Key Takeaways

- Divesting Understory should streamline operations and enhance net margins, as the company refocuses on core segments like Human Health Ingredients.

- Expansion in Asia and optimizing production processes suggest potential revenue growth and improved operating margins through strategic partnerships and cost reductions.

- Decreased revenue, lower krill oil prices, high leverage, and divestment risks could suppress margins and affect Aker BioMarine's financial stability and profitability.

Catalysts

About Aker BioMarine- Engages in harvesting krill and supplies krill-derived products worldwide.

- Aker BioMarine is planning to divest its protein business, Understory, which will likely streamline operations and reduce costs, potentially increasing net margins as the company focuses on core segments like Human Health Ingredients.

- The company has established partnerships in Japan and China for its Kori brand, indicating potential revenue growth through international market expansion, especially in high-demand regions.

- The Human Health Ingredients segment is expected to benefit from a normalization of sales volumes in South Korea, and new pricing strategies could increase revenues and expand margins by adjusting prices in line with inflation.

- Optimizing and scaling production processes, especially in the Houston facility, is expected to lower cost of goods and improve gross margins, which is crucial for enhancing operating margins.

- There is potential for significant EBITDA growth by leveraging innovation in the krill oil and algae product lines, particularly in expanding sales of high-margin products like Lysoveta and PL+, which will likely enhance earnings.

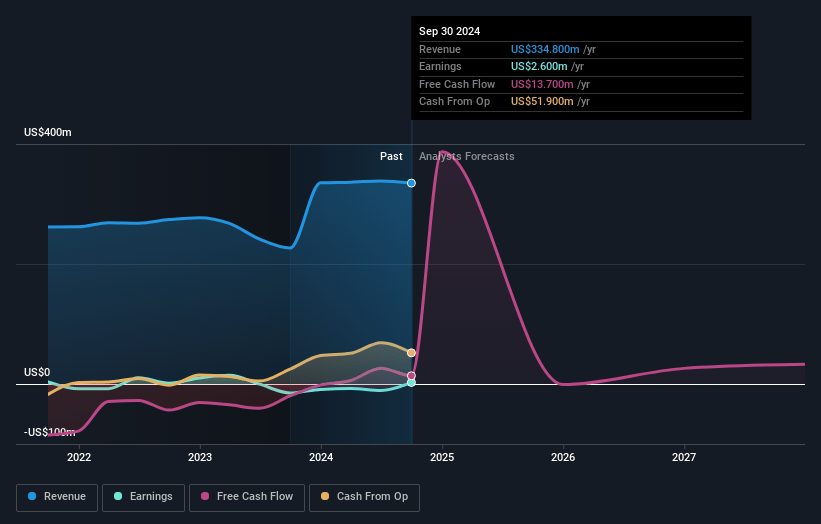

Aker BioMarine Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aker BioMarine's revenue will decrease by 9.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.8% today to 14.1% in 3 years time.

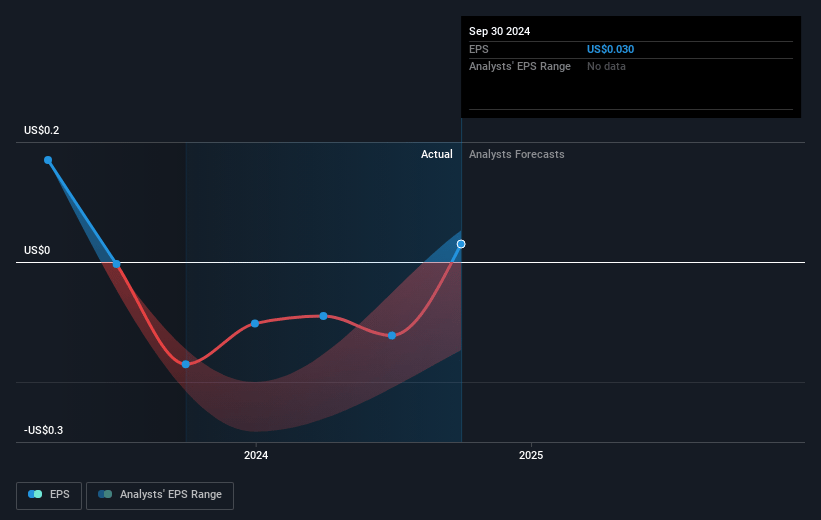

- Analysts expect earnings to reach $34.7 million (and earnings per share of $0.4) by about February 2028, up from $2.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, down from 192.2x today. This future PE is lower than the current PE for the NO Food industry at 22.5x.

- Analysts expect the number of shares outstanding to decline by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.67%, as per the Simply Wall St company report.

Aker BioMarine Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in overall group revenue, down 7% year-over-year, is primarily due to internal sales eliminations and a strong prior year comparator in Consumer Health Products, indicating potential challenges in sustaining revenue growth. This could impact future revenue figures.

- The decrease in krill oil average prices and the impact on total gross margin from low-margin products like QHP could lead to suppressed future earnings despite stable price points. This poses a risk to overall net margins.

- Higher leverage with a net debt of $135 million and leverage of 5.4x EBITDA may strain financial flexibility, particularly under liquidity covenants. This could affect the company's earnings stability in adverse situations.

- Potential uncertainty and execution risk associated with divestment plans for Understory and shifting focus on two main segments might cause transitional impacts on revenue and operational costs. This could impact short-term profitability and net margins.

- Uncertainties tied to cost optimization and scaling after the Feed Ingredients sale pose risks to maintaining effective cost controls and thereby achieving projected improvements in net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK60.686 for Aker BioMarine based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK70.15, and the most bearish reporting a price target of just NOK51.22.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $245.7 million, earnings will come to $34.7 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 5.7%.

- Given the current share price of NOK64.1, the analyst price target of NOK60.69 is 5.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives