Narratives are currently in beta

Key Takeaways

- Significant price hikes in insurance products align with loss trends, likely boosting revenue and profitability amidst changing market conditions.

- Operational efficiency, automation, and strategic divestments focus resources on higher-margin areas, enhancing profitability and financial performance.

- Gjensidige faces profitability pressures from high claims costs, pricing challenges, operational expenses, and volatility in insurance claims affecting earnings and revenue growth.

Catalysts

About Gjensidige Forsikring- Engages in the provision of general insurance and pension products in Norway, Sweden, Denmark, Latvia, Lithuania, and Estonia.

- Gjensidige is implementing significant price increases across their insurance products, raising average prices in motor insurance by 40% and property insurance by over 60%, expected to improve revenue and profitability by ensuring prices align with long-term loss trends.

- Claims inflation is projected to decline from 5%-7% to 4%-6%, potentially improving net margins and profitability as insurance payouts become more predictable.

- The company's ongoing commitment to operational efficiency and automation is reducing the cost ratio, currently at a competitive 11.8%, enhancing net margins and overall financial performance.

- Gjensidige's continuous focus on sustainability and innovative initiatives aimed at reducing claims costs indicate future improvements in net margins due to decreased operational expenses.

- The expected sale of Baltic operations, which are less profitable, should improve the group's combined ratio and optimize earnings by focusing on higher-margin segments.

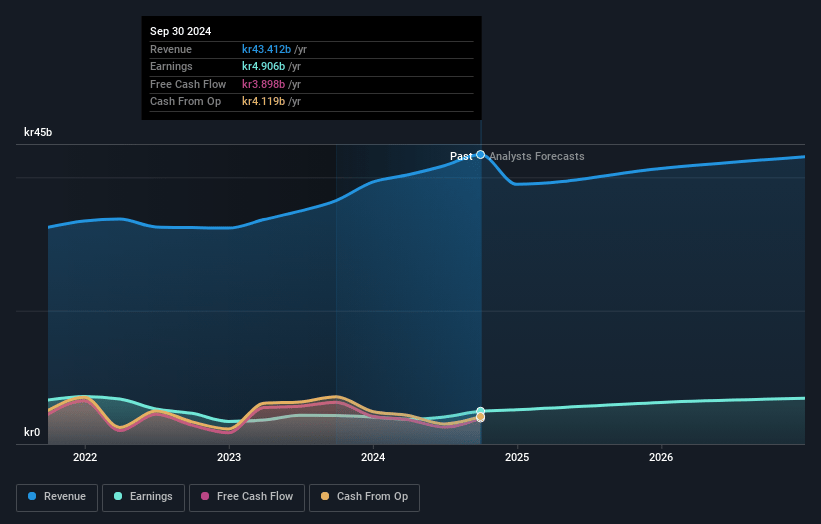

Gjensidige Forsikring Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gjensidige Forsikring's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.3% today to 14.4% in 3 years time.

- Analysts expect earnings to reach NOK 6.5 billion (and earnings per share of NOK 13.02) by about December 2027, up from NOK 4.9 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as NOK 7.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2027 earnings, down from 20.5x today. This future PE is greater than the current PE for the GB Insurance industry at 12.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.69%, as per the Simply Wall St company report.

Gjensidige Forsikring Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Gjensidige's underlying profitability has been negatively impacted by higher claims costs in Norway, which could continue to pressure net margins if claims frequency and costs remain elevated.

- The company's efforts to increase prices significantly to offset claims costs may lead to customer attrition, which could impact revenue growth if customers are unwilling to absorb higher premiums.

- The firm faces volatility in property insurance claims, with more frequent weather and fire-related incidents, which could unpredictably affect earnings.

- Increased claims frequency and costs in the motor insurance segment may require ongoing significant pricing adjustments to maintain profitability, potentially affecting future revenue if not managed effectively.

- Rising operational challenges such as increased interest expenses on loans and higher amortization of intangible assets could erode net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK 197.35 for Gjensidige Forsikring based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK 235.0, and the most bearish reporting a price target of just NOK 155.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be NOK 45.2 billion, earnings will come to NOK 6.5 billion, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 5.7%.

- Given the current share price of NOK 201.6, the analyst's price target of NOK 197.35 is 2.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives