Key Takeaways

- Strategic acquisitions and focus on offshore farming technology aim to optimize operations, enhance value creation, and improve revenue and earnings.

- Operational efficiencies, cost reductions, and improved fish welfare are expected to boost net margins and revenue growth significantly.

- Environmental and regulatory challenges, along with higher operational costs, hinder SalMar's revenue growth and net margins, necessitating strategic management to mitigate impacts.

Catalysts

About SalMar- An aquaculture company, produces and sells farmed salmon in Asia, North America, Europe, and internationally.

- SalMar's strategic acquisition of a controlling stake in Knutshaugfisk in Central Norway and the increase in ownership in other farms is expected to optimize operations and enhance value creation, which would likely boost revenue and earnings.

- The company's focus on offshore farming technology, with the deployment of semi-offshore units like Arctic Offshore Farming and Ocean Farm 1, demonstrates potential for improved biological performance and growth, potentially improving margins and revenue in 2025 and beyond.

- SalMar’s ongoing strategy and improvement program aims to achieve NOK 1.2 billion in yearly cost reductions through operational efficiencies and ending lesser-performing activities like cleaner fish production, which could enhance net margins and earnings.

- The investment in expanded smolt capacity, optimized feed strategies, and advanced vaccine programs are tailored to improve fish welfare and performance. This enhancement in operational efficiency is likely to positively impact revenue and net margins by lowering mortality rates and increasing growth rates.

- The anticipated 14% increase in harvest volume for 2025, driven by higher biomass and improved operational strategies, positions SalMar for significant growth in revenue and earnings in the coming years.

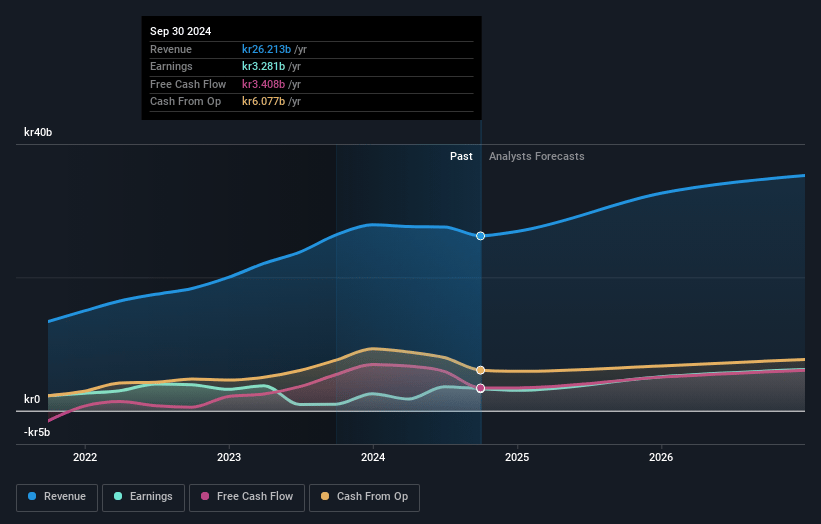

SalMar Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SalMar's revenue will grow by 12.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.5% today to 19.3% in 3 years time.

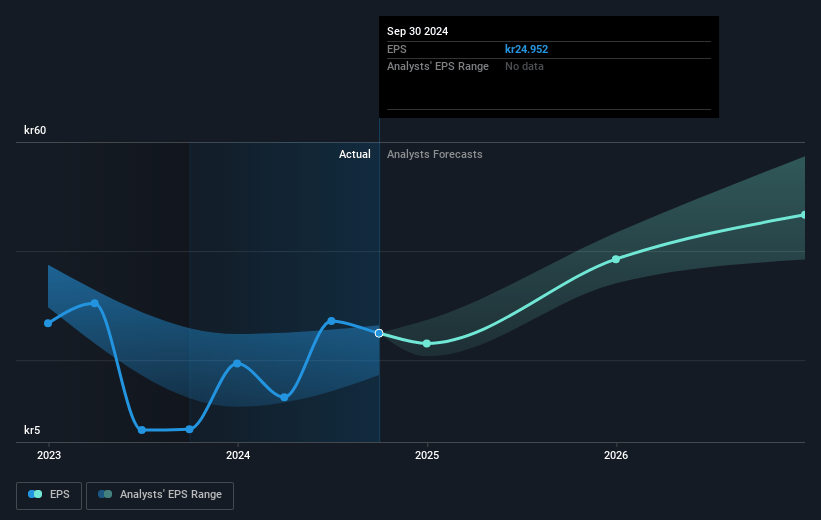

- Analysts expect earnings to reach NOK 7.2 billion (and earnings per share of NOK 54.69) by about January 2028, up from NOK 3.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as NOK5.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, down from 24.1x today. This future PE is lower than the current PE for the GB Food industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.67%, as per the Simply Wall St company report.

SalMar Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Environmental challenges such as high sea temperatures, jellyfish attacks, and high lice levels have led to biological issues, impacting operational decisions, increasing costs, and requiring early fish harvesting at lower weights, which can reduce revenue and profitability.

- The introduction of an ISA zone and necessity to harvest earlier than planned due to sea lice pressure leads to lower average fish weights and increased costs per kilo, negatively affecting net margins.

- The withdrawal of sterile licenses in Iceland due to regulatory issues limits production potential, posing risks to revenue growth and requiring negotiation with authorities to resolve.

- The increased interest costs from a higher debt level weakens net earnings, despite a robust financial position, which could undermine investment capability if not managed carefully.

- Operational and financial performance is further challenged by higher feed costs from previous years, increasing operational expenses, and potentially squeezing net margins if not offset by price achievements.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK645.0 for SalMar based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK781.0, and the most bearish reporting a price target of just NOK525.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK37.4 billion, earnings will come to NOK7.2 billion, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 5.7%.

- Given the current share price of NOK600.0, the analyst's price target of NOK645.0 is 7.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives