Key Takeaways

- Mowi's growth plan and superior farming volumes are expected to significantly drive revenue growth and market share in the coming years.

- Lower feed costs and financing strategies are expected to enhance net margins and earnings through reduced production and financial expenses.

- Environmental and strategic challenges, along with economic pressures, could weigh on revenue growth, margin stability, and investor confidence.

Catalysts

About Mowi- A seafood company, farms, produces, and supplies Atlantic salmon products worldwide.

- Mowi has a robust growth plan, projecting an increase in harvest volumes from 500,000 tonnes in 2024 to 600,000 tonnes by 2029, which is expected to drive revenue growth significantly over the next few years due to increased output and market capture.

- The ongoing organic growth trajectory, where Mowi has consistently outperformed the industry in farming volumes with a notable CAGR of 4.8% versus the industry's 2.7%, is expected to positively impact revenues by capitalizing on market share gains.

- Improved market conditions and a tighter market balance due to lower industry supply are anticipated to bolster Mowi's price realization, positively impacting revenue and net margins in the coming quarters.

- Mowi's expectation of lower feed prices due to declining costs of marine ingredients, which are a major input factor, should lead to reduced production costs, thereby enhancing net margins and overall earnings.

- The company's strategy of financing in Euros, with anticipated savings related to lower interest rates compared to Norwegian kroner, is expected to support lower cost of capital and enhance earnings growth by improving net financial expenses.

