Narratives are currently in beta

Key Takeaways

- New farming technology reduces lice treatments and costs, potentially boosting future net margins through increased efficiency.

- Turnaround at Scottish Sea Farms and salmon price increases are expected to significantly enhance Lerøy’s profitability and revenue.

- Weak salmon and trout prices, high sea lice pressure, and rising costs could negatively impact Lerøy Seafood's margins and profitability.

Catalysts

About Lerøy Seafood Group- Produces, processes, markets, sells, and distributes seafood products worldwide.

- Lerøy Seafood Group has invested heavily in its VAP, Sales and Distribution segment across Europe, achieving strong improvements. This segment saw a rolling 12-month EBIT of NOK 884 million with targeted EBIT for 2025 at NOK 1.2 billion, indicating expected revenue and earnings growth.

- The introduction of new shielding technology in farming shows reduced lice treatments by 90% in the new technology farms. Increased efficiency is expected to reduce costs substantially, thereby potentially increasing net margins in the future.

- Lerøy is on track to achieve its goal of increasing salmon and trout harvest to 200,000 tonnes by 2025, aided by improvements in genetics, smolt production, and new sea technology, suggesting a significant boost to future revenue streams.

- The turnaround at Scottish Sea Farms, a 50% owned subsidiary, has shown strong improvements in profitability. This turnaround is expected to substantially contribute to overall earnings and EPS in the coming fiscal periods.

- Expected price increases for salmon due to supply constraints are likely to positively impact revenue and profit margins in the upcoming quarters, as weaker prices seen in 2024 are projected to rebound significantly.

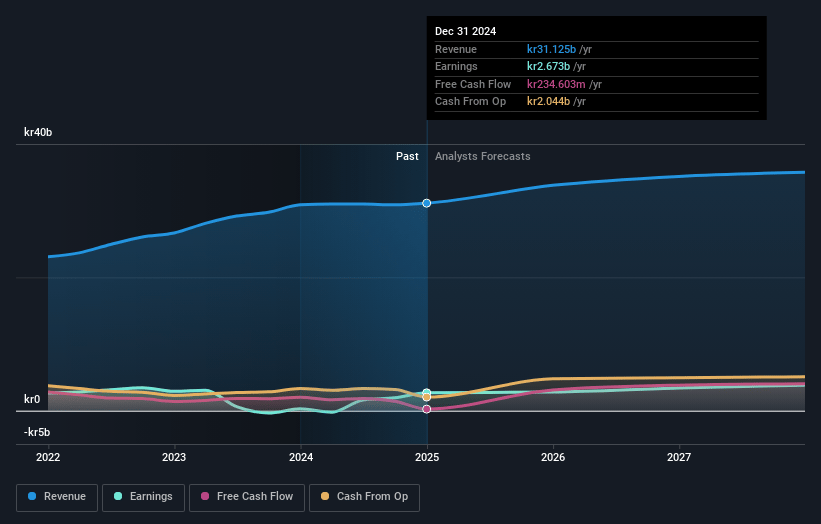

Lerøy Seafood Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lerøy Seafood Group's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.2% today to 9.6% in 3 years time.

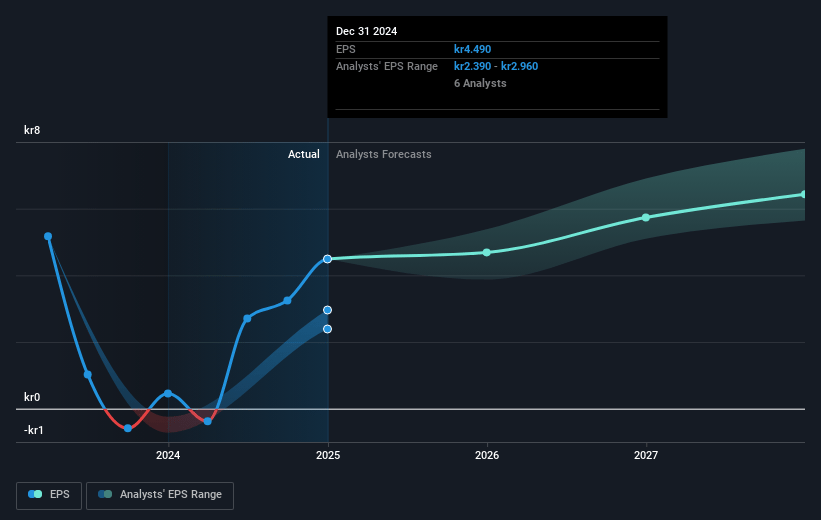

- Analysts expect earnings to reach NOK 3.7 billion (and earnings per share of NOK 6.22) by about February 2028, up from NOK 1.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as NOK2.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, down from 16.6x today. This future PE is lower than the current PE for the GB Food industry at 22.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.67%, as per the Simply Wall St company report.

Lerøy Seafood Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weak price development for salmon and trout, coupled with lower quotas and high sea lice pressure, could negatively impact revenue and margins.

- Increased costs due to high sea lice treatment and rising feed costs could further erode margins and earnings.

- Reduction in whitefish quotas and associated obligations may lead to lower profitability in the Wild Catch segment, impacting overall earnings.

- Expectations of higher costs in certain regions, driven by external factors such as seawater temperatures, may affect net margins negatively.

- Currency fluctuations, particularly the weakened Norwegian kroner impacting CapEx, could result in increased costs and potential strain on financials.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK61.143 for Lerøy Seafood Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK70.0, and the most bearish reporting a price target of just NOK51.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK38.8 billion, earnings will come to NOK3.7 billion, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 5.7%.

- Given the current share price of NOK53.8, the analyst price target of NOK61.14 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives