Key Takeaways

- Strategic partnerships and Clean Ammonia projects set to boost earnings and reduce financial risk through shared capital and scale efficiencies.

- Planned cost reductions and favorable market conditions are expected to enhance net margins and revenue, outpacing current earnings.

- Delays in U.S. projects, tariff threats, and high debt may strain finances and affect revenues, margins, and investor returns.

Catalysts

About Yara International- Provides crop nutrition and industrial solutions in Norway, European Union, Europe, Africa, Asia, North and Latin America, Australia, and New Zealand.

- Yara's plans to proceed with Clean Ammonia projects in the U.S. are based on the anticipation that these will be very profitable, driven by low-cost gas, scale efficiency, and supportive policies like 45Q, potentially increasing future revenue and net margins.

- The company's strategic partnerships in major projects, historically resulting in successful joint ventures, suggest upcoming projects will similarly leverage shared capital and complementary interests, ultimately enhancing earnings potential and reducing financial risk.

- A planned $150 million cost reduction by the end of 2025, mainly through external cost cuts and FTE reductions, is expected to enhance net margins as the bulk of savings will be realized.

- Positive market fundamentals, driven by tightening nitrogen markets and the recovery in agriculture commodity prices, provide a supportive backdrop for higher future margins and revenue growth, suggesting that current earnings may be significantly outpaced in 2025.

- Yara's exploration of various funding structures for Clean Ammonia projects, coupled with ongoing discussions around potential IPOs for their ammonia business, demonstrates readiness to capitalize on market demand, reflecting potential future improvements in cash flow and reduced leverage.

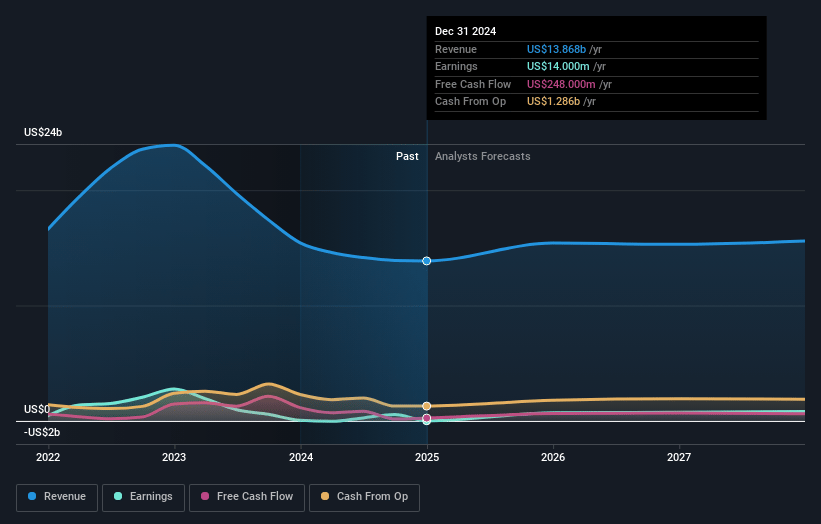

Yara International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Yara International's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.1% today to 5.3% in 3 years time.

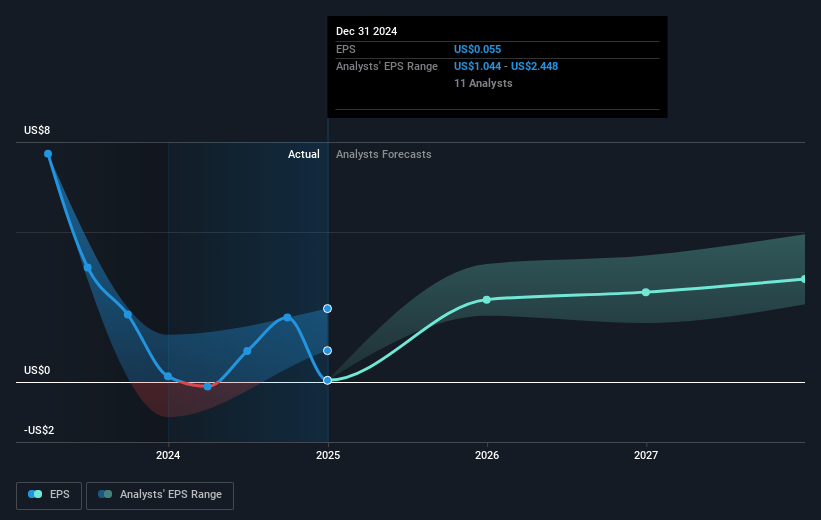

- Analysts expect earnings to reach $817.9 million (and earnings per share of $3.22) by about April 2028, up from $14.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.2 billion in earnings, and the most bearish expecting $437.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, down from 567.1x today. This future PE is lower than the current PE for the GB Chemicals industry at 19.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

Yara International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The postponement of the Final Investment Decision (FID) on the Clean Ammonia projects in the U.S. introduces uncertainty, particularly if factors like necessary CapEx or potential subsidies remain unresolved, which could delay revenue from these projects.

- Potential tariff threats affecting the Belle Plaine plant's ability to deliver product to the U.S. market could impact Yara's sales and ultimately its revenues.

- Concerns about high net debt to EBITDA ratios and low free cash flow due to tied-up operating capital suggest financial strain, which may affect Yara's ability to maintain or increase dividend payouts, impacting investor returns.

- Lower than expected distribution margins in Brazil could indicate weakening of market conditions or increased costs, putting pressure on Yara's net margins.

- Risk of China resuming urea exports after their peak season could disrupt global supply and lead to a decrease in fertilizer prices, thereby negatively affecting Yara's revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK346.563 for Yara International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK435.0, and the most bearish reporting a price target of just NOK250.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $15.5 billion, earnings will come to $817.9 million, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 7.5%.

- Given the current share price of NOK324.4, the analyst price target of NOK346.56 is 6.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.