Key Takeaways

- Increased production capacity and focus on sustainable packaging solutions support growth, geographic diversification, and higher margins in core and emerging markets.

- Product innovation and strategic pricing address regulatory and consumer trends, strengthening recurring revenue and margin resilience despite challenges in legacy segments.

- Declining demand, intense competition, high investment needs, currency fluctuations, and inflationary inputs threaten future revenue growth, margins, cash flow, and earnings stability.

Catalysts

About Elopak- Manufactures and supplies paper-based packaging solutions for liquid food in Europe, the Middle East, Africa, Asia, the Americas, and internationally.

- Ramp-up of the new U.S. manufacturing plant is set to materially increase capacity and support double-digit organic growth in the Americas, a region with heightened demand for sustainable packaging-positively impacting revenue and geographic diversification.

- Ongoing product innovation (e.g., Natural White Board, D-PAK cartons with recycled polymers, and advanced Pure-Fill filling machines) directly addresses regulatory and consumer demands for lower CO2 packaging, enabling premium pricing opportunities and improved net margins.

- Regulatory pressure and customer sustainability targets are driving significant conversion from plastic to fiber-based and recyclable packaging, a trend that supports sustained volume growth and fortifies Elopak's core business-benefiting long-term recurring revenue.

- Expansion in emerging markets such as India and continued growth in core European Pure-Pak segments (with rising market share) are likely to offset softer volumes in legacy segments and support both top-line and margin expansion.

- Strategic focus on higher-margin product mix, coupled with price increases and cost efficiencies (including passing on raw material price increases in the Americas), should underpin margin resilience and earnings growth.

Elopak Future Earnings and Revenue Growth

Assumptions

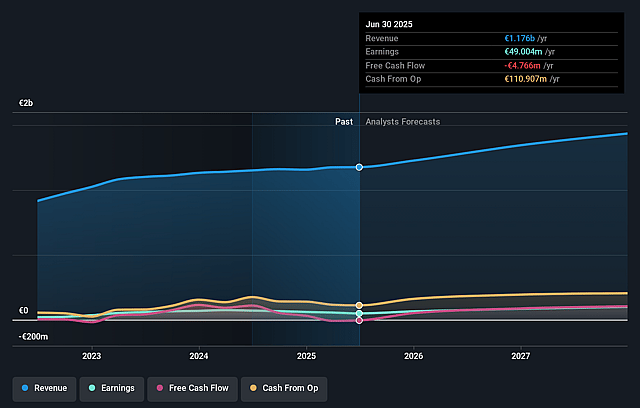

How have these above catalysts been quantified?- Analysts are assuming Elopak's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.2% today to 7.1% in 3 years time.

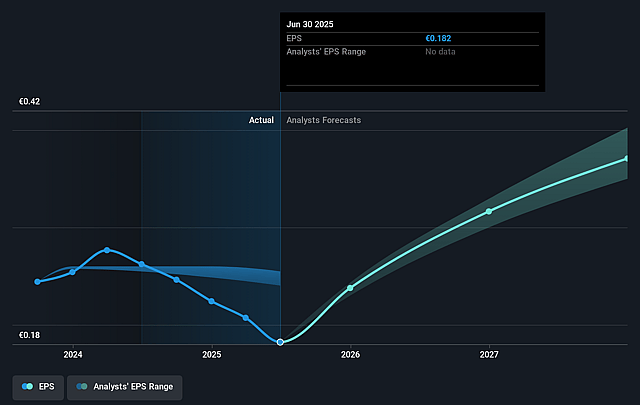

- Analysts expect earnings to reach €102.0 million (and earnings per share of €0.38) by about September 2028, up from €49.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, down from 21.5x today. This future PE is lower than the current PE for the NO Packaging industry at 21.5x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

Elopak Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Consumption declines in key segments like dairy and juice in EMEA-despite Elopak gaining share, these underlying secular trends could lead to stagnant or shrinking addressable markets, negatively impacting topline revenue growth over the long term.

- Intense competition in the Roll Fed segment (especially in Europe), including increased price pressure and new entrants, is resulting in business losses and margin compression, posing a sustained risk to EBITDA margins and overall profitability.

- Heavy capital expenditure requirements for U.S. plant ramp-up, converter replacements in Europe, and innovation projects could constrain free cash flow and reduce returns on invested capital, which may pressure net earnings if revenue growth does not keep pace.

- Currency volatility (notably the EUR/USD exchange rate and local market fluctuations in joint ventures) and soft volumes in certain international markets (such as Mexico) contribute to unpredictable earnings, with further downside risk if these trends persist.

- Exposure to input cost inflation and raw material price increases (e.g., paperboard), which despite pass-through mechanisms particularly in the U.S., could hinder profitability if cost increases outpace Elopak's ability to adjust prices in more competitive markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK51.358 for Elopak based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.4 billion, earnings will come to €102.0 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of NOK45.95, the analyst price target of NOK51.36 is 10.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.