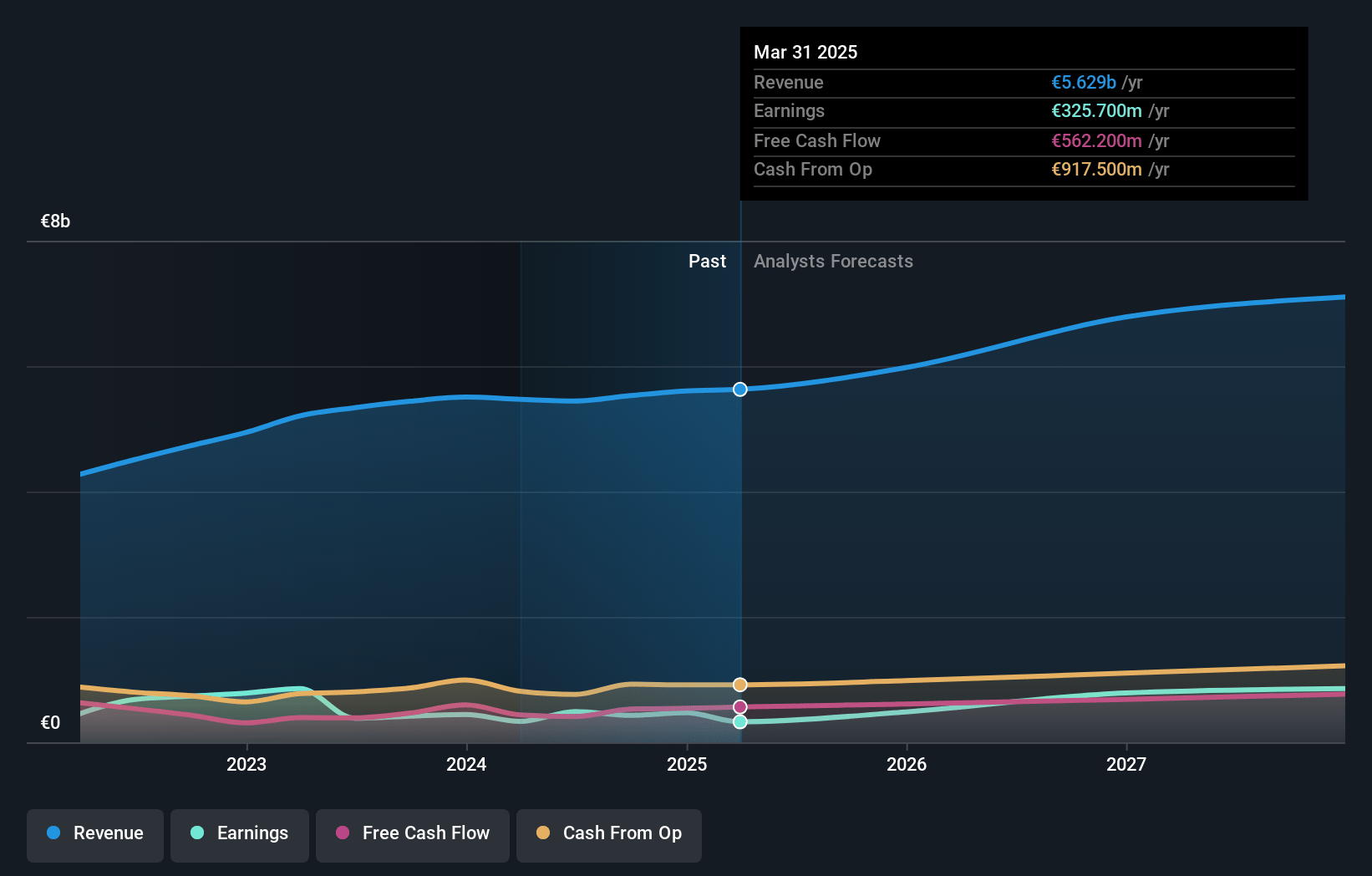

Mowi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mowi's revenue will grow by 6.1% annually over the next 3 years.

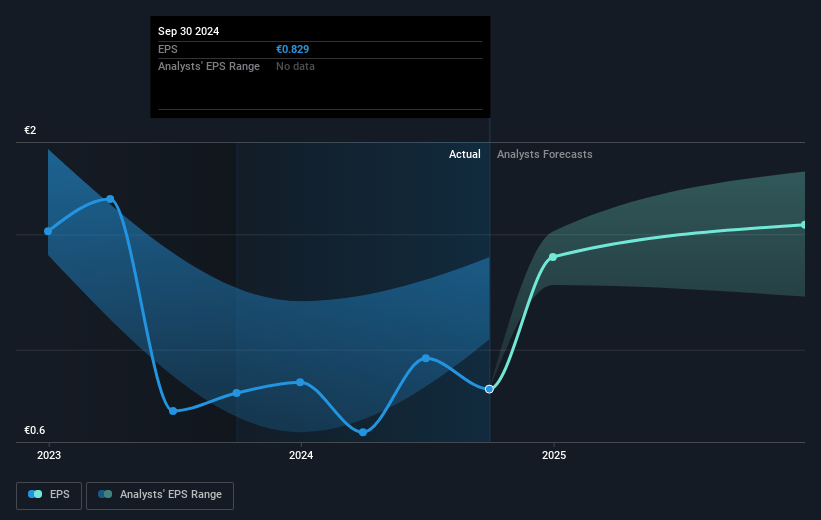

- Analysts assume that profit margins will increase from 7.8% today to 22.8% in 3 years time.

- Analysts expect earnings to reach €1.5 billion (and earnings per share of €2.83) by about January 2028, up from €429.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, down from 22.7x today. This future PE is lower than the current PE for the GB Food industry at 23.1x.

- Analysts expect the number of shares outstanding to grow by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.67%, as per the Simply Wall St company report.

Mowi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The soft prices in the Americas due to the cost of living crisis could continue to weigh on revenue and margin growth, impacting overall earnings.

- Seasonal issues with lice and gills, record high sea temperatures, and biological challenges such as algae issues and elevated mortality might increase farming costs and squeeze net margins.

- The strategic uncertainty around British Columbia, compounded by the challenges faced there, could impact operational profits and overall company performance.

- A significant portion of Mowi's financial success relies on the Feed division's continued profitability, and fluctuations in feed prices and biological issues could affect their margins and operational expenses.

- The weakening of the NOK and its adverse effects on financial performance (e.g., the €18 million hit in Q3) could create variability in earnings, impacting investor confidence and the share price trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK220.77 for Mowi based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK251.24, and the most bearish reporting a price target of just NOK187.84.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €6.6 billion, earnings will come to €1.5 billion, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 5.7%.

- Given the current share price of NOK221.8, the analyst's price target of NOK220.77 is 0.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives