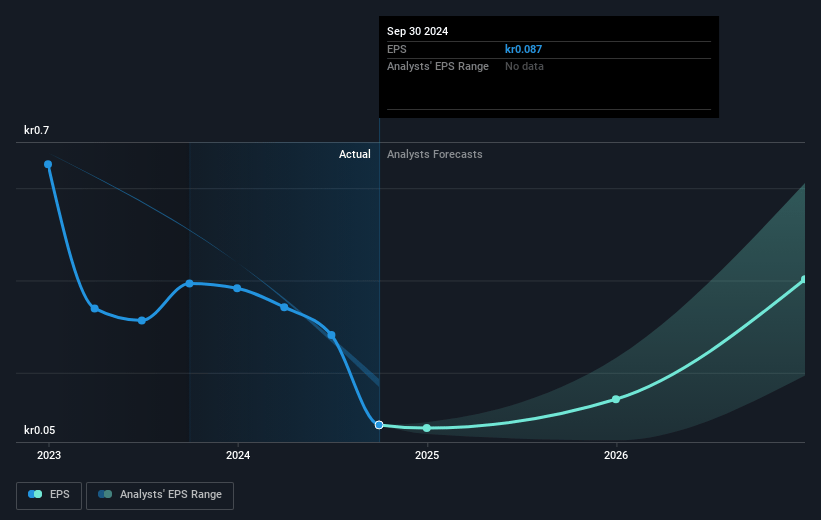

- Analysts expect earnings to reach NOK 32.3 million (and earnings per share of NOK 0.49) by about July 2028, up from NOK 2.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.1x on those 2028 earnings, down from 390.3x today. This future PE is lower than the current PE for the GB Biotechs industry at 196.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.12%, as per the Simply Wall St company report.

ArcticZymes Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ArcticZymes has experienced a multi-year revenue decline since 2022 and management acknowledges that a turnaround is gradual due to the long product adoption cycles in biomanufacturing and molecular tools, posing a risk to near

- and medium-term revenue and earnings growth.

- The company's heavy reliance on a small number of major customers, highlighted by the significant revenue drop from a single Molecular Tools OEM this quarter, exposes ArcticZymes to high revenue concentration risk and sales volatility, which could continue to impact financial performance.

- Intensifying competition in the nuclease market, including new salt-tolerant products from rivals, risks commoditizing ArcticZymes’ offering, potentially exerting sustained downward pressure on pricing and gross margins.

- Increased investments in commercial transformation, personnel, and marketing are boosting operating expenses faster than revenue is recovering, as shown by this quarter’s negative EBITDA margin; if revenue growth does not accelerate, profitability and net margins may remain challenged.

- Geopolitical risks—specifically the potential for increased U.S. tariffs or trade barriers—could impact ArcticZymes’ export business, and the company does not have short-term plans to diversify production geographically, presenting a risk to its substantial and growing North American revenue base.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK17.5 for ArcticZymes Technologies based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK158.8 million, earnings will come to NOK32.3 million, and it would be trading on a PE ratio of 33.1x, assuming you use a discount rate of 6.1%.

- Given the current share price of NOK16.75, the analyst price target of NOK17.5 is 4.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.