Last Update 11 Dec 25

CONTX: Share Buybacks Will Support Capital Efficiency With Balanced Long Term Outlook

Analysts have raised their price target for ContextVision slightly, now valuing the shares at roughly SEK 4.00. This reflects modestly higher confidence in the companys long term earnings power, even as underlying model assumptions have changed only marginally.

What's in the News

- ContextVision has completed a buyback tranche, repurchasing 1,440,211 shares, or 1.86% of its share capital, for NOK 6.42 million under the program announced on September 15, 2025 (Key Developments).

- The company commenced a broader share repurchase program on September 5, 2025, authorized to buy back up to 4,000,000 shares for up to NOK 20 million, as approved at the May 13, 2025 Annual General Meeting (Key Developments).

- Under a related market repurchase initiative launched on September 3, 2025, ContextVision plans to repurchase up to 4,000,000 shares for NOK 10 million between September 4, 2025 and March 4, 2026, using cash on hand (Key Developments).

Valuation Changes

- Fair Value: Maintained at SEK 4.00 per share, indicating no material change in the base valuation outcome.

- Discount Rate: Increased slightly from 7.52 percent to 7.54 percent, reflecting a marginally higher required return.

- Revenue Growth: Kept effectively unchanged at around 2.17 percent, suggesting stable long term growth assumptions.

- Net Profit Margin: Held broadly steady at approximately 25.53 percent, implying no meaningful revision to profitability expectations.

- Future P/E: Reduced modestly from 11.27x to 11.12x, signaling a slightly lower valuation multiple applied to future earnings.

Key Takeaways

- Expanded academic and strategic alliances, along with increased R&D, position ContextVision for market growth and stronger margins through new AI-driven imaging products.

- Diversification efforts in Asia and focus on disease areas with demographic growth trends support recurring revenue streams despite short-term demand challenges.

- Rising competitive pressures, market shifts, and persistent cost challenges risk eroding margins, while limited innovation and geographic reach threaten long-term revenue and earnings growth.

Catalysts

About ContextVision- A software company, provides image analysis and imaging for medical systems in South Korea, China, Japan, the United States, and internationally.

- The company's sustained investment in AI-based data quality solutions and the addition of leading academic and technical partners (e.g., University of Waterloo, InPhase Solutions, AMRA Medical) set the stage for advanced, clinically focused product launches, positioning ContextVision to capitalize on rising global demand for AI-driven diagnostic imaging and expanding potential addressable market-expected to support strong future revenue growth.

- The upcoming launch of a new software platform and a series of clinically focused products, underpinned by substantial R&D efforts, should fuel higher-margin revenue streams and improve long-term gross margins as the medical imaging industry pivots toward more interoperable, value-based diagnostic solutions.

- Recent successful market penetration in Asia and the strengthening of the partnership network mitigate geographic concentration risks and open new channels for recurring software licensing, offering potential for revenue diversification and consistent topline growth over the long term.

- The company's focus on disease areas with secular growth tailwinds (e.g., fatty liver disease linked to aging and chronic illness) aligns product strategy with global demographic shifts, increasing the relevance of its solutions and driving sustainable demand growth-supportive of expanding earnings over time.

- Despite near-term revenue softness due to macro headwinds and delayed purchasing cycles, ContextVision's robust cash position (SEK 70 million) ensures ongoing investment in innovation and growth initiatives, paving the way for long-term earnings recovery and enhanced net margins as market conditions normalize.

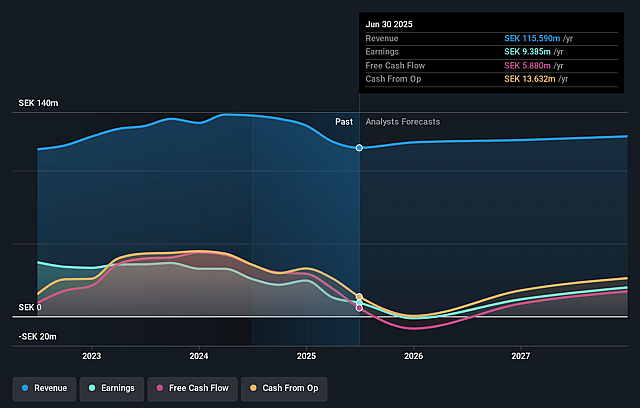

ContextVision Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ContextVision's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.1% today to 19.9% in 3 years time.

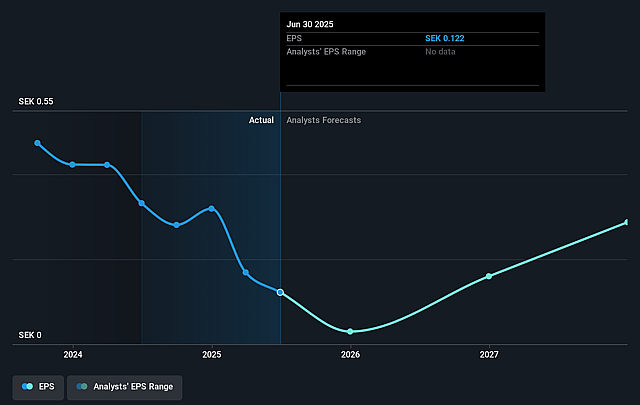

- Analysts expect earnings to reach SEK 24.7 million (and earnings per share of SEK 0.26) by about September 2028, up from SEK 9.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, down from 35.5x today. This future PE is lower than the current PE for the NO Healthcare Services industry at 35.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.16%, as per the Simply Wall St company report.

ContextVision Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent global economic uncertainty, including customer hesitation due to tariffs, higher supply chain costs, and tighter budgets, is causing clients to delay purchases and draw down existing inventories, directly suppressing current and potentially future revenue growth.

- The shift in ultrasound market demand from higher-end to mid

- and low-range products may drive overall pricing and margins downward, as ContextVision could face increased competition from low-priced rivals, impacting net margins and gross profit.

- The loss of business to low-cost competitors in Asia and the phaseout of an existing ultrasound platform highlight the risk of further share loss to aggressive pricing and commoditization, which would negatively affect recurring revenue and earnings stability.

- Despite ongoing investments, recent financials show revenues trending sideways with declining EBITDA margin due to increased R&D spend and revenue pressure, raising concerns that escalating costs may not be offset by sufficient top-line growth, thus compressing net earnings.

- Limited geographic expansion and reliance on incremental product updates (rather than breakthrough innovations) may constrain long-term market reach and ability to outpace global competitors, resulting in muted revenue growth and pressured future margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK5.0 for ContextVision based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK124.4 million, earnings will come to SEK24.7 million, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 7.2%.

- Given the current share price of SEK4.59, the analyst price target of SEK5.0 is 8.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ContextVision?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